The Federal Reserve delivered a second 75 basis point rate hike in a row. Decision was in-line with expectations and therefore did not result in any major move in the markets. However, volatility picked up during Powell's press conference, especially after the Fed Chair said that rate increase may have to slow down. Interestingly, this was one of few dovish mentions during the whole press conference as Powell sounded rather hawkish. A point to note is that a similar surge occurred after the meeting in June but back then it proved to be short-lived.

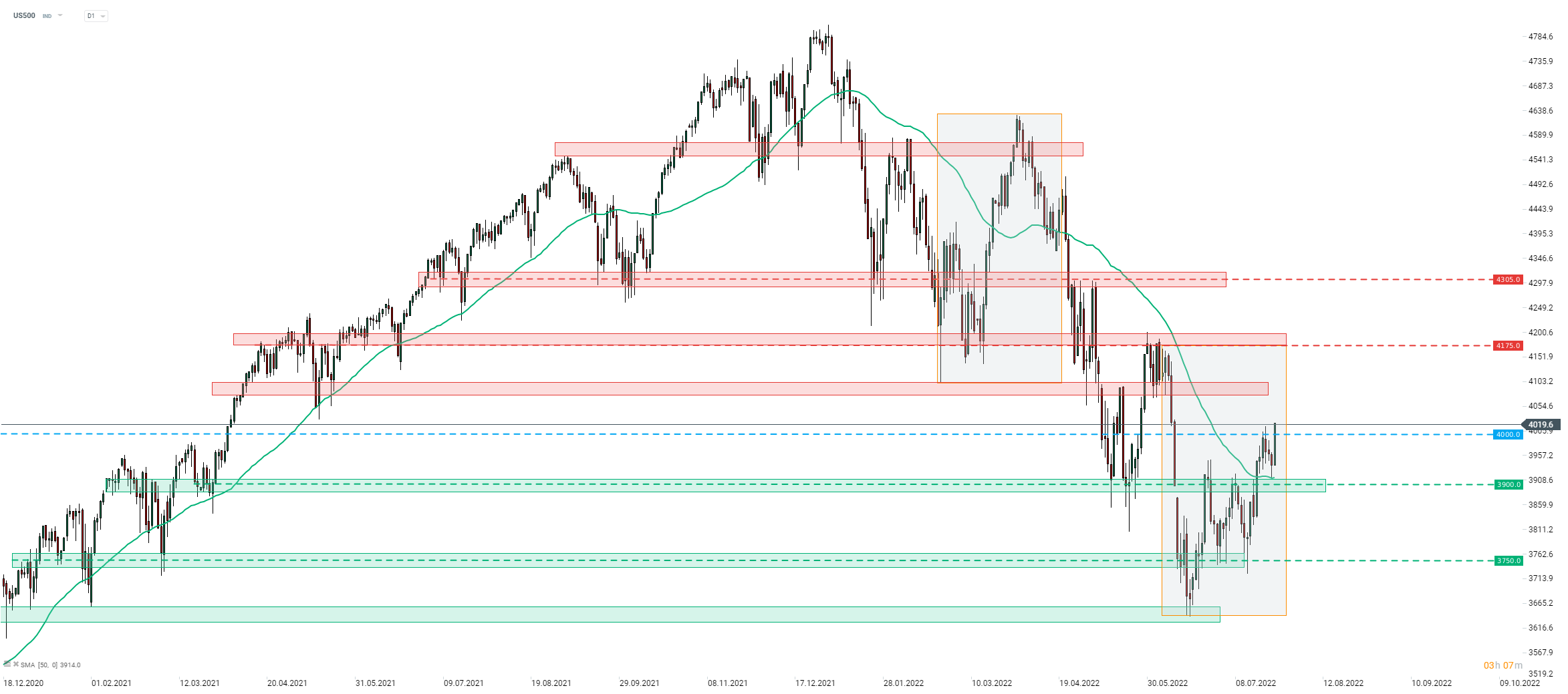

S&P 500 (US500) jumped above 4,000 pts during Powell's presser as Fed Chair hinted that pace of tightening may need to slow. Source: xStation5

S&P 500 (US500) jumped above 4,000 pts during Powell's presser as Fed Chair hinted that pace of tightening may need to slow. Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด