- Wall Street indices open slightly higher

- US500 tests 4,745 pts resistance zone

- Boeing drops 8% after issues with 737 Max 9 jets

Wall Street indices launched today's trading slightly higher, following small gains made by European indices earlier today. S&P 500 gained 0.2% at session launch, Dow Joens traded 0.1% higher while Nasdaq jumped 0.5%. Small-cap Russell 2000 dropped 0.4%.

Economic calendar for today's US session is empty. Investors will only be offered a speech from Atlanta Fed chief, Raphael Bostic at 5:30 pm GMT. US economic calendar gets more interesting in the second half of the week with US CPI data for December on Thursday and Q4 banking earnings on Friday.

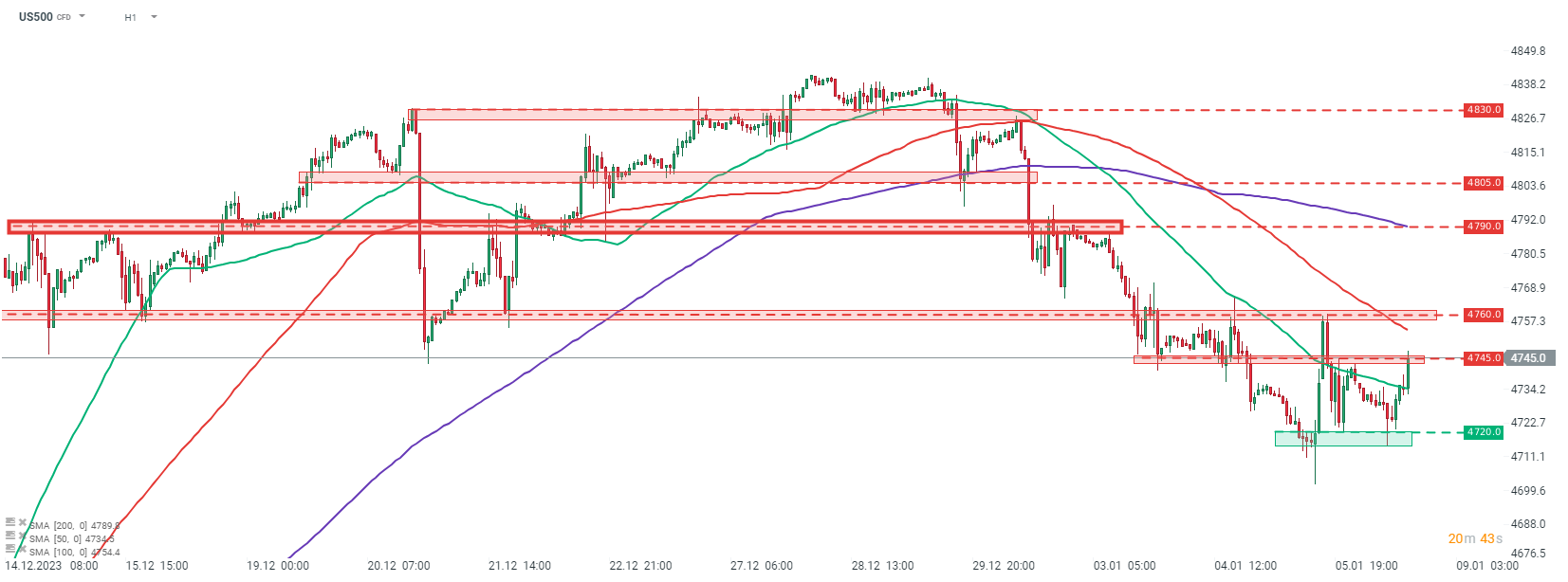

Source: xStation5

Source: xStation5

S&P 500 futures (US500) are trading higher today, with gains accelerating after launch of the US cash session. Taking a look at the index at H1 interval, we can see that bulls are attempting to break above the 4,745 pts resistance zone, that was tested a few times recently. Should buyers clear this area, the next resistance in-line can be found in the 4,760 pts area. Breakout would make short-term technical situation more bullish and, given a light newsflow, technicals may play a key role in today's price moves.

