US inflation surprised markets with higher than expected reading. The annual inflation rate in the US slowed only slightly to 6.4% in January from 6.5% in December, less than market forecasts of 6.2% although some analysts expected even a reading of 5.8%YoY.

Core inflation eased for a fourth consecutive month to 5.6%YoY in January, the lowest since December 2021. Still, the rate came in above market expectations of 5.5%.

Inflation on an annual basis is falling, partially due to the base effect, whose impact should be stronger in the coming months. However, the monthly reading is very surprising, with increases of 0.5%MoM and 0.4%MoM for core inflation.

The real estate market is primarily responsible for the high inflation reading. Contribution of the shelter component continues to play a significant role. In the case of monthly inflation, shelter accounted for as much as half of the increase! Moreover, lower energy prices should have a positive impact in the short term, while lower car prices may also have limited impact on the overall reading in the upcoming months. This means that inflation may reached a local low, which reinforces bets that the Fed will stick to its hawkish rhetoric.

The real estate market still has a significant impact on the CPI reading. On an annual basis, the impact of fuel prices is negative, however the situation reverses when we look on a monthly basis. Source: Macrobond, XTB

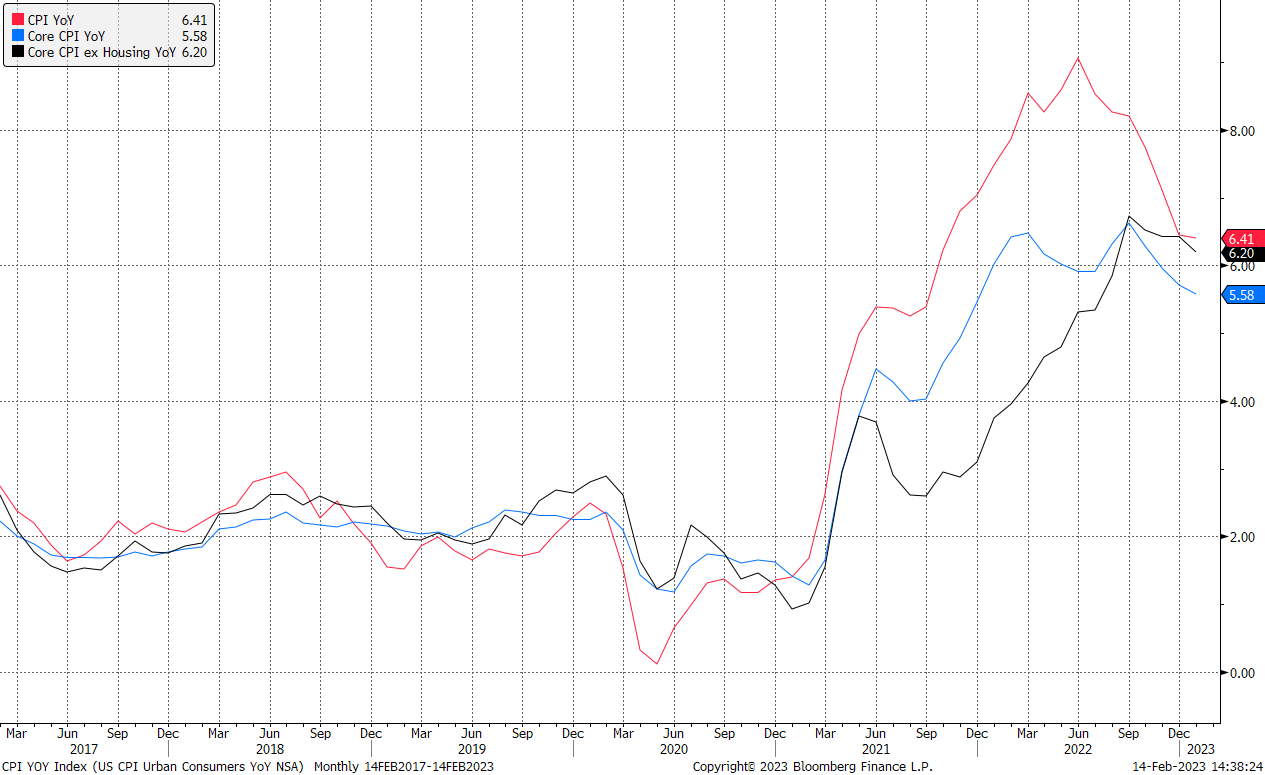

The real estate market still has a significant impact on the CPI reading. On an annual basis, the impact of fuel prices is negative, however the situation reverses when we look on a monthly basis. Source: Macrobond, XTB A positive aspect is the decrease of core CPI ex- housing. The Fed itself has hinted that real estate services will continue to make a significant impact in the near future, however it expects that this trend may weaken later in the year. source: Bloomberg

A positive aspect is the decrease of core CPI ex- housing. The Fed itself has hinted that real estate services will continue to make a significant impact in the near future, however it expects that this trend may weaken later in the year. source: Bloomberg

Market response was very volatile, although fresh data supports the hawkish rhetoric of the Fed, which should ultimately strengthen the dollar and negatively affect Wall Street. Final impact of today's publication will be known later in the session - for now, markets are still very volatile.

US100 is highly volatile and erases early gains. Local support around 12,500 points is currently being tested. Break below may offset the recovery move which started at the beginning of the week. Source: xStation5

US100 is highly volatile and erases early gains. Local support around 12,500 points is currently being tested. Break below may offset the recovery move which started at the beginning of the week. Source: xStation5

ดัชนีภาคบริการ ISM ออกมาแข็งแกร่ง กิจกรรมทางเศรษฐกิจขยายตัวมากที่สุดนับตั้งแต่ปี 2022

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈

VIX พยายามปรับตัวขึ้นแต่ติดขัด แม้ความไม่แน่นอนในวอลล์สตรีทยังสูง 🔎