US dollar is one of the best performing major currencies today, just hours ahead of the release of top-tier US data. US retail sales report for May is a key macro release of the day. Report will be released at 1:30 pm BST and is expected to show a 0.2% monthly increase in both headline and core retail sales. This comes after flat headline retail sales in May and a 0.2% monthly increase in core retail sales.

Expectations of an increase in retail sales are driven by discount offered by businesses around the Memorial Day weekend, as well as lower car prices, which encouraged spending. On the other hand, revolving credit data continues to suggest that US consumers are more wary in their spending amid high interest rate environment, although the latest data on credit is from April so it may be somewhat outdated. However, declines in University of Michigan consumer sentiment index in May and June suggest support the outlook for a more cautious consumer, especially as declines in headline UoM index were driven by current conditions subindex.

US, retail sales for May

- Headline. Expected: +0.2% MoM. Previous: 0.0% MoM

- Ex-autos. Expected: +0.2% MoM. Previous: +0.2% MoM

However, the report is unlikely to have a major impact on Fed's policy views. While US central bank takes all economic data into account when making decisions, it is primarily focused on inflation and jobs market. And neither of those support rate cuts yet, with inflation remaining above Fed's target and jobs market remaining strong and tight (although signs of cooling can be spotted). Money markets currently see a 8% chance of 25 basis rate cut at July meeting and an over-60% chance of a cut by September meeting.

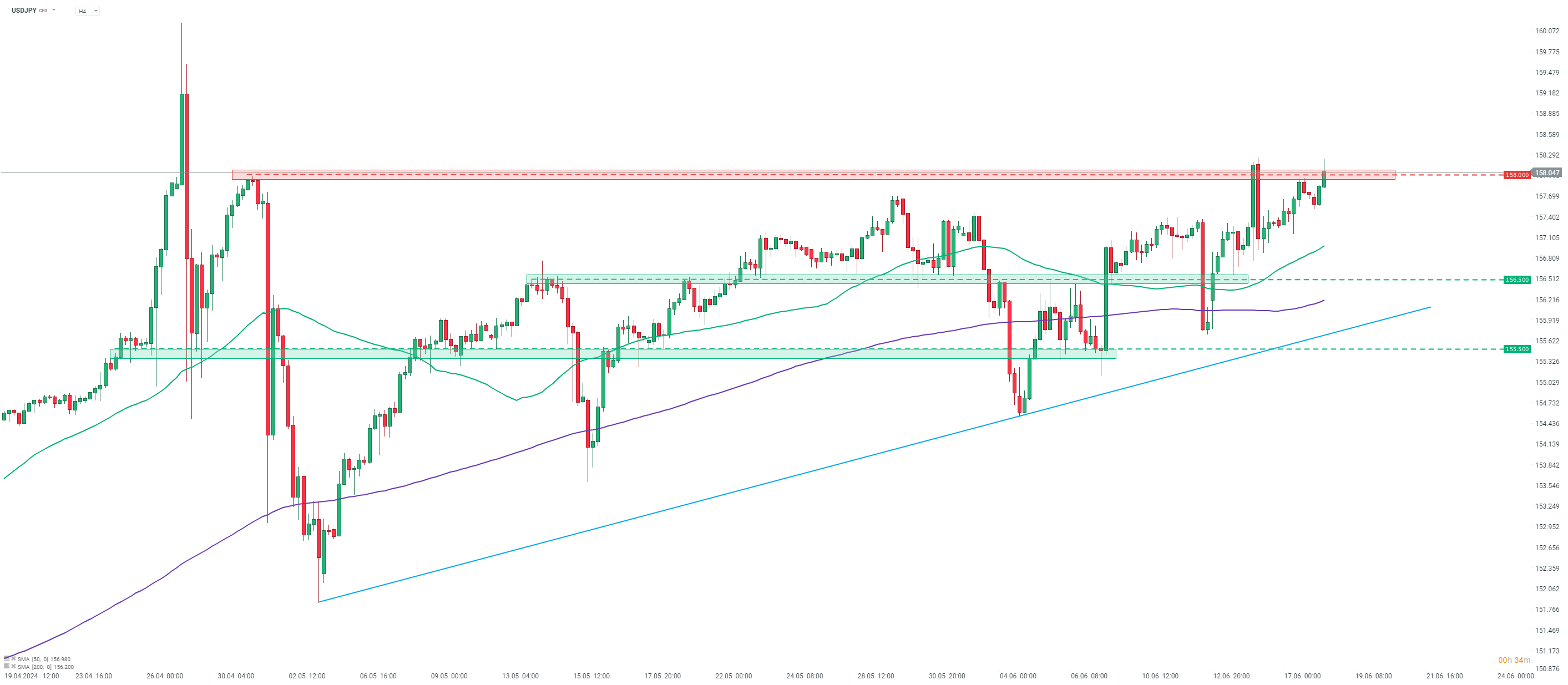

USD is one of the best performing G10 currencies today. Taking a look at USDJPY chart at H4 interval, we can see that the pair is making another attempt at breaking above the resistance zone ranging around 158.00 handle, and marked with local highs from early-May and mid-June.

Source: xStation5

Source: xStation5

สรุปข่าวเช้า 6 มี.ค.

ECB Minutes: ผลกระทบเต็มที่จากความแข็งค่า ยูโร ต่อเงินเฟ้อยังมาไม่ถึง 🇪🇺

ตลาดเด่นวันนี้: EURUSD

ปฏิทินเศรษฐกิจ: ธนาคารกลางปะทะความเสี่ยงเงินเฟ้อทั่วโลก