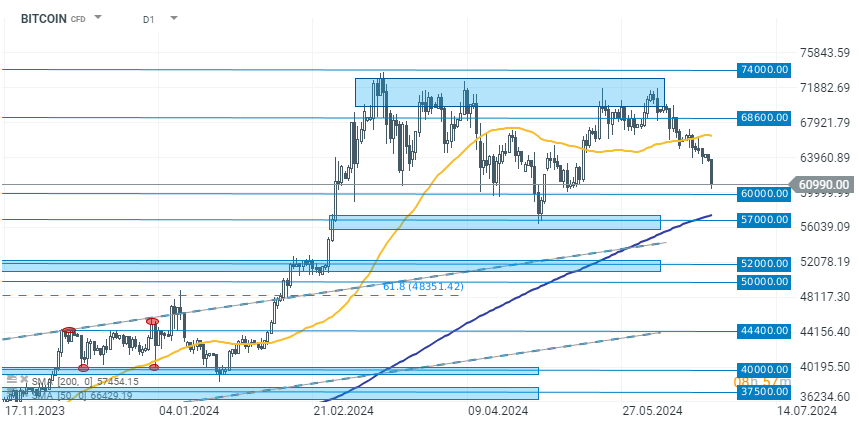

Selling pressure on Bitcoin has intensified following the public announcement from Mt. Gox, revealing plans to start distributing assets stolen in a 2014 hack starting July 2024. Currently, Bitcoin has dipped by 3.20% to $61,000. This distribution by Mt. Gox, which once handled over 70% of all Bitcoin transactions, involves substantial amounts of Bitcoin and Bitcoin Cash, potentially impacting market dynamics due to expected sales from early investors who might capitalize on the current higher market values.

Mt. Gox's trustee, Nobuaki Kobayashi, announced that the repayment plan, which has been delayed multiple times, is set to commence in the first week of July 2024, aiming to address claims from approximately 127,000 creditors affected by the hack. The exchange had moved 141,686 BTC (valued at approximately $9.62 billion) to new wallets in May as part of the preparation for these repayments. Despite this, the full impact of the repayments on the market remains uncertain, especially with concerns over potential downward pressure on Bitcoin prices as recipients may sell their recovered assets.

ข่าวคริปโต: บิทคอยน์ร่วงต่ำกว่า 90,000 ดอลลาร์อีกครั้ง 🚩 สกุลเงินดิจิทัลเผชิญแรงกดดัน

สรุปข่าวเช้า

ข่าวคริปโต: Bitcoin ฟื้นตัวเหนือ 90,000 ดอลลาร์ ท่ามกลางความเชื่อมั่นใน Wall Street 📈

Bitcoin ร่วง 3% 📉 เกิดสัญญาณทางเทคนิค “Bearish Flag” หรือไม่?