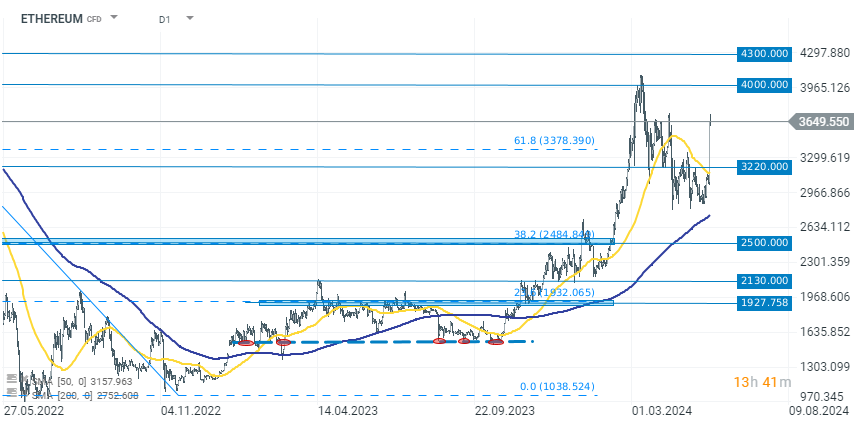

Ethereum has gained almost 20% since yesterday, briefly surpassing the $3700 level following news about the possible acceptance of a spot ETF by the SEC this week.

The price of the second-largest cryptocurrency rose from $3070 to $3700 within a few hours. At the time of publication, the price is consolidating between $3600 and $3700. Such a sharp increase was possible because the market had priced in very low chances of the SEC accepting spot ETFs on Ethereum. Recently, the SEC has not been cooperating at the best level according to those involved in the process. Just last week, the official stance was as follows:

“According to two people familiar with the matter, who asked not to be named to discuss private conversations, some fund companies expect rejection because their private dialogue with the SEC was not as robust as it was before the approval of spot-Bitcoin ETFs in January.”

However, everything changed yesterday with reports that the SEC requested updates to the 19b-4 applications on an accelerated basis. At the same time, Bloomberg analysts increased their expectations for the approval of these applications to 75% from 25%, citing the SEC's change in attitude and the growing political value ahead of the upcoming elections.

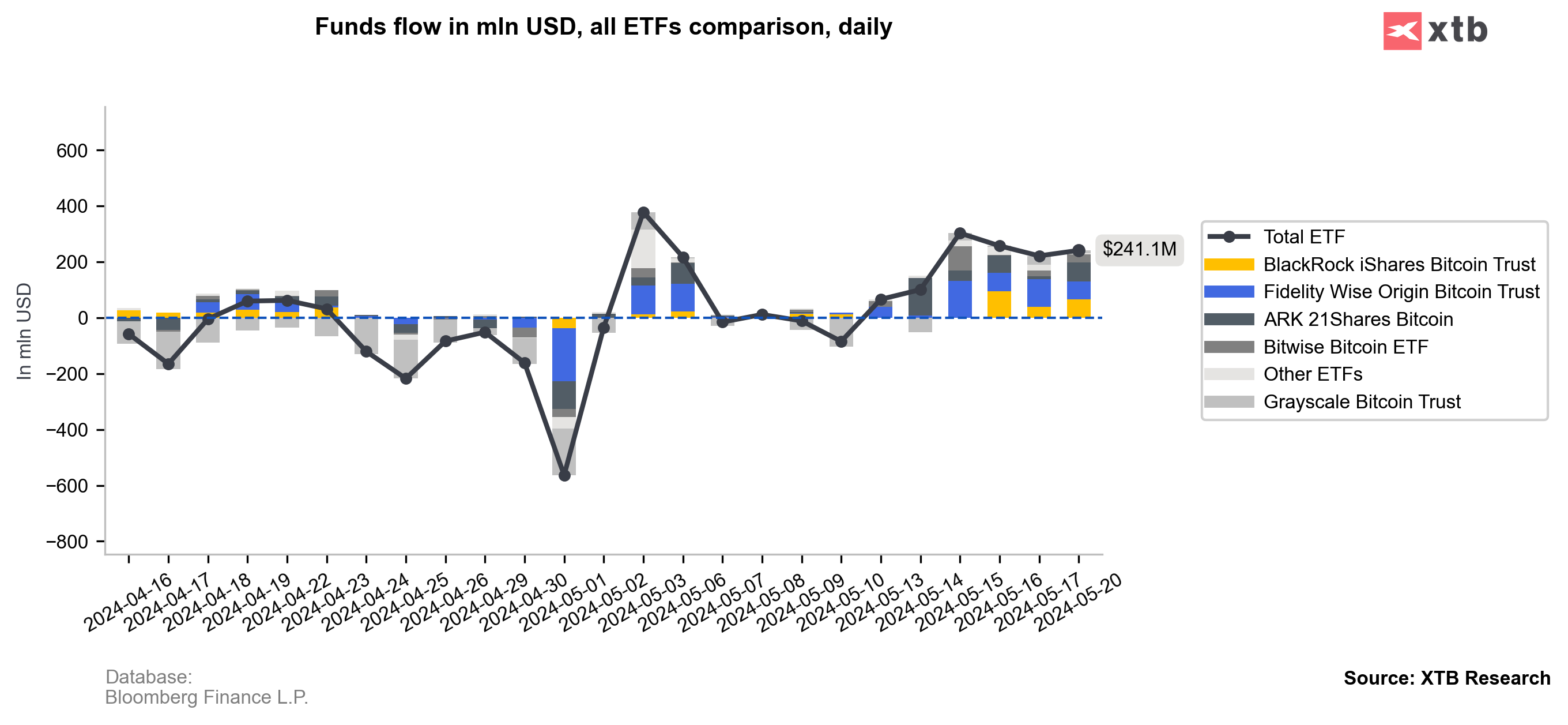

Another catalyst for improved sentiment in the cryptocurrency market are inflows into Bitcoin ETFs, which have been at record highs since the start of last week. Combined with slashed post-halving supply, this is certainly an important upside stimulus.

Ethereum (D1 interval)

As a result of these events, we observed a dynamic increase in Ethereum, which led the market's gains. However, the improving sentiment also supported smaller projects and Bitcoin, which returned above $70000 and $71000 respectively. The second half of this week could be extremely important for market sentiment in the coming weeks. Firstly, the final deadline for SEC approval of the applications by VanEck and ARK 21Shares is on May 23 and 24, respectively. Secondly, Nvidia, which currently sets trends in the AI and tech sectors, will publish its quarterly report on Wednesday. These will undoubtedly be two very strong impulses for movement in both directions.

Source: xStation 5

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

🚨 انخفاض سعر البيتكوين إلى 69,000 دولار 📉 هل هذا سيناريو تصحيح بنسبة 1:1؟

ملخص السوق: نوفو نورديسك تقفز بأكثر من 7% 🚀

أخبار العملات الرقمية: انخفاض سعر البيتكوين إلى ما دون 70 ألف دولار 📉 هل ستنخفض العملات الرقمية مرة أخرى؟