The Federal Reserve raised the target for the fed funds rate by 75 basis points to 1.5%-1.75% during its June meeting, after the inflation rate unexpectedly accelerated last month to 41-year highs. Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures. The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is strongly committed to returning inflation to its 2 percent objective.

Key takeaways from the statement:

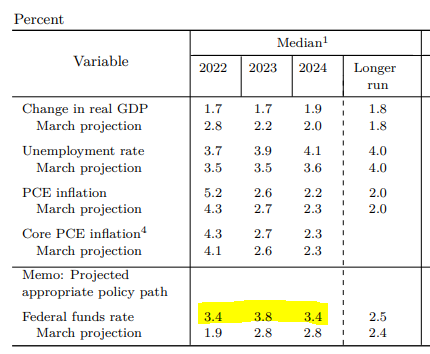

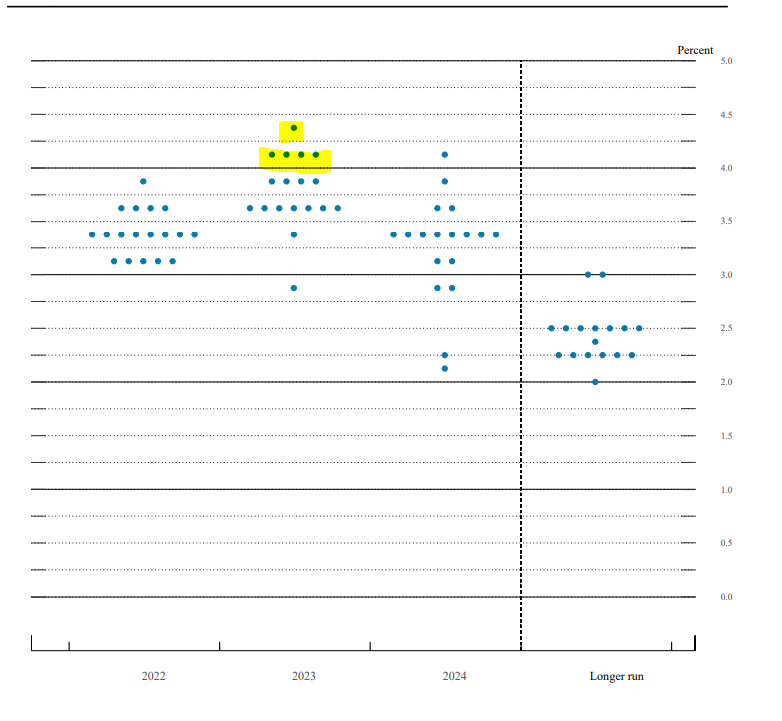

- Quite a large increase in expectations of an increase in interest rates (3.4% this year and 3.8% next year), which probably means another hike of 75 bp

- The considerable increase in inflation projections shows that the Fed admits that the situation is very tense, which requires strong interest rate hikes

- The Fed in the statement strongly indicates that it is focused on bringing inflation back to the target, especially taking into account the strong labor market and good economic prospects

- 5 members see interest rates at 4% in 2023

- In 2023, the first interest rate cuts will be possible, inflation will not return to the target in 2024

- Inflation projections for 2023 show a strong decline in inflation, to a range below 3%, although from a much larger base of over 5% for 2022

Source: FED

Source: FED

US500 failed to break above resistance at 3800 pts and resumed downward move. Source: xStation5

US500 failed to break above resistance at 3800 pts and resumed downward move. Source: xStation5

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ

Wall Street ปรับตัวขึ้นต่อเนื่อง; ดัชนี US100 รีบาวด์มากกว่า 1% 📈

Market Wrap: หุ้น Novo Nordisk ทะยานมากกว่า 7% 🚀