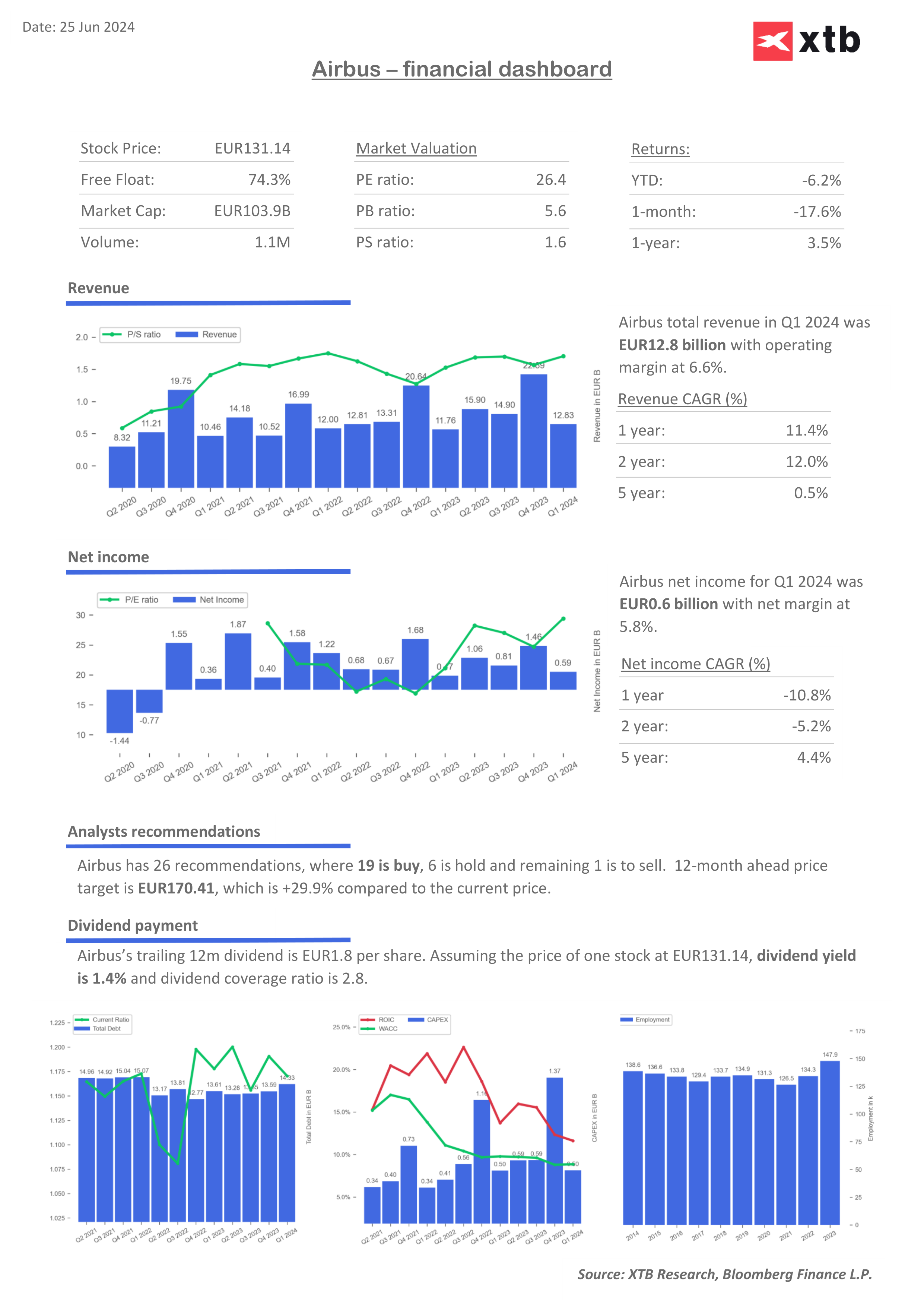

Shares in Europe's largest aerospace-industrial conglomerate Airbus (AIR.FR) are trading down 12% today, as the company lowered its financial forecast for the full year 2024. It now expects lower pre-tax profits and fewer aircraft to add to its fleet this year. The company also indicated that the decision to lower expectations was influenced by higher costs in the space operations segment and problems in supply chains (particularly in the engine and cabin equipment sectors).

- The company expects EBIT to be around €5.5 billion this year, compared to the €6.5 to €7 billion estimated on April 25. Aircraft deliveries are expected to reach 770 models this year, against 800 expected; at the same time, Airbus has postponed the return of A320 production.

- Airbus relayed that costs for its space systems unit rose to €900 million in the first half of the year, as a result of higher service and labor costs. Airbus has already surprised the market once this year with a weaker-than-forecast report, and investors expect the problems with satisfactory profitability to continue. Half-year results will be released on July 30, 2024.

