The CPI report surprised with slightly higher readings than expected. Core inflation rose for the second consecutive month by 0.4% m/m against expectations of 0.3% m/m. For inflation, above all, a further large contribution comes from the rental equivalent side. In overall inflation, fuel prices and transport prices are responsible for the increase. Does today's report change the outlook for interest rates in the US?

The report certainly does not indicate a need for an interest rate cut now. March is ruled out, while the May deadline is clearly moving away. For a May cut, we would need to see data showing a clear reduction in economic activity and very weak labour market data. It still seems that the base case scenario is for a cut in June.

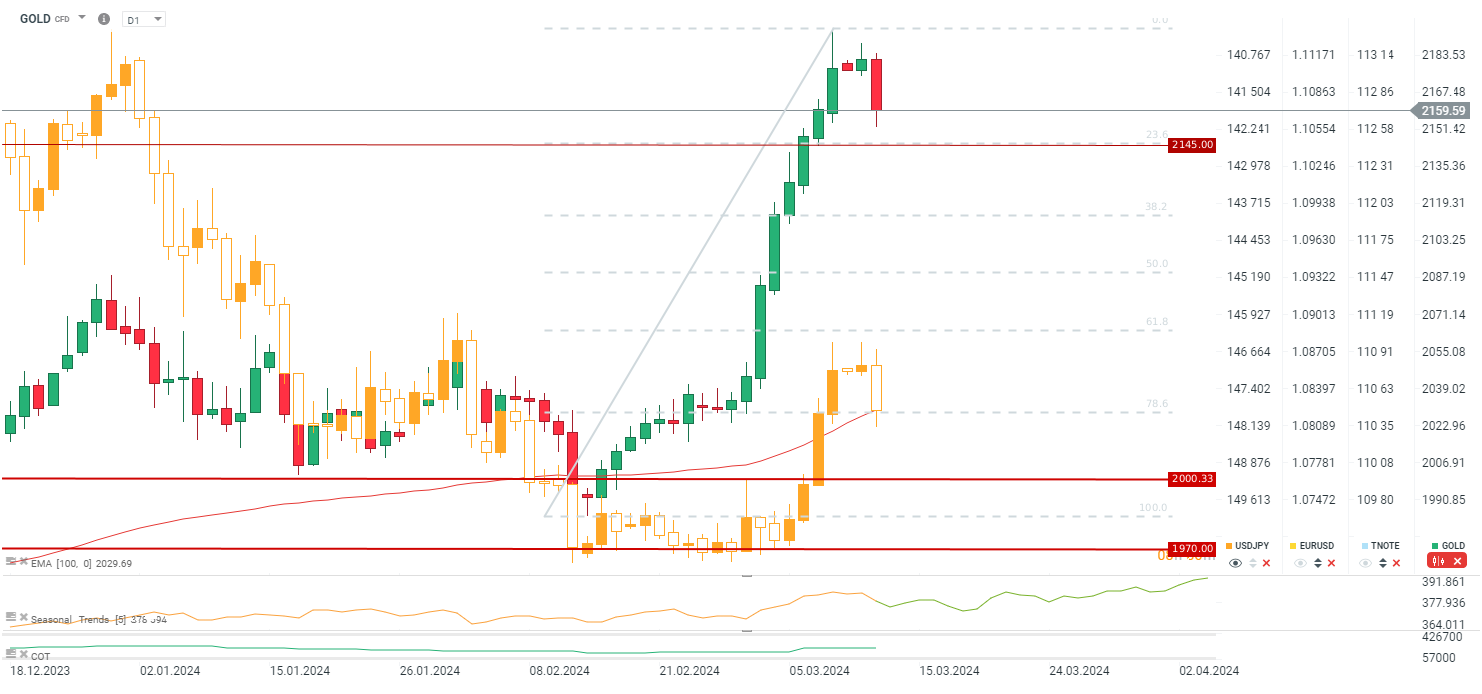

In response, we are seeing a rebound in yield and as trengthening of the dollar with the EURUSD falling around the 1.0900 level. Gold is also losing heavily, above 1% and testing the area of USD 2160 per ounce. The key short-term support is around the level of USD 2145 per ounce.

Source: xStation5

التقويم الاقتصادي - الأنظار كلها متجهة نحو تقرير الوظائف غير الزراعية (06.03.2026)

حصاد الأسواق - أسعار النفط لا تزال مرتفعة (06.03.2026)

الفضة وحرب الخليج: صعود أم هدوء؟

محضر اجتماع البنك المركزي الأوروبي: لم يبلغ تأثير قوة اليورو على التضخم ذروته بعد