Federal Reserve Governor, Michelle W. Bowman

In her comments today following the labor market report, Bowman suggested that the Fed's monetary policy must remain restrictive to regain control over inflation. The banker noted that progress in combating inflation is slowing, or even at a standstill. If inflation turns out to be more "sticky" than initial forecasts indicated, and even returns to an upward trend, another interest rate hike is not ruled out.

Bowman has been known for her hawkish approach since she joined the Board in 2018. Her comments today confirm her hawkish stance. However, it's worth noting that she is not the only Fed banker maintaining a hawkish position. Next week, we will learn about inflation data in the USA, which are crucial at this moment. Data higher than expected will confirm the Fed's concerns and are likely to push back expectations for the first interest rate cuts. On the other hand, lower readings will allow the markets to breathe a bit and calm the Fed bankers.

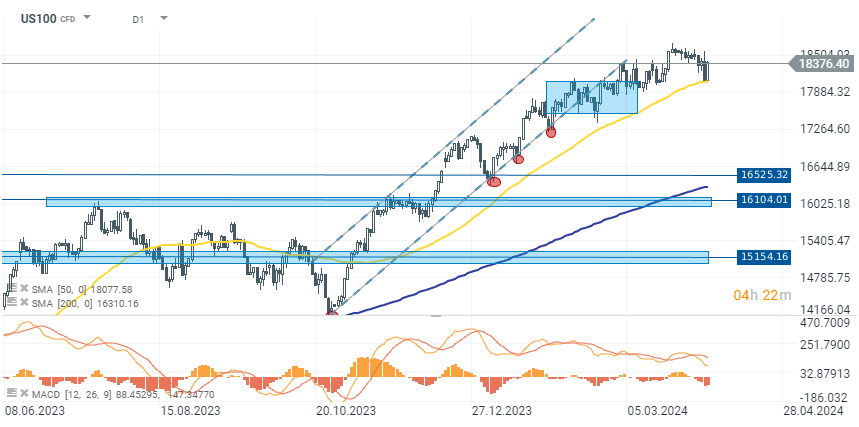

US100

Although the start of the day seemed bearish, the end of the session turned out to be under the control of bulls. After the NFP report was published, we observed the erasing of increases in indices and a very strong rise in the USDIDX dollar. However, a few hours after publication, the dollar erased virtually all of its gains, and the indices returned to their upward trends. The euphoria in the market is still noticeable, and investors seem to not be pricing in the risk of keeping higher interest rates for an extended period. After all, so far the U.S. economy has been going through a tightening period almost unscathed. This argument allowed bulls to recover yesterday's drop on US100. The index gained nearly 1.80% today, reaching 18,380 points. The falls were halted at the 200-session SMA level.

Source: xStation 5

ملخص اليوم: انخفاض حاد في الفضة بنسبة 9% 🚨المؤشرات والعملات الرقمية والمعادن الثمينة تحت ضغط

الذهب يتأرجح بين قوة الدولار وطبول الحرب

356 مليون درهم أرباح «تاكسي دبي» في العام 2025 بنمو 7%

مطار دبي الدولي يستقبل 95.2 مليون مسافر خلال 2025 ويتوقع 99.5 مليون في 2026