Major Wall Street indices launched Thursday's session higher, however upbeat sentiment faded away later on and stock resumed recent downward correction, while the dollar index firmed up near 104.7, hovering near its strongest levels in seven weeks.

Investors remained cautious as recent US economic data pointed to a still-tight labor market. At the same time, minutes of the Federal Reserve’s last meeting showed that US policymakers largely agreed to keep fighting inflation with more interest rate hikes. Also rising geopolitical tensions weigh on market sentiment. Ahead of the first anniversary of the Russian invasion of Ukraine, NATO Chief Stoltenberg said that the alliance has observed indications that China is perhaps considering sending weapons to Russia. Meanwhile Germany’s Chancellor Scholz informed Chinese representatives that sending weapons to Russia is not acceptable.

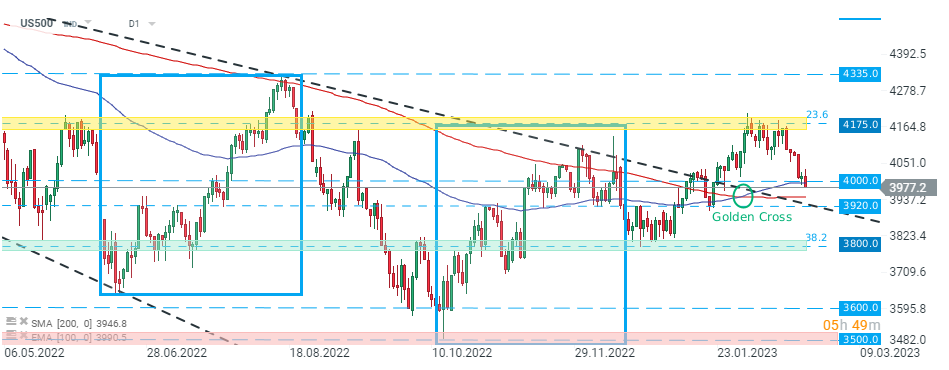

US500 fell below psychological support at 4000 pts and is trading at its lowest level since the end of January. If current sentiment prevails, next support to watch can be found at 3920 pts, which is marked with previous price reactions and 200 SMA (red line). Source: xStation5

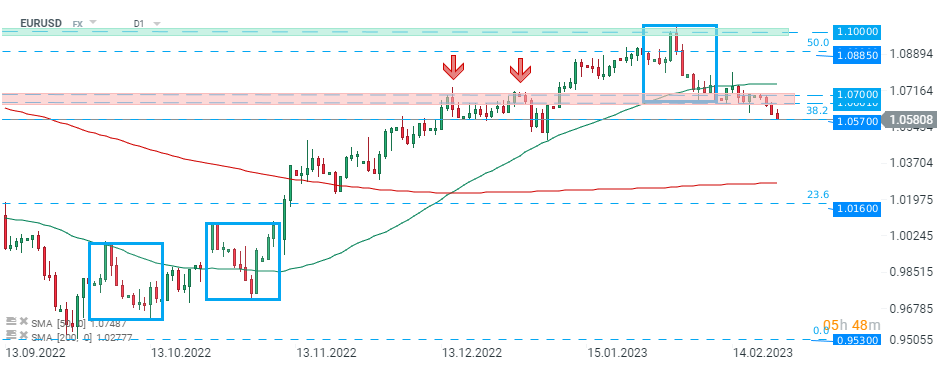

EURUSUD pair extends downward move and is currently testing crucial support at 1.0570, which coincides with 38.2% Fibonacci retracement of downward wave launched in May 2021. Break lower may provide additional fuel for the bears. Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด