On Thursday, semiconductor stocks generally are recording decent gains, as the sector awaits earnings reports from major players including Broadcom (AVGO.US). Among notable gainers we can distinguish such companies as Qualcomm (QCOM.US), AMD (AMD.US) or Nvidia (NVDA.US).

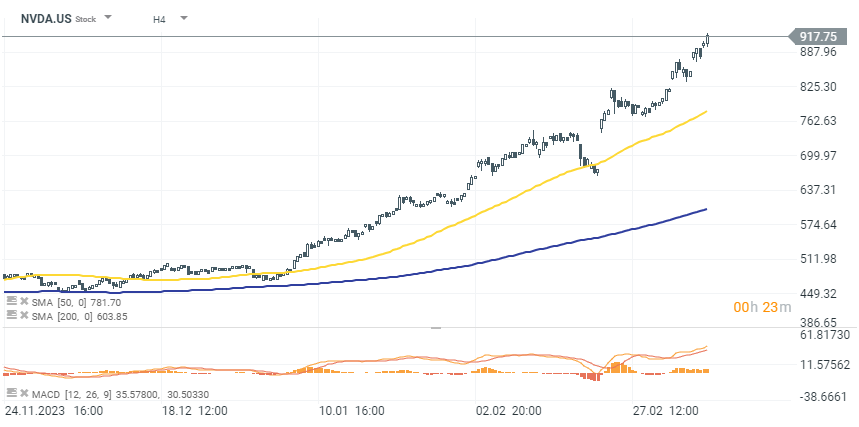

Nvidia (NVDA.US) gains over 4.00%. Recently Nvidia announced a collaboration with HP (HPQ) to integrate CUDA-X data processing libraries into HP's AI workstations.

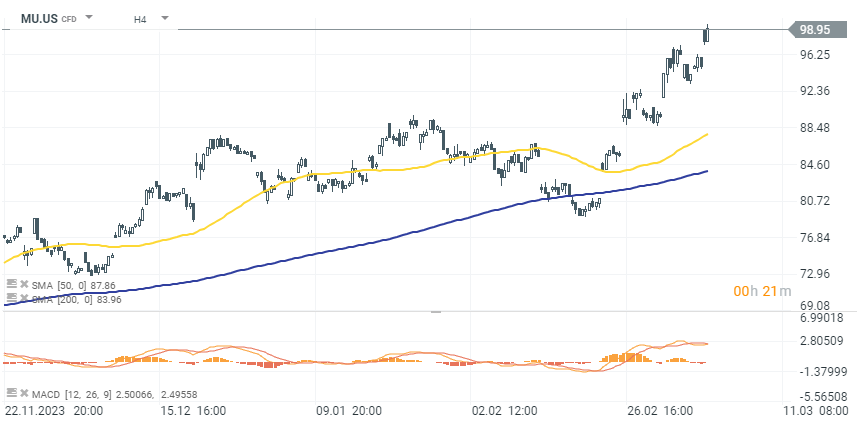

Micron (MU.US) also is recording over 4.00% gains following an upgrade from Stifel, citing underestimated 2025 projections.

Micron (MU.US) also is recording over 4.00% gains following an upgrade from Stifel, citing underestimated 2025 projections.

Broadcom (AVGO.US) stock rose over 3.00% as the market awaited its quarterly earnings, with expectations set at earnings of $10.42 per share and revenue of $11.72B.

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.