- European index finished session higher

- Disappointing macroeconomic data from the US

- Amazon (AMZN.US) to report earnings after session close

European indices extended yesterday's gains and finished Thursday's session higher amid upbeat quarterly results from top companies. Volkswagen posted record earnings in the first half of the year. Royal Dutch Shell’ recorded its highest quarterly profit since 2019. Airbus rose 0.6% as results revealed a €2.2 billion net profit during 1H 2021, thanks to the company’s ability to fend off order cancellations, which led the airplane maker to double its operating profits forecasts up to €4 billion for the current year.

The Dow Jones and the S&P 500 reached new all-time highs while the Nasdaq managed to stay in the green despite weak economic data. The US economy expanded 6.5% in the second quarter, below market expectations of 8.5% but consumer spending was strong while initial jobless claims fell less than anticipated to 400K. Investors also cheered the FED's reiteration of its dovish policy stance. Yesterday the US central bank kept its benchmark interest rate at a record-low level of near-zero and the pace of the quantitative easing program unchanged. On the earnings front, Comcast and Qualcomm posted strong quarterly figures while Paypal and Facebook warned of a significant growth slowdown. Amazon and T-Mobile will report their quarterly earnings today after the closing bell.

WTI crude rose more than 1.1% and is trading slightly above $73.20 a barrel, while Brent is trading 1.00% higher around $75.60 a barrel. Elsewhere gold rose 1.3% and is trading slightly above $ 1,830.00 / oz, while silver is trading 2.80 % higher, around $ 25.60 / oz as a dovish US Federal Reserve weighed on the greenback. The yield on the benchmark US 10-year Treasury note was around 1.26%, remaining close to low levels not seen since mid-February.

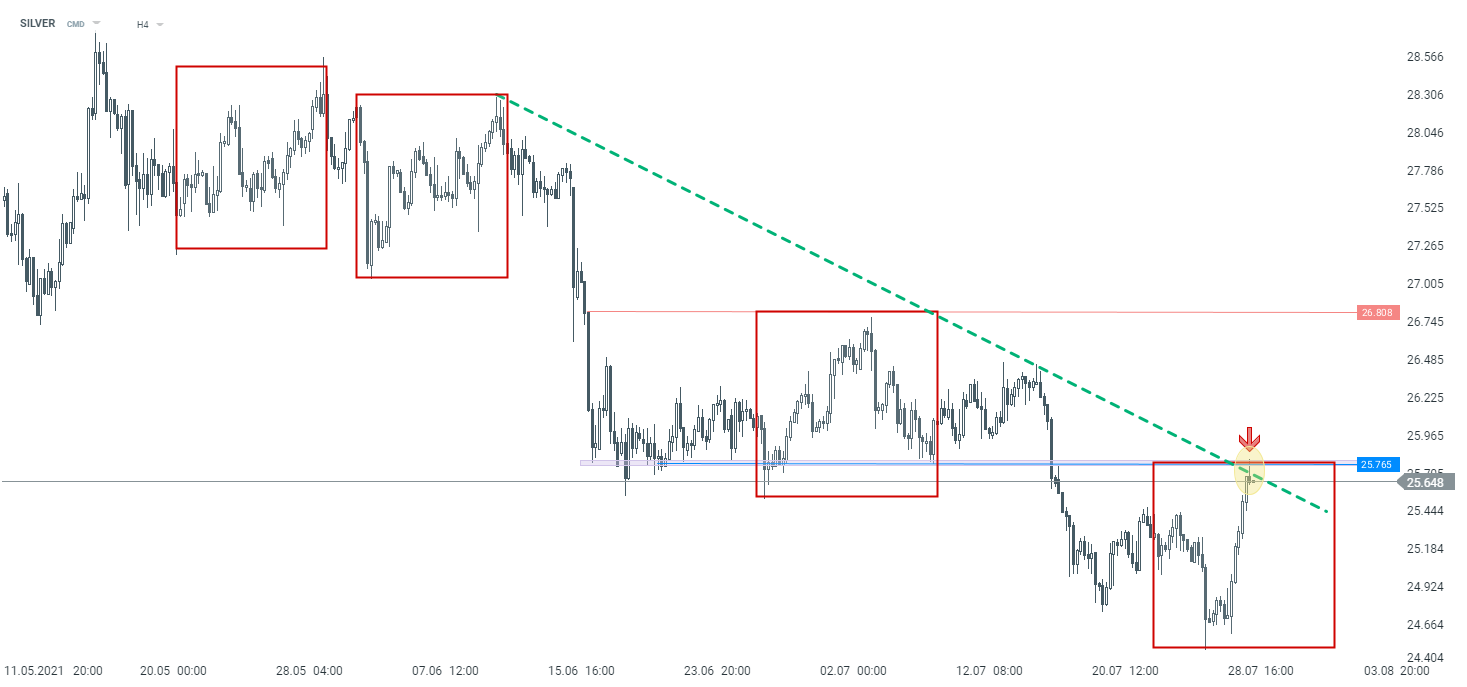

Silver price rose sharply during today's session and is approaching a downward trendline which coincides with the upper limit of the 1:1 structure. Should a break higher occur, then upward move may accelerate towards resistance at $26.80. Source: xStation5

Silver price rose sharply during today's session and is approaching a downward trendline which coincides with the upper limit of the 1:1 structure. Should a break higher occur, then upward move may accelerate towards resistance at $26.80. Source: xStation5

ارتفاع الفضة بنسبة 3% 📈 هل يعود الزخم الصعودي في المعادن الثمينة؟

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

الولايات المتحدة: ارتفاع وول ستريت رغم ضعف مبيعات التجزئة

عاجل: مبيعات التجزئة الأمريكية أقل من التوقعات