- Small-cap companies are once again favored by investors

- The dollar loses 0.15%

- Bond yields are also recorded lower

Markets in the USA open the last trading session of this week definitely in an optimistic mood. PCE data came out as expected, which did not cause a significant market reaction. In the early hours of trading, we observe strong gains in the sector of smaller capitalization companies. The US2000 index gains 1.40% to 2270 points. However, the US500 and US100 also perform well, gaining 0.88% and 0.80%, respectively.

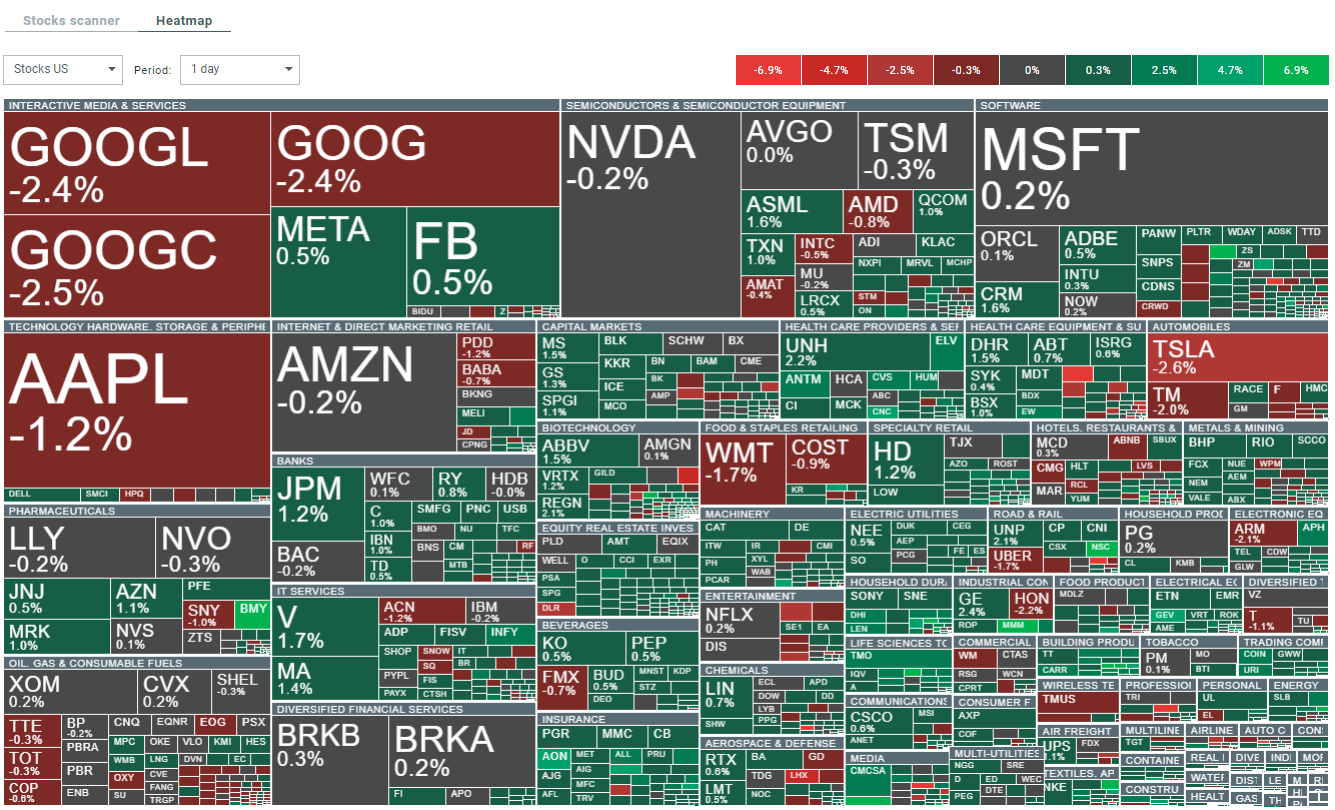

The increases are mainly dominated by smaller companies. In BigTech, we observe mixed sentiments with Apple, Alphabet, and Tesla recording losses. Source: xStation 5

US2000

The index price has remained in a consolidation range. Currently, we observe a price rise to the upper limit below the 2300 point level. If bulls manage to break through this zone, we can expect a continuation of increases. The direction of exit from the current consolidation between 2200-2300 points will be key.

