The widely watched US CPI inflation for October has just been released and unexpectedly showed a massive deceleration in price growth in October. The annual inflation rate in the US slowed for a fourth month to 7.7% in October, the lowest since January, and below analysts estimates of 8%. It compares with 8.2% in September. Compared to the previous month, the CPI rose 0.4%, the same as in September and below expectations of a higher 0.6% rate. On a yearly basis CPI index advanced 6.3% YoY in October, after rising at a 40-year high of 6.6% in September and compared with market expectations of 6.5% gain.

The energy index increased 17.6%, below 19.8% in September, due to gasoline (17.5% vs 18.2%) and electricity (14.1% vs 15.5%). A slowdown was also seen in the cost of food (10.9% vs 11.2%) and used cars and trucks (2% vs 7.2%). On the other hand, prices for shelter (6.9% vs 6.6%) and fuel oil (68.5% vs 58.1%) increased faster.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. Still, figures continue to point to strong inflationary pressures and a broad price increase across the economy, mainly in the services sector while prices of goods have benefited from some improvements in supply chains.

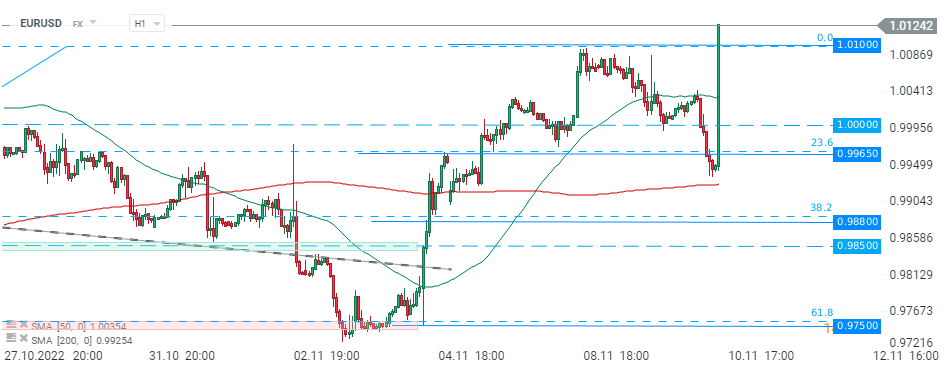

Today's report eases concerns that high inflation will last longer than expected and may make policymakers rethink the need for aggressive tightening going forward. Following today’s data release we can observe weakening of the US dollar, while major US indices futures rose sharply.

Source: Bloomberg

Source: Bloomberg

US500 jumped above key resistance at 3800 pts following the CPI data release. Source: xStation5

EURUSD broke above parity level. Source: xStation5

สรุปข่าวเช้า 6 มี.ค.

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

ตลาดเด่นวันนี้: EURUSD

US500 ปรับขึ้น หลังเจ้าหน้าที่ทหารส่งสัญญาณบวกต่อสถานการณ์ในช่องแคบฮอร์มุซ