Abbvie (ABBV.US) is down nearly 4.0% after publishing its first quarter 2024 results. Investor reaction to the release reflects a mixed report. The declines can primarily be attributed to disappointing forecasts for sales of the company's flagship drug, Humira. However, several aspects of the report may attract positive attention. The company recorded a significant increase in GAAP diluted earnings per share, which rose by 492.3% to $0.77, mainly due to one-time items. Meanwhile, adjusted diluted EPS fell by 6.1% year-over-year to $2.31, although it still exceeded market estimates.

- Adjusted diluted EPS: $2.31, representing a 6.1% year-over-year decline but surpassing analyst estimates of $2.23.

- GAAP EPS: $0.77, a significant increase of 492.3% compared to the previous year.

- Net revenues: $12.310 billion, an increase of 0.7% on a reported basis and 1.6% on an operational basis, exceeding the forecasted $11.922 billion.

- Immunology Portfolio Revenues: $5.371 billion, a 3.9% decrease year-over-year, mainly due to a sharp 35.9% drop in global Humira revenues caused by biosimilar competition.

- Oncology Portfolio Revenues: $1.543 billion, a 9.0% increase on a reported basis, supported by a 14.2% increase in global Venclexta revenues, indicating strong product performance.

- Neuroscience Portfolio Revenues: $1.965 billion, up 15.9% on a reported basis, driven by significant sales growth in Vraylar and Qulipta.

- 2024 Full-Year Guidance: Adjusted diluted EPS forecast raised from a range of $10.97 - $11.17 to $11.13 - $11.33.

- Key Operational Data: Adjusted operating margin was 42.2%, while the GAAP operating margin was 22.7%.

Revenue streams of the company did not show a clear trend: neuroscience and oncology portfolios provided solid growth rates of 15.9% and 9.0%, respectively, driven by strong sales of products like Vraylar and Venclexta. However, the immunology sector, typically a strong performer due to Humira, experienced a 3.9% decline due to increased biosimilar competition. For the full year 2024, AbbVie has raised its adjusted diluted EPS forecast, reflecting confidence in operational execution and market strategy.

- Almost former CEO, Richard A. Gonzalez, the outgoing general manager, emphasized the company's excellent operational condition and good quarterly results.

- Next CEO, Robert A. Michael, president and chief operating officer, who will take over as general manager in July 2024, expressed his honor at assuming this role and noted the excellent results excluding Humira.

Although the results were positively surprising in some business segments of the company, investor attention focused on the projected decline in sales volume of the blockbuster arthritis drug Humira. The drug has been one of the best-selling drugs in the world until now. AbbVie shares are losing over 4.00%. The company also reported that the revenue decline from this will amount to about 32% in the second quarter.

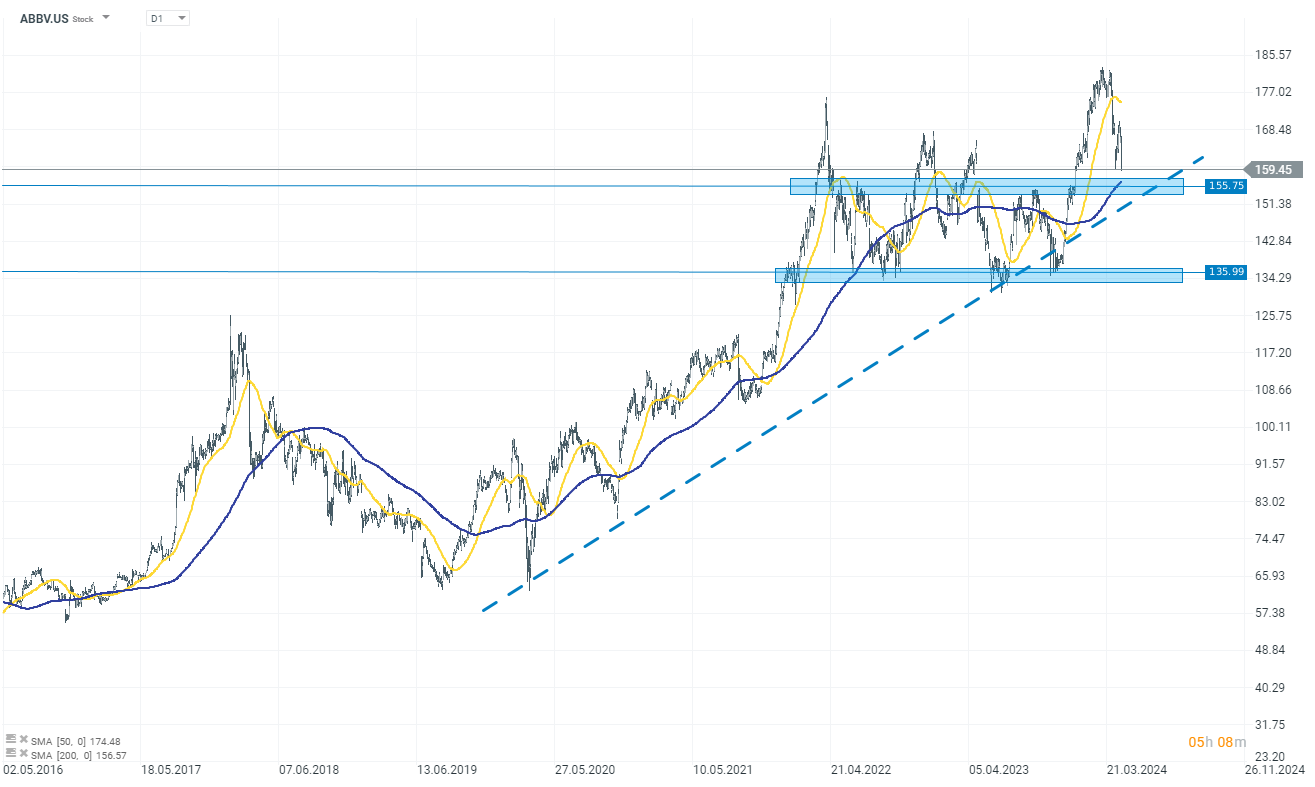

Source: xStation 5

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท