3M reported a robust second quarter, with adjusted earnings per diluted share rising to $1.93 from $1.39 the previous year, exceeding analysts' expectations of $1.68 per share. Despite a slight decline in net sales to $6.26 billion from $6.28 billion year-over-year, the figures still surpassed the expected $5.83 billion. The share price reflected this positive performance, surging nearly 20% as a result of the earnings beat.

The company revised its full-year earnings forecast upwards, setting the new range between $7.00 to $7.30 per share, tightening the lower end from the previous $6.80. This update came alongside a reaffirmation of the sales forecast, which anticipates a minor decline of 0.25% to a potential increase of 1.75%. This adjustment in guidance underscores a conservative yet optimistic outlook under the leadership of new CEO Bill Brown, who aims to under-promise and over-deliver

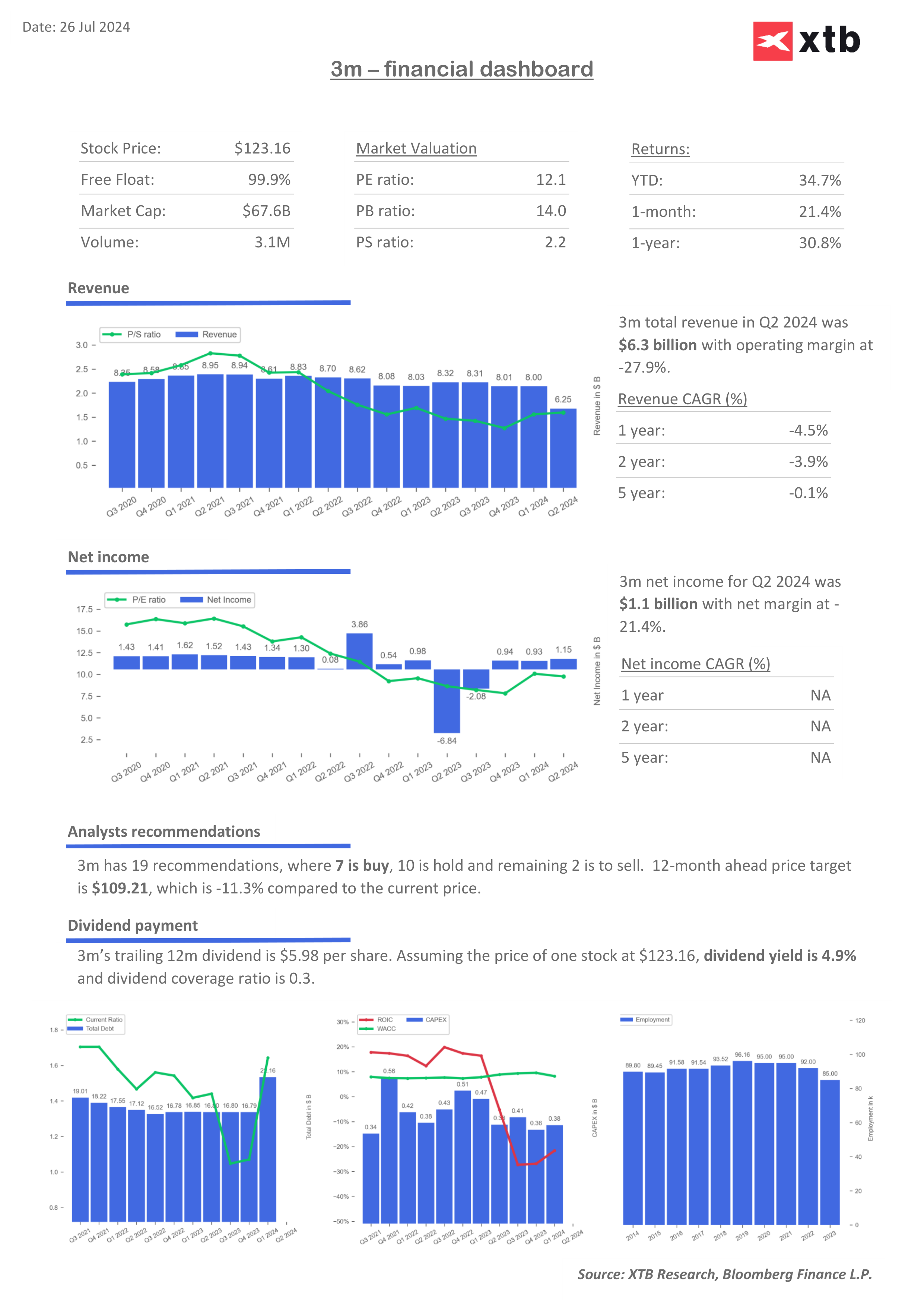

- Adjusted Earnings Per Share (EPS): Increased to $1.93 in Q2, up from $1.39 in the same quarter last year, surpassing analyst expectations of $1.68.

- Net Sales: Slightly decreased to $6.26 billion from $6.28 billion year-over-year but still exceeded the forecasted $5.83 billion.

- Full-Year Earnings Guidance: Adjusted upwards to $7.00-$7.30 per share from a previous range of $6.80-$7.30.

- Sales Forecast: Maintained at a slight decline of 0.25% to a potential increase of 1.75%.

- Stock Performance: Shares rose nearly 20% following the earnings announcement.

- Adjusted Free Cash Flow: Reported at $1.2 billion for the quarter.

- Operating Cash Flow: Reached $1 billion, although below the estimated $1.76 billion.

- Net Income: Swung to $1.15 billion, or $2.07 per share, from a significant loss in the year-ago quarter.

Bill Brown's time as CEO has started off strongly, with a focus on growing revenue steadily, enhancing company operations, and wisely using capital. His approach is shown through careful price control and strategic changes to meet market needs. Under Brown's leadership, 3M is entering a crucial period aimed at improving efficiency and introducing innovative strategies to handle economic uncertainties.

Bill Brown's time as CEO has started off strongly, with a focus on growing revenue steadily, enhancing company operations, and wisely using capital. His approach is shown through careful price control and strategic changes to meet market needs. Under Brown's leadership, 3M is entering a crucial period aimed at improving efficiency and introducing innovative strategies to handle economic uncertainties.

3M (D1 interval)

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท