Bitcoin has returned to dynamic growth and is increasing its dominance in the cryptocurrency market capitalization, which is already over 42%. The king of cryptocurrencies managed to overcome significant resistance despite last week's weakness, which was fueled by news of the determination of US regulators and the investigation into stablecoin and cryptocurrency exchanges. Even falling slower-than-expected U.S. inflation and hawkish statements by Fed members did not deter crypto bulls. Bitcoin today costs $24,500 and faces resistance near $25,000.

- Significant increases are also recorded by altcoins, but traditionally these are somewhat muted because the largest capital flows into BTC, which has caught momentum. Typically, smaller cryptocurrencies only see the largest capital inflows when Bitcoin begins to consolidate after a wave of increases, at which point many investors move from BTC to other projects, on a risky wave of 'profit maximization';

Ordinals drive Bitcoin

- Recently, the BTC network has been experiencing a 'renaissance' of thanks to the huge amount of data migrating to the Bitcoin blockchain so-called 'Ordinals'. We're talking about the issuance of NFT tokens directly on the Bitcoin network but also a massive amount of videos, photos or even games (such as the iconic Doom). The popularity of Ordinals has already resulted in a surge in fees and renewed interest in NFT as very well-known projects like Bored Ape move to BTC. Potentially, the development of new technologies on the Bitcoin network could threaten smaller projects and support demand for the largest cryptocurrency.

By Ordinals activity, the average transaction size on the network has increased by 138%

Source:Glassnode

After the implementation of Ordinals dynamically grow the number of BTC addresses with a non-zero balance. It reached ATH and is more than 44 mln, confirming the interest in the new functionality of the network. If the momentum is maintained, this could translate into an increase in the price of BTC.

Source: Glassnode

Source: Glassnode

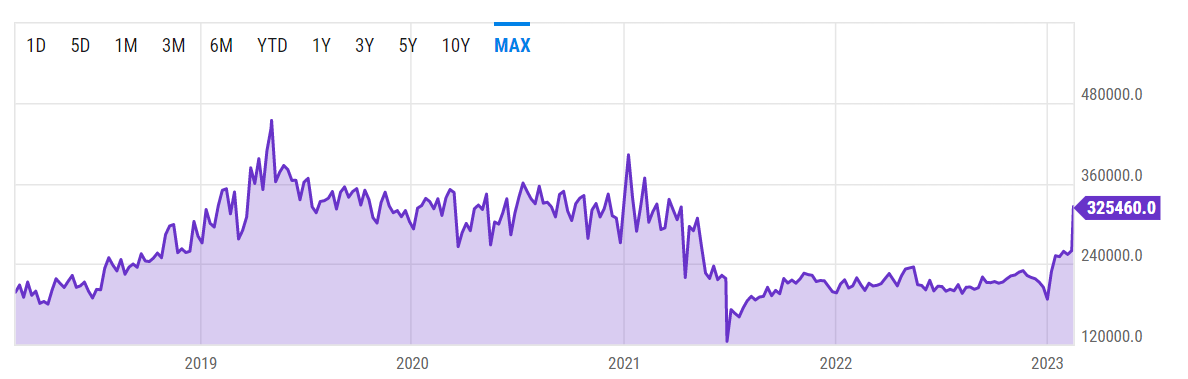

The daily average transaction volume of the BTC network increased by nearly 20% y/y. Bitcoin is seeing unprecedented growth in average transaction volume in 2023.

Source: Ycharts

Source: Ycharts

Bitcoin, D1 interval. The major cryptocurrency managed to rise again above the 71.6 Fibonacci resistance of the upward wave started in March 2020 and is now measuring itself against the psychological resistance level near $25,000. It is worth noting the bullish intersection of the SMA50 (yellow line) above the SMA200 (red line). We saw a similar intersection in May 2020 and September 2021. Source: xStation5

Bitcoin, D1 interval. The major cryptocurrency managed to rise again above the 71.6 Fibonacci resistance of the upward wave started in March 2020 and is now measuring itself against the psychological resistance level near $25,000. It is worth noting the bullish intersection of the SMA50 (yellow line) above the SMA200 (red line). We saw a similar intersection in May 2020 and September 2021. Source: xStation5

เศรษฐกิจอังกฤษชะงักงัน ภาษีการค้ากดดันหุ้นยักษ์ใหญ่ ขณะที่คริปโตเริ่มทรงตัว

สรุปข่าวเช้า

ข่าวเด่นวันนี้

🚨 Bitcoin หลุด $69K 📉 อาจเข้าสู่การแก้ไข 1:1