Source: xStation 5

Corporate news

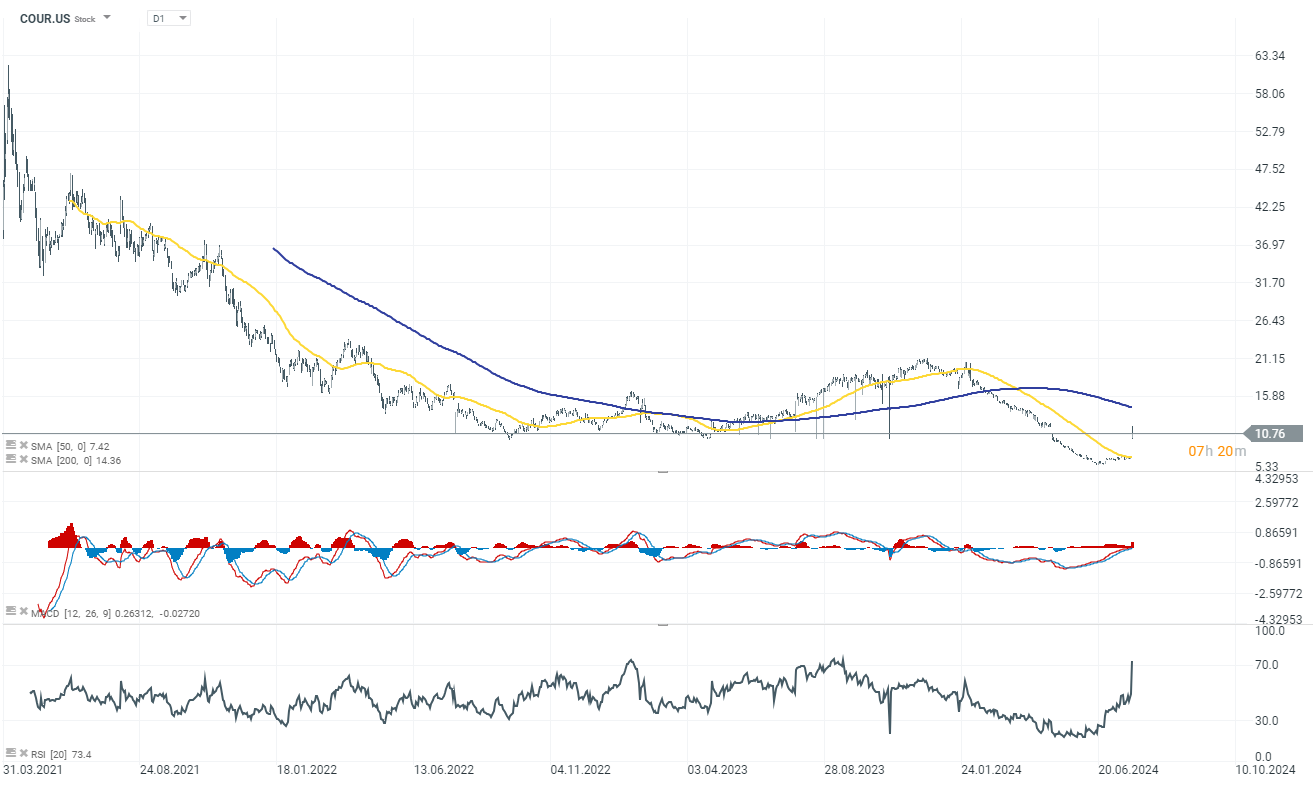

Coursera (COUR.US) stock gained 42% following strong quarterly results, significantly fueled by the growing demand for generative AI courses. CEO Jeff Maggioncalda highlighted that the success was largely due to over two million enrollments in AI-related courses. For fiscal year 2024, Coursera has reaffirmed its revenue expectations to be between $695 million and $705 million, aligning with analyst estimates around $699.91 million. Additionally, the company expects its adjusted EBITDA to range from $24 million to $28 million, which supports its goal of an approximate 4% EBITDA margin.

Boston Beer (SAM.US) initially decreased by more than 4% after the company reported disappointing second-quarter results. However, the stock has rebounded strongly and are currently trading at +4% note. The earning report shows the revenue fell by 4%, primarily due to a decline in sales volumes, although this was somewhat mitigated by price increases. The brand's depletion rate and shipment volume also saw reductions, largely due to weak performance in the Truly Hard Seltzer brand.

DexCom's (DXCM.US) stock experienced a significant drop of over 41% after releasing mixed second-quarter results. Despite a 15% year-over-year increase in revenue, the company's future revenue outlook was lower than anticipated. DexCom now projects third-quarter revenue to be between $975 million and $1 billion, missing the $1.15 billion consensus. For the full year, the company anticipates revenue to be between $4 billion and $4.05 billion, which is below the expected $4.33 billion.

Arista Networks ปิดปี 2025 ด้วยผลประกอบการระดับสูงสุดเป็นประวัติการณ์!

สรุปข่าวเช้า

US100 ร่วง 1.5% 📉

ข่าวเด่นวันนี้