- Wall Street opens higher

- Dollar loses slightly

- Bond yields lose for third consecutive session

Weak NFP data reignited investor hopes for faster interest rate cuts. While total employment came in above expectations at 206k market attention shifted to strong downward revisions for last month's data, a rise in the unemployment rate and lower private sector growth. Following the release of the data, we saw a sharp jump in index futures and a fall in the value of the dollar. However, moments later, the initial movements were erased. Investors are pricing in the chances of a cut in September and less than a cut in December this year. Following the release of the reports, the chances of interest rate cuts in the US have increased.

Today's market rises are mainly driven by the largest companies, as can be seen very well in the graphic presented above. Source: xStation 5

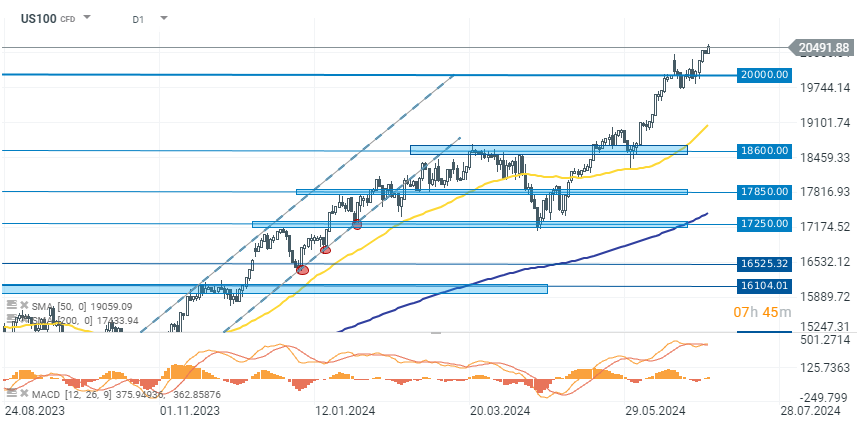

US100

The technology companies index (US100) is back on the rise after a brief consolidation at the 20000 point level. The US100 is today gaining 0.70% above 20500 points. The increases are mainly driven by the largest companies, including Amazon, Google and Meta Platforms.

Source: xStation 5

Company news

Macy (M.US) gains over 9% after an investor group, including Arkhouse Management and Brigade Capital Management, raised their takeover bid to $24.80 per share, valuing the company at approximately $6.9 billion. This new offer follows earlier rejections of $24 per share in March and $21 per share in December.

Crypto-related stocks are experiencing panic sellof as Bitcoin's price continued to drop for the fourth day in a row, decreasing nearly 6% to $54,300 ahead of a $9 billion payout to users of the defunct Mt. Gox exchange. The decline in Bitcoin is also affecting other cryptocurrencies like Ethereum, which fell about 10%, and related stocks such as Riot Platforms (RIOT.US), MicroStrategy (MSTR.US), CleanSpark (CLSK.US), Coinbase (COIN.US) and Marathon Digital (MARA.US).

Cleanspark stock price, source: xStation 5

Cleanspark stock price, source: xStation 5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