Minutes from latest FOMC meeting has just been released. The publication was perceived as dovish triggered moves on the markets. As aresult Wall Strret inidces rose sharply, while USD moved south.

Here are key takeaways from the document:

-

FED members agreed that a slower pace of rate hikes would allow the FOMC to better assess progress toward its goals "given the uncertain lags" associated with monetary policy.

-

Policymakers agreed that there were few signs of inflation pressures easing, however some of them suggested that slowing the pace of rate increases could reduce financial system risks, others suggested that slowing should wait for more progress on inflation

-

Policymakers observed that the labour market remained tight; many noted tentative signs that it may be gradually moving toward a better balance of supply and demand. Participants agreed that there were few signs of inflation pressures easing.

-

Many participants expressed significant uncertainty about the ultimate level of the fed funds rate required to contain inflation, with various participants suggesting it was higher than previously anticipated.

-

Some members observed that the labor market remained tight, many noted tentative signs that it may be gradually moving toward a better balance of supply and demand.

-

Central bankers agreed that the risks to the inflation outlook remained skewed to the upside.

-

Some participants stated that stricter policy was consistent with risk management; others observed an increasing risk of overtightening.

-

The minutes of the November 1-2 Fed policy meeting show that a substantial majority of participants thought a slowing in the pace of interest rate hikes would be appropriate soon.

-

All participants agreed that a 75-basis-point increase was necessary and a next step toward making monetary policy sufficiently restrictive.

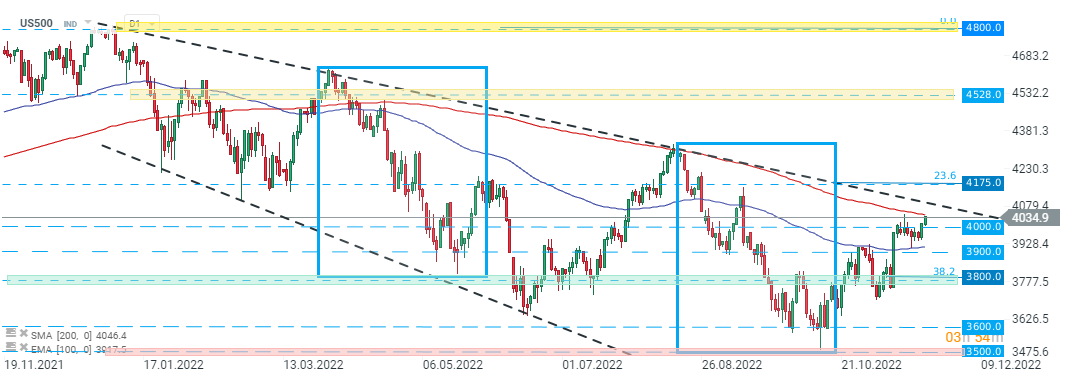

US500 rose sharply and is appraching recent highs. Source: xStation5

US500 rose sharply and is appraching recent highs. Source: xStation5

EURUSD is trading higher today and today’s Minutes provided more fuel for bulls. Source: xStation

EURUSD is trading higher today and today’s Minutes provided more fuel for bulls. Source: xStation

📉 BREAKING: US100 ร่วงเล็กน้อย หลังรายงาน NFP ต่ำกว่าคาด

ปฏิทินเศรษฐกิจ – ทุกสายตาจับตา NFP

ECB Minutes: ผลกระทบเต็มที่จากความแข็งค่า ยูโร ต่อเงินเฟ้อยังมาไม่ถึง 🇪🇺

ปฏิทินเศรษฐกิจ: ธนาคารกลางปะทะความเสี่ยงเงินเฟ้อทั่วโลก