- Goldman Sachs sees no downside risk to commodity prices despite the prospect of a banking crisis and sees an average 28% upside potential over the next 12 months;

- Despite declines in lithium prices, demand for electric cars in China remains at higher levels due to the opening up of the Chinese economy and moderately loose monetary policy in the Middle Kingdom;

- The US has implemented the Inflation-Reduction Act (IRA) programme, which could lift demand for electric cars in the US. Energy prices have fallen convincingly that electric cars can be a competitive source of transport.

Albemarle (ALB.US) has been the largest supplier of lithium for electric vehicle batteries since 2020. Lithium prices are a key factor in the company's profitability - sentiment around its shares has deteriorated as they have fallen. Albemarle also specialises in niche chemical services (bromine, catalysts) but lithium accounted for 68% of its revenues in 2022. The company has issued optimistic forecasts for 2023 and expects demand to improve. The main risks appear to be the spectre of a financial crisis, tighter credit conditions for consumers and potential geopolitical risks arising from strained Washington-Beijing relations. The company has a manufacturing facility in China.

New plant and further higher demand?

Albemarle will invest US$1.3bn in a new lithium processing plant in the US, securing a domestic supply chain for the strategic raw material. According to the company, the plant will double its lithium processing capacity and help serve major customers (including Tesla, TSLA.US) who are reporting higher demand for batteries. The South Carolina plant will be able to process 50,000 tonnes of lithium per year (approximately 2.4 million EVs per year).The company sees the US as a major area for expansion thanks to, among other things, tax credits for electric cars. Construction of the giant project is expected to begin in late 2024; the company has not yet announced an opening date for the plant.

Despite falling lithium prices, the company expects demand to increase. In Q4 2022, the company's net margin was over 36%. The company aims to almost triple production capacity by 2027. In 2022, it reported revenue and EBITDA growth of 120% and 299% y-o-y, respectively. For the current year, Albemarle estimates significant sales growth in the range of 55% - 75% and operating cash flow of US$2.2bn. Despite business growth, the company's shares are still trading at attractive fundamental valuation ratios, at a discount to the average for US equities. P/E is 8 (Nasdaq average 19), C/Wk around 3 (Nasdaq average 4).

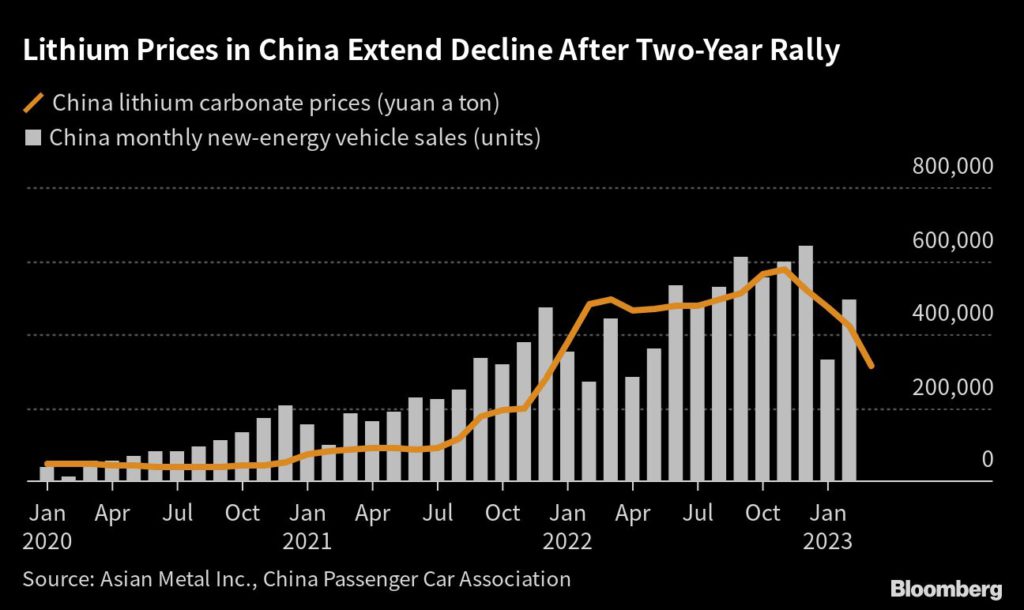

Lithium prices have fallen since Q4 2022 but higher EV sales in China have increased and may support a rebound. Source: Bloomberg

Lithium prices have fallen from a peak reached in late 2022 but still have long-term potential for a rebound. Source: Bloomberg Albemarle (ALB.US) share chart, D1 interval. The price has settled below the 38.2 Fibonacci retracement of upward wave started in march 2020 and now is trading below the SMA200 and SMA100. However fundamental valuation ratios contrary to technical analysis suggest that the current valuation of the company's business may be much more attractive. The PEG ratio is 0.6 against an average of 2.1 for the US chemical industry. Source: xStation5

Albemarle (ALB.US) share chart, D1 interval. The price has settled below the 38.2 Fibonacci retracement of upward wave started in march 2020 and now is trading below the SMA200 and SMA100. However fundamental valuation ratios contrary to technical analysis suggest that the current valuation of the company's business may be much more attractive. The PEG ratio is 0.6 against an average of 2.1 for the US chemical industry. Source: xStation5

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