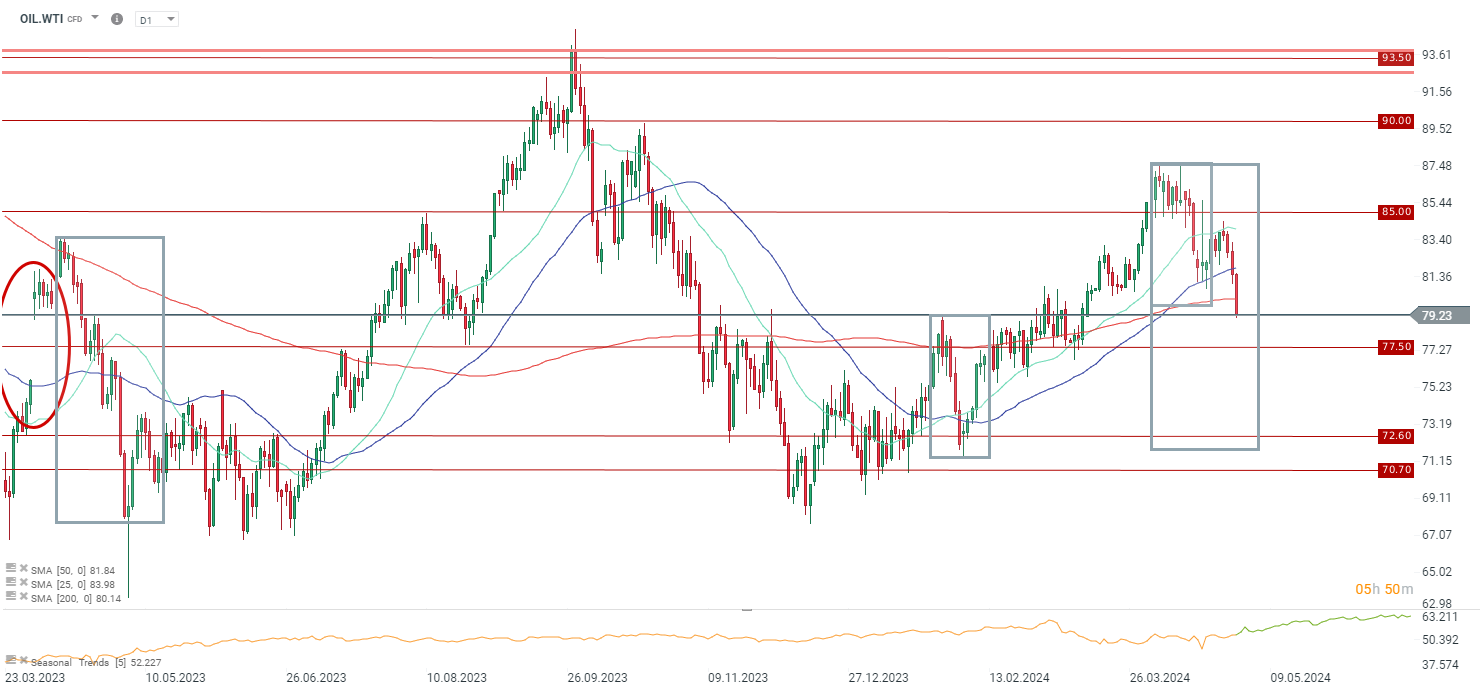

WTI oil is losing nearly 3% today, testing around $79 per barrel, following the release of a DOE report showing a 7.26 million bbl inventory build, against expectations for a draw of over 2 million bbl. While the data is for the previous week, it's worth noting that May is typically a period when oil inventory builds start to dwindle due to increased demand for fuels. Additionally, the ISM manufacturing report showed a reading below 50, which could signal a weaker economy and potentially lower fuel demand in the near future.

WTI oil is breaking below $80 per barrel today, its 100 and 200-day moving averages, and breaching the range of its largest retracement of the trend, trading near $79 per barrel, its lowest level in 6 weeks. Oil is down nearly 10% from its recent highs.

BREAKING: ปริมาณสำรองน้ำมันสหรัฐเพิ่มขึ้นอย่างมหาศาล!

📈 ราคาทองพุ่ง 1.5% ก่อน NFP ทำระดับสูงสุดตั้งแต่วันที่ 30 มกราคม

Silver พุ่ง 3% ในวันนี้ 📈

ข่าวเด่นวันนี้