On Thursday, US stock index futures indicated a likely recovery for Wall Street after experiencing its most significant drop since late September the day before. This comes after a range of economic updates, which we will summarize in the paragraph below. In the last hour before the market opened, futures for the Nasdaq 100, S&P 500, and Dow were all up, signaling a positive start and this sentiment continues at the market open. This rebound follows Wednesday's sharp decline, where the S&P 500 nearly reached a record high before suddenly falling 1.5%.

Macro summary:

-

In the final revision for Q3 2023, US GDP growth was adjusted to a 4.9% annualized rate, down from the previous 5.2% estimate but matching the initial October prediction. This marks a significant increase from the 2.1% growth in Q2 and is the highest since Q4 2021. The adjustment was mainly due to reduced consumer spending and imports. Meanwhile, real disposable personal income and the personal saving rate saw slight increases, while personal consumption expenditures and the PCE price index rose but at a slower pace than initially estimated.

-

For the week ending December 16, initial jobless claims slightly rose to 205K, below the anticipated 210K and just above the previous week's 203K. The four-week average dipped to 212,000. Continuing claims were slightly below expectations at 1.865M, with the insured unemployment rate steady at 1.3%. Really low data still suggest a strong labor market, which is relatively positive given the falling inflation data and cooling down of other economic sectors.

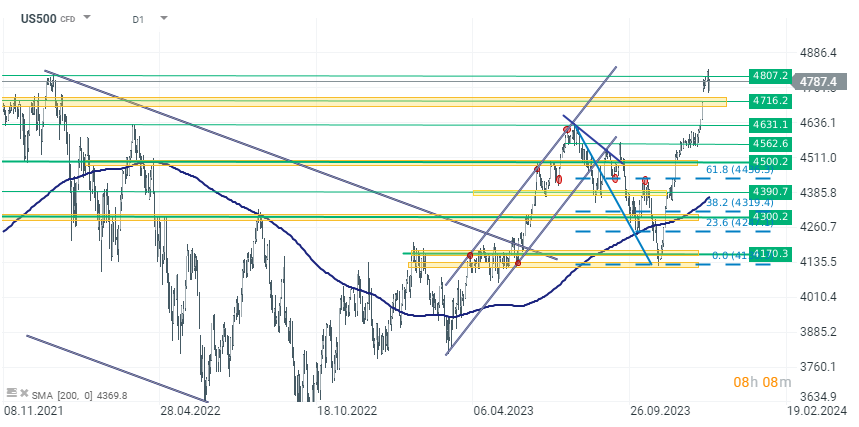

US500 Index

The US500 index experienced extremely dynamic increases last week. After a brief consolidation around the 4600 point level, it broke through to 4800, approaching close to historical highs. Yesterday, we observed a correction, but today the bulls are trying to make up for yesterday's decline. The 4700 point level deserves attention as the first support, and moreover, testing it would allow closing the upward gap that appeared a week ago.

Source: xStation 5.

Company news

Cisco (CSCO.US), a network equipment manufacturer, announced its intention to acquire Isovalent, a private company specializing in open-source cloud-native networking and security, on Thursday. Cisco aims to enhance and continue Isovalent's product range, including Isovalent Enterprise, for its customers. Post-acquisition, the Isovalent team will become part of Cisco's Security Business Group. While the financial details of the transaction were not disclosed, the deal is anticipated to be finalized in Q3 2024.

According to a Reuters investigation, Tesla (TSLA.US) has long been aware of significant vehicle defects affecting tens of thousands of customers but often attributed the issues to driver misuse rather than acknowledging the chronic problems. This revelation follows Tesla's recent recall of over 2 million vehicles due to Autopilot safety concerns. Records and interviews indicate that Tesla observed frequent suspension or steering failures for at least seven years globally. The company has been criticized for blaming customers, sometimes charging them for repairs on out-of-warranty vehicles, despite knowing the high failure rates of certain parts. Although Tesla addressed hundreds of complaints in China under regulatory pressure, it did not issue recalls for the same faulty components in the U.S. and Europe.

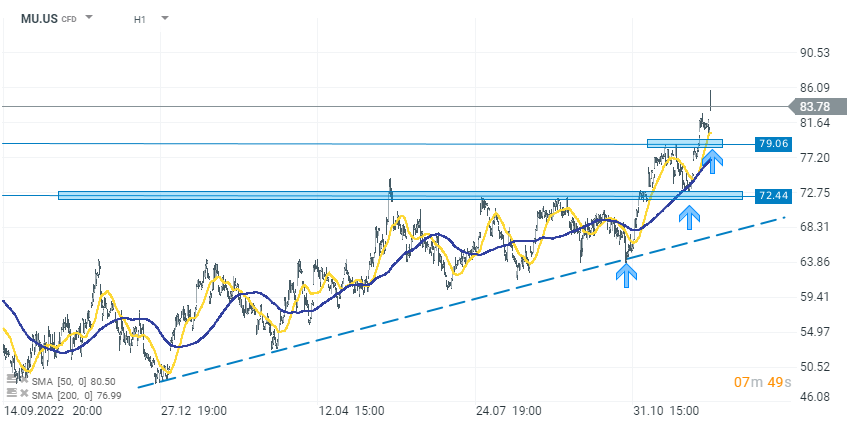

Micron Technology (MU.US) shares surged nearly 6% in premarket trading after announcing first-quarter results and guidance that exceeded expectations, signaling a real rebound in the memory sector driven by artificial intelligence (AI). Analysts are optimistic, with J.P. Morgan and BMO Capital upgrading their outlooks due to the demand for high-bandwidth memory, especially for AI applications. Bank of America highlighted Micron's potential in AI servers and its strategic positioning for significant revenue in fiscal 2024. Despite a loss in the recent quarter, Micron projects increased revenue and a narrower loss in the next quarter, with a positive outlook for 2024 driven by recovery in key markets and AI-driven demand.

Source: xStation 5

Source: xStation 5

VIX พยายามปรับตัวขึ้นแต่ติดขัด แม้ความไม่แน่นอนในวอลล์สตรีทยังสูง 🔎

ปฏิทินเศรษฐกิจวันนี้: 🔎 รายงานตลาดแรงงาน ADP (ADP Labor Market Report)

สรุปข่าวเช้า 4 มี.ค.

ข่าวเด่นวันนี้ 4 มี.ค.