- ตลาดหุ้นสหรัฐฯ ผันผวนในวันนี้ โดยดัชนี US500 และ US100 ผันผวนอยู่ที่ระดับสูงสุดเป็นประวัติการณ์

- ดัชนี CPI ของสหรัฐฯ สอดคล้องกับที่คาดไว้ Fed Logan มองว่าจะมีการปรับลดอัตราดอกเบี้ยอย่างระมัดระวังในอนาคต อัตราดอกเบี้ยกองทุนของ Fed ที่แท้จริงจะเข้าใกล้ระดับเป็นกลางอีกขั้น

- Fed Kashkarki มองว่าตลาดแรงงานจะมีแนวโน้มอ่อนตัวลง โดย Fed อยู่ในตำแหน่งที่ดีในการสนับสนุนการเติบโตหากจำเป็น

- อัตราผลตอบแทนพันธบัตรอายุ 10 ปีอยู่ที่ 'เหนียวแน่น' ที่ 4.43% ในวันนี้ ดอลลาร์สหรัฐแข็งค่าขึ้น หุ้นที่เกี่ยวข้องกับ Bitcoin Coinbase และ Microstrategy เปลี่ยนแปลงเล็กน้อยแม้ว่า Bitcoin จะพุ่งสูงเหนือ 92,000 ดอลลาร์

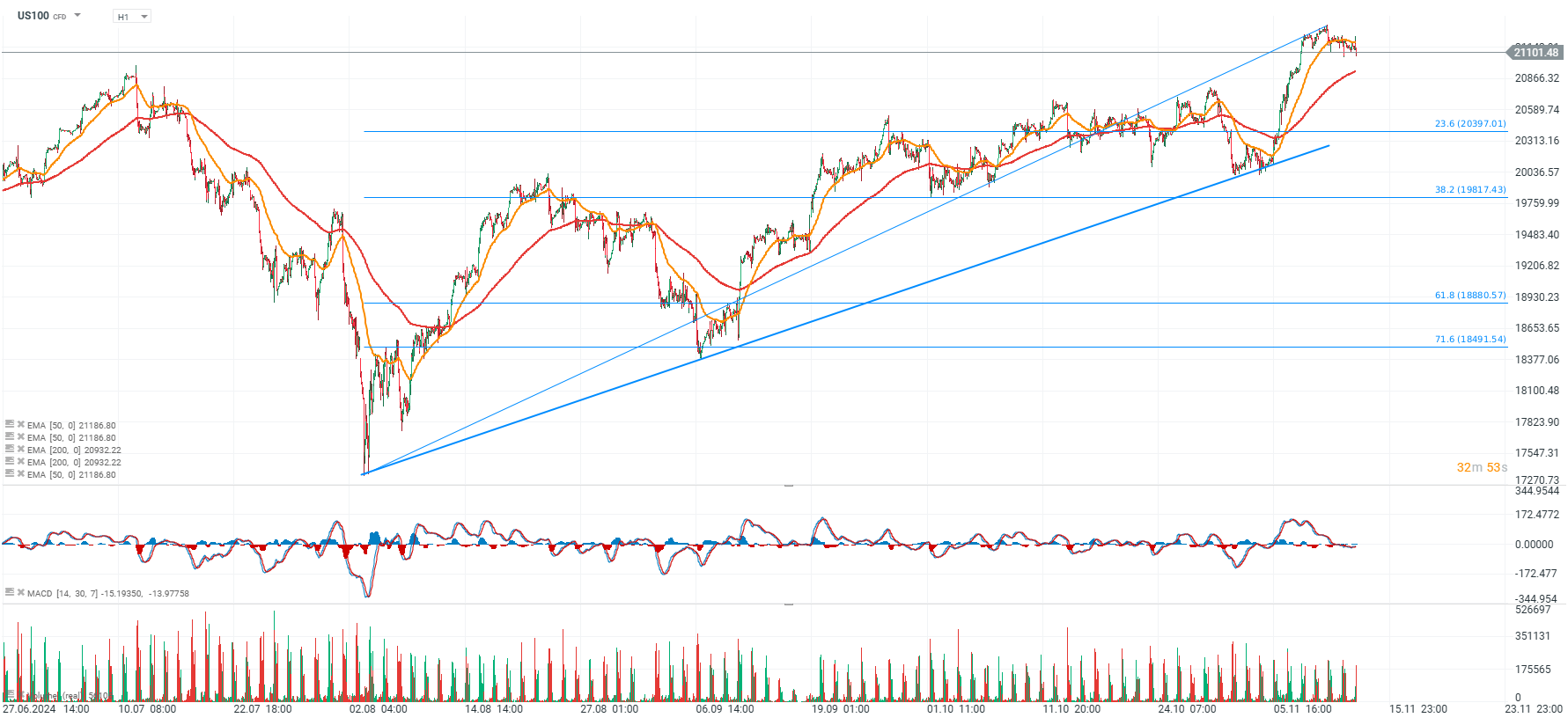

US100 (D1 interval)

Source: xStation5

Source: xStation5

Overall sentiments on US stock market session today are mixed. Source: xStation5

US stock market news

- Amgen (AMGN.US) rises 4% after the drugmaker says its phase 1 study results on MariTide don’t suggest bone safety concern and don’t change its conviction.

- Coty (COTY.US) declines 2% after the beauty company was downgraded to hold from buy at TD Cowen, which noted limited near-term catalysts.

- CyberArk Software (CYBR.US) is up 7%, after the security software company reported third-quarter results that beat expectations and raised its full-year forecast.

- MARA Holdings (MARA.US) slips 4% after the Bitcoin mining company reported third-quarter revenue that missed expectations.

- Spire Global (SPIR.US) soars 27% after the space-based data and analytics company agreed to a sell its maritime business to Kpler for about $241 million. We can see also soaring today shares of Momentus (MTUS.US) and RocketLab (RKLAB.US)

- Cava Group (CAVA.US) jumps 17% after the Mediterranean restaurant chain increased its annual projections for comparable sales.

- The biggest US-based lithium miner and EV supplier, Albemarle (ALB.US) surges 7%, continuing the rebound as big lithium miner Liontown plans production cuts, potentially benefiting

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.