BlackRock reported higher 1Q24 results than market consensus. The company recorded a record AUM (assets under management), which at the end of the quarter amounted to $10.47 trillion (+15% year-over-year). The average AUM for the quarter was $10.18 trillion, up 14% year-over-year. Revenues exceeded market expectations by 1.06%, diluted earnings per share were 5.04% higher than consensus, and the AUM value surpassed expectations by +0.37%.

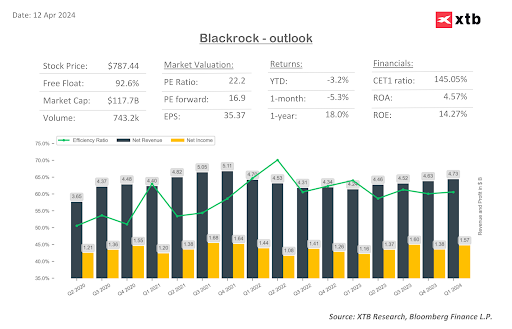

Revenues amounted to $4.73 billion, up +11% year-over-year and +2% quarter-over-quarter. The solid growth foundation includes a positive market impact on AUM value, organic growth of base fees, which increased by 8.8% year-over-year—marking the third consecutive quarter of increasing dynamics—and a strong rebound in the performance fees segment, which saw a +270% growth year-over-year, although these fees were -34% lower than in the previous quarter.

The quarterly capital inflow to the long-term segment amounted to $76 billion, nearly 40% of the inflows recorded in the entire year of 2023. The largest inflow was recorded from the Americas, accounting for $58 billion.

The fund shows strong results against the financial sector backdrop, presenting solid growth in every key financial performance segment. Following these results, it is likely that market expectations for future quarters may increase, which ultimately, in the long-term perspective, could be an impetus for growth. After a strong opening, the share price initially stabilized (at the peak moment, the company recorded a +3.7% increase in share price), and now the supply side prevails, pushing down the share price.

FINANCIAL RESULTS FOR 1Q24:

- AUM: $10.47 trillion (+15% year-over-year)

- Average AUM: $10.18 trillion (+14% year-over-year)

- Revenue: $4.73 billion (+11% year-over-year)

- Operating profit: $1.69 billion (+18% year-over-year)

- Operating profit margin: 35.8% (+1.9 percentage points)

- Net profit: $1.57 billion (+36.8% year-over-year)

- Diluted earnings per share: $10.48 (+37% year-over-year)

Source: xStation 5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

شركة داتادوغ في أفضل حالاتها: ربع رابع قياسي وتوقعات قوية لعام 2026"

الولايات المتحدة: ارتفاع وول ستريت رغم ضعف مبيعات التجزئة

أرباح شركة كوكاكولا: هل سيصمد الرئيس التنفيذي الجديد أمام الضغوط؟