Airbus shares (AIR.FR)

Airbus shares are experiencing one of the biggest sell-offs in their history and are trading 10% below the 200-day simple moving average (SMA200, red line). The relative strength index (RSI) is trading at 20 points, signalling a deep oversold condition. Significant support can be found around EUR120 per share.

Source: xStation5

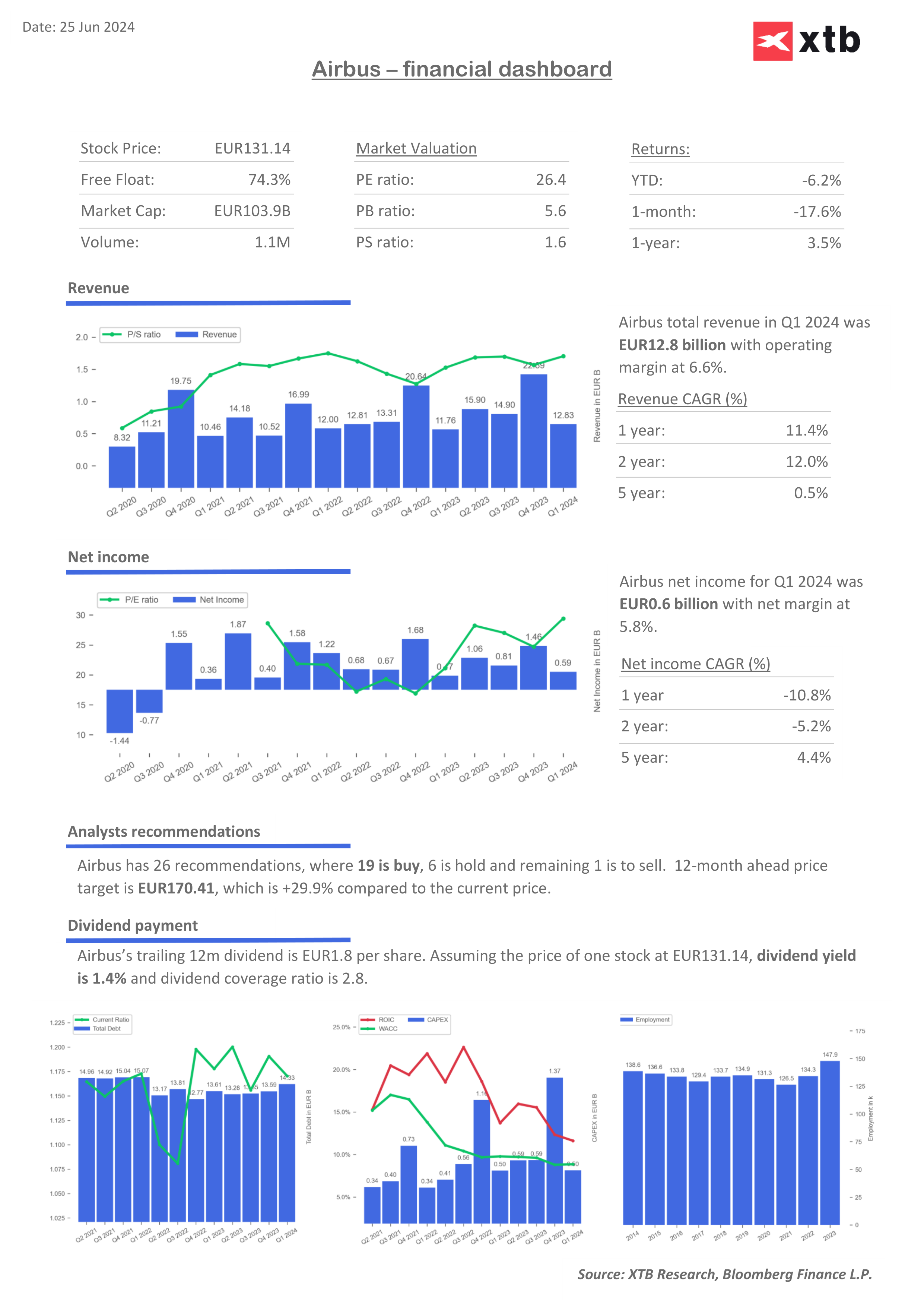

Airbus valuation forecasts and multipliers

As a result of lower earnings, the price-to-earnings ratio for Airbus shares is rising, while ROIC or ROE ratios are falling, suggesting challenges in the business. Higher costs could eventually cause the WACC ratio to rise above ROIC, reducing economic value added (EVA).

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Arista Networks ปิดปี 2025 ด้วยผลประกอบการระดับสูงสุดเป็นประวัติการณ์!

ข่าวเด่นวันนี้

การขายทำกำไรในปัจจุบันหมายถึงจุดจบของบริษัทควอนตัมหรือไม่?

Howmet Aerospace พุ่ง 10% หลังประกาศผลกำไร ทำมูลค่าบริษัททะลุ 100 พันล้านดอลลาร์ 📈