USDCAD jumped following the release of upbeat data from the United States earlier today (ADP and ISM services). Drop in oil prices following release of DOE data also contributed to weakness of the Canadian dollar against the US dollar. While the pair has been strengthening since European morning, release of the aforementioned data pushed the pair to daily highs. However, as the time passed the situation began to reverse - USDCAD began to erase gains, even as crude prices held lower.

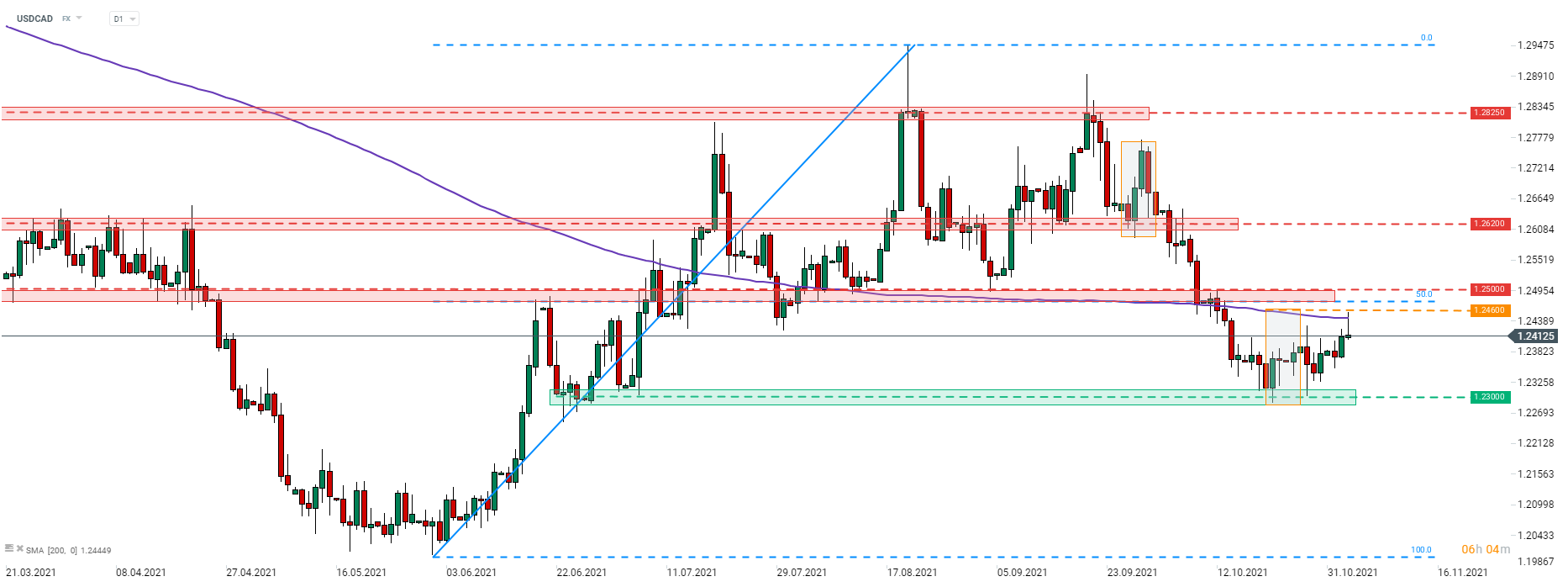

A look at USDCAD at daily intervals shows that the pair failed to break above the 200-session moving average in the 1.2445 area (purple line). Shape of today's daily candlestick suggests that the ongoing, brief upward correction may be about to end. Note that today's daily high was reached just a touch below the upper limit of the local market geometry in the 1.2460 area, what further supports bearish reversal. The pair is likely to become more volatile when the FOMC announces a monetary policy decision today at 6:00 pm GMT. Taper announcement looks like a done deal but size and timing of tapering is uncertain. Should the Federal Reserve decide on a large tapering (i.e $20 billion less in monthly purchases) with immediate launch (in November), USD may strengthen and USDCAD may rise along.

Source: xStation5

Source: xStation5

BREAKING: จำนวนผู้ยื่นขอสวัสดิการว่างงานในสหรัฐฯ ปรับตัว สูงกว่าที่คาดเล็กน้อย

เศรษฐกิจอังกฤษชะงักงัน ภาษีการค้ากดดันหุ้นยักษ์ใหญ่ ขณะที่คริปโตเริ่มทรงตัว

สรุปข่าวเช้า

ข่าวเด่นวันนี้