Company News

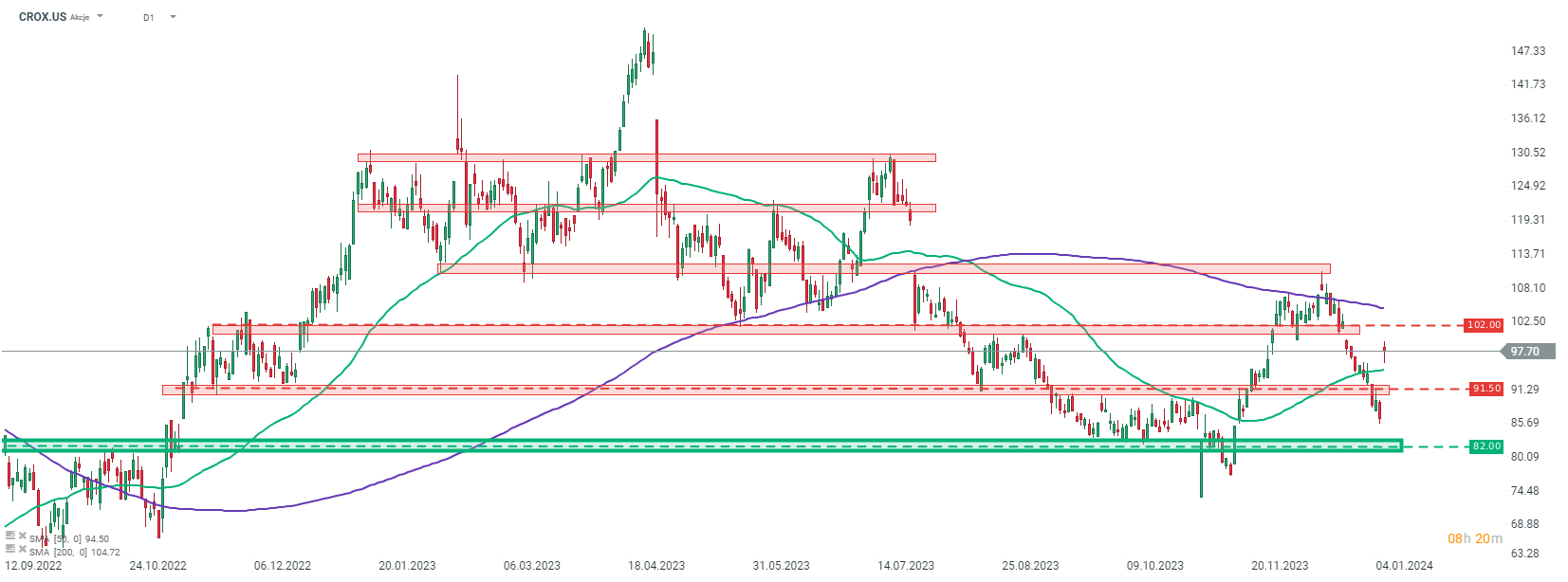

Shares of Crocs (CROX.US) rally today after company released updated full-year revenue guidance. Crocs said that it now expects 2023 revenue to be 11% YoY higher at around $3.95 billion. The outlook was upgraded on the back of a strong holiday season, with Q4 revenue now expected to have grown 1% YoY, while previous guidance called for a 1-4% drop.

Moderna (MRNA.US) said that its 2023 vaccine sales reached $6.7 billion, marking a massive drop from over $18 billion reported for 2022. Nevertheless, it is still above the $6 billion target the company has set for the previous year. Market share of Moderna's vaccine in the US increased from 37% in 2022 to 48% in 2023, but fewer people overall were interested in getting vaccine shot last year, what drove the sales plunge.

Shares of Boeing (BA.US) launched today's trading around 8% lower after a panel in one of Boeing 737 Max 9 jets owned by Alaska Airlines blew out mid-flight on Friday. US regulator ground over 170 aircraft to investigate. We wrote more on it in the earlier post. Shares of Spirit AeroSystems (SPR.US), a Boeing supplier, opened 13% lower.

Analysts' actions

- Dell Technologies (DELL.US) upgraded to 'overweight' at JPMorgan. Price target set at $90.00

- NetApp (NTAP.US) downgraded to 'underweight' at JPMorgan. Price target set at $87.00

- Garmin (GMRN.US) downgraded to 'neutral' at JPMorgan. Price target set at $135.00

- DoorDash (DASH.US) upgraded to 'buy' at Jefferies. Price target set at $130.00

- GitLab (GTLB.US) upgraded to 'buy' at Mizuho Securities. Price target set at $73.00

- ZoomInfo Technologies (ZI.US) downgraded to 'underperform' at RBC. Price target set at $14.00

Crocs shares (CROX.US) rally after company upgraded full-year revenue outlook. Stock launched today's trading with an over-10% bullish price gap but erased some gains after trading began. A near-term resistance zone to watch can be found ranging below $102.00 mark. Source: xStation5

Crocs shares (CROX.US) rally after company upgraded full-year revenue outlook. Stock launched today's trading with an over-10% bullish price gap but erased some gains after trading began. A near-term resistance zone to watch can be found ranging below $102.00 mark. Source: xStation5

US500 ปรับขึ้น หลังเจ้าหน้าที่ทหารส่งสัญญาณบวกต่อสถานการณ์ในช่องแคบฮอร์มุซ

สรุปข่าวเช้า 5 มี.ค.

ข่าวเด่นวันนี้ 5 มี.ค.

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท