01:30 PM BST, Canada - Employment Data for Jun:

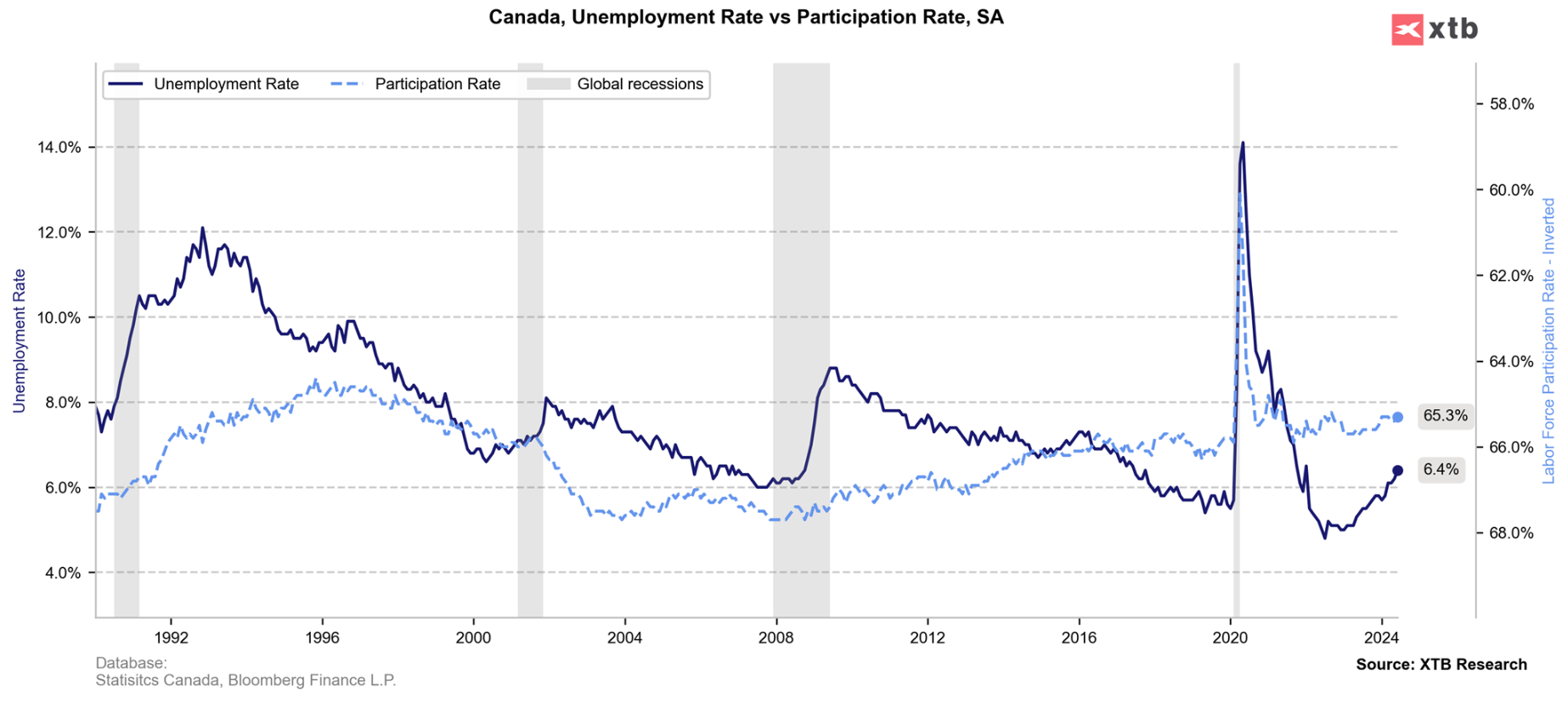

- Participation Rate: actual 65.3%; previous 65.4%;

- Full Employment Change: actual -3.4K; previous -35.6K;

- Employment Change: actual -1.4K; forecast 27.3K; previous 26.7K;

- Avg hourly wages Permanent employee: actual 5.6%; previous 5.2%;

- Unemployment Rate: actual 6.4%; forecast 6.3%; previous 6.2%;

- Part Time Employment Change: actual 1.9K; previous 62.4K;

Employment was nearly unchanged in June with a slight decrease of 1,400 jobs and the employment rate dropping by 0.2 percentage points to 61.1%. The unemployment rate rose by 0.2 percentage points to 6.4%, continuing its upward trend since April 2023. Specific sectors such as transportation and warehousing, and public administration saw declines in employment, while accommodation and food services, and agriculture experienced growth. Regionally, employment fell in Quebec but rose in New Brunswick and Newfoundland and Labrador. Despite a 5.4% year-over-year increase in average hourly wages, total hours worked decreased by 0.4% in June. The employment rate for returning students hit its lowest point since June 1998, reflecting difficulties in the labor market for youth and core-aged men.

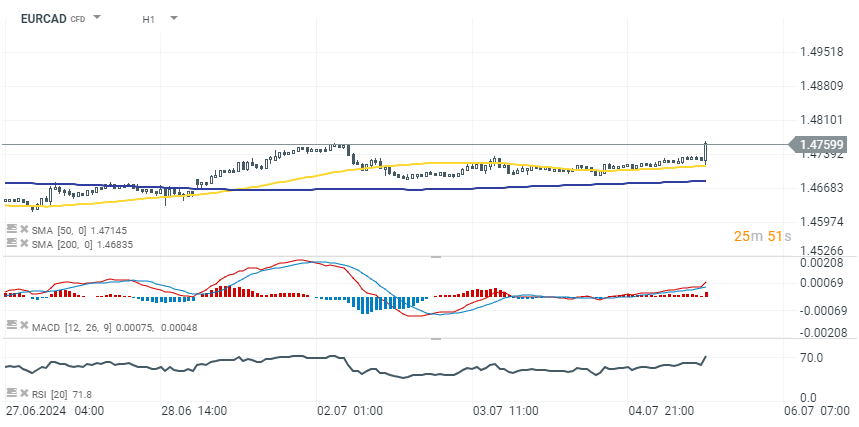

Canadian dollar weakens after data release. The labour market is weakening, as in the US, and the pace seems to be accelerating month on month. The data are not the best, raising investor concerns about the economy.

BREAKING: ตัวเลข PMI ของยุโรปอ่อนตัวกว่าที่คาดเล็กน้อย; สเปนเด่นในเชิงบวก 🔎

ปฏิทินเศรษฐกิจ: ข้อมูล PMI เป็นรายงานสำคัญของวันนี้ 📌

สรุปข่าวเช้า

สรุปข่าวเช้า