- Wall Street opens higher near record levels

- The US Dollar (USD) depreciates

- Yields on U.S. bonds remains unchanged

On Thursday, U.S. indices start the cash session with solid gains. At the time of publication, the US500 is up 0.70% to 5150 points, and the US100 is up 1.00% to 18220 points. The gains are supported by the weakening Dollar (USD), which is one of the weakest currencies in the G10 today. The USD Index (USDIDX) records a 0.30% loss to 103 points.

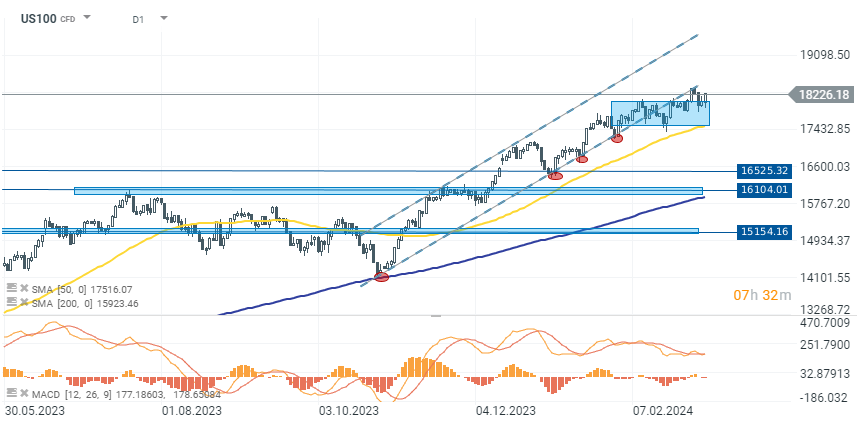

US100

The technology company index gains 1.00% at the start of the session and is approaching historical highs around 18330 points. The index is attempting to break out of a short-term consolidation upwards. However, on the MACD indicator, a divergence is observed, suggesting a weakening upward momentum.

Source: xStation 5

Company News

The Honest Company (HNST.US) gains as much as soared 25% following a profitable Q4. The company reported a 10% rise in sales that surpassed estimates. For 2024, the company projects low-to-mid single-digit percentage revenue growth, expecting a softer first half compared to the second. CFO Dave Loretta highlighted the company's focus on profitable growth and confidence in its long-term strategy and financial prospects.

Source: xStation 5

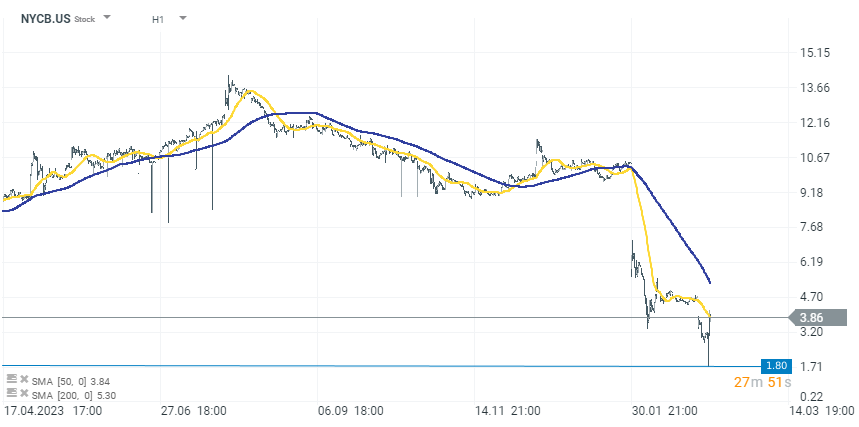

New York Community Bancorp (NYCB.US): Shares of New York Community Bancorp rebounded by almost 10% after a dramatic drop. The bank secured over $1B in capital, notably from Liberty Strategic Capital and other investors. To raise this capital, NYCB will issue shares at $2.00 and offer warrants. The bank has reduced its quarterly dividend by 80% and appointed Steven Mnuchin and Joseph Otting (the new CEO) to its board, aiming for future growth stabilization.

Source: xStation 5

American Eagle Outfitters (AEO.US) gains over 4,00% after exceeding holiday quarter expectations and revealing a new strategic plan. The company anticipates 2024 operating income between $445M and $465M and revenue growth of 2% to 4%.

Big Lots (BIG.US) dips over 5,00% ahead of its Q4 earnings report with analysts expecting a quarterly loss. The consensus EPS estimate is at -$0.26, a 7.1% year-over-year improvement, with revenue estimates down 7.1% at $1.43B.

Source: xStation 5

Rheinmetall โตแรง แต่ตลาดยังคาดหวังมากกว่า

Meta ก้าวจากการพึ่งพาไปสู่การควบคุม พัฒนา AI Chip ของตัวเอง

ข่าวเด่นวันนี้ 12 มี.ค.

Wall Street เคลื่อนไหวผสมท่ามกลางสงครามอิหร่าน 🗽 หุ้น Oracle พุ่งแรง 10%