U.S. market sentiment is very weak today, but improved after July ISM data from the U.S., which the market took as evidence that a recession in the U.S. economy is not a foregone conclusion. ISM services data in June showed 48.8, but today's July reading shows a slight expansion at 51.4. Statements by the Fed's Goolsbee suggest that the Federal Reserve will not be in too much of a hurry to cut rates, 'overreacting' to the recent, noticeably weaker, but in Goolsbe's view 'not yet recessionary' data.

Such a 'hawkish' scenario is also made plausible by the strong reading of the services price sub-index, in today's ISM data (57 versus an expected drop to 55.1 after 56.3 in June). As a result, the ISM data is not unequivocally positive for the markets, so Wall Street's reaction after the report is admittedly upward, but the indexes are still far from erasing the declines.

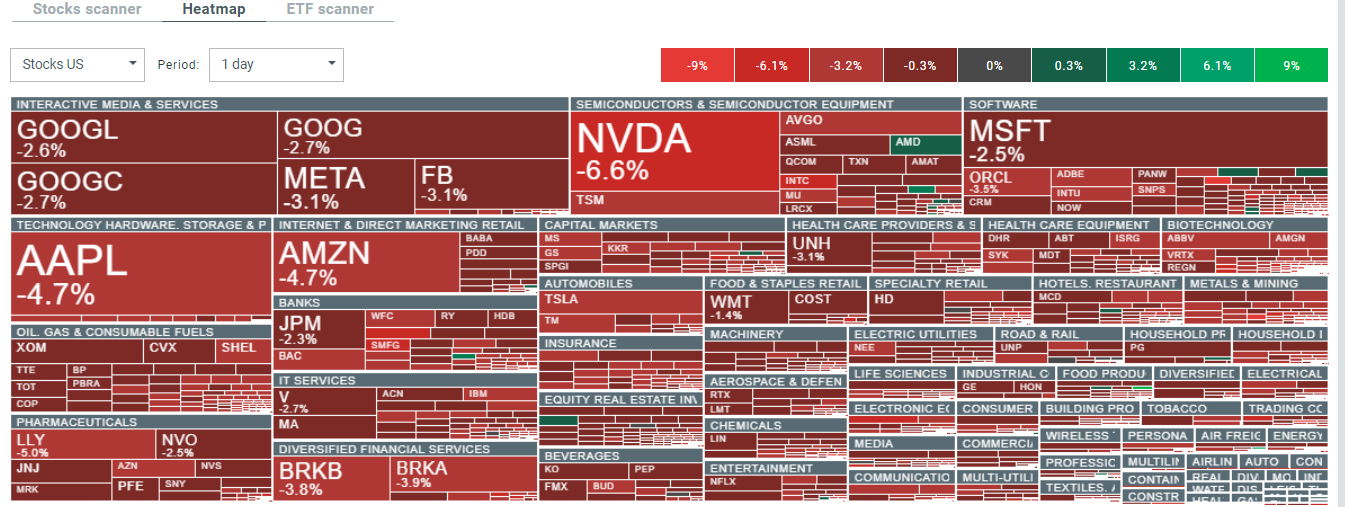

We are seeing a slight strengthening of the dollar and an improvement in sentiment in the stock market, which had feared that today's reading would confirm Friday's very weak ISM data from manufacturing and increase fears of a recession. US100 futures are still losing nearly 2.9%, although they were down nearly 5.5% before the Wall Street market opened. Still, strong selling pressure is seen across the entire technology, especially semiconductor sector.

- ISM data above forecasts, but price index much higher; Mixed comments from Fed's Goolsbee

- US 10-year bond yields fall below 3.8%

- Euphoric 13% gains on Kellogg (K.US) shares after potential deal to sell Kellanova brand to Mars for $30 billion

- Nvidia (NVDA.US) dives 9% below $100 per share in response to potential postponement of AI Blackwell GPU chip shipments until 2025; Apple and Amazon lose close to 5%

US100 (M15 interval)

Nasdaq 100 (US100) futures are trying to stave off a correction and bounce from around 17300 to near 18,000 points, where we see the 100-session simple moving average (SMA100, black line) and an important psychological resistance level.

Source: xStation5

ISM services data from the United States (for July)

- ISM index for services:51.4 (expected: 51; previous: 48.8)

- Employment sub-index: 51.1 (previous: 46.1)

- Price sub-index: 57 (previous: 56.3)

- New orders sub-index: 52.4 (previous: 47.3)

Previously released July PMI data for services showed a drop to 55 points, with a preliminary reading of 56 points and 56 in June. However, S&P's chief economist points out that the PMI report indicates a strong economy and job growth for the second month in a row. This clearly conflicts, with the 'recessionary' fears that the market has begun to discount in recent days, fearing high stock valuations.

Almost all stocks of large US companies are under pressure today, however the pressure weakens after the US ISM data. Source: xStation5

US100 ร่วง 1.5% 📉

ข่าวเด่นวันนี้

เศรษฐกิจอังกฤษชะงักงัน ภาษีการค้ากดดันหุ้นยักษ์ใหญ่ ขณะที่คริปโตเริ่มทรงตัว

DE40 ทำผลงานเหนือกว่าตลาดหุ้นยุโรป 🇩🇪 📈 กำไรของหุ้นบิ๊กแคปหนุนดัชนีพุ่งแรง 🚀