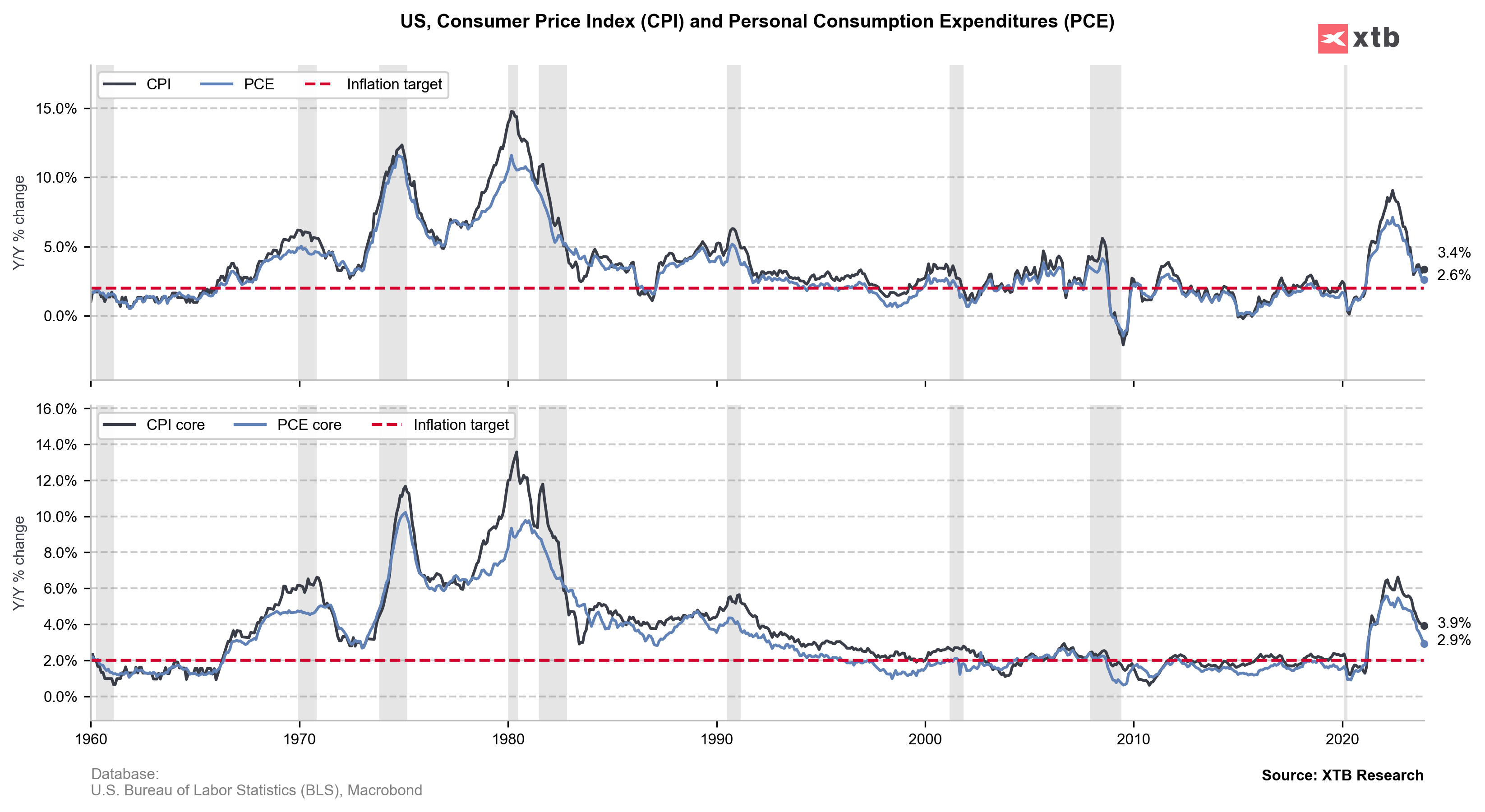

US PCE Price Index, for December YoY: 2.6% Forecast 2.6%, Previous 2.6%

- PCE MoM: 0.2% Forecast 0.2% Previous 0.1%

- PCE services price index ex-energy/housing MoM: 0.3%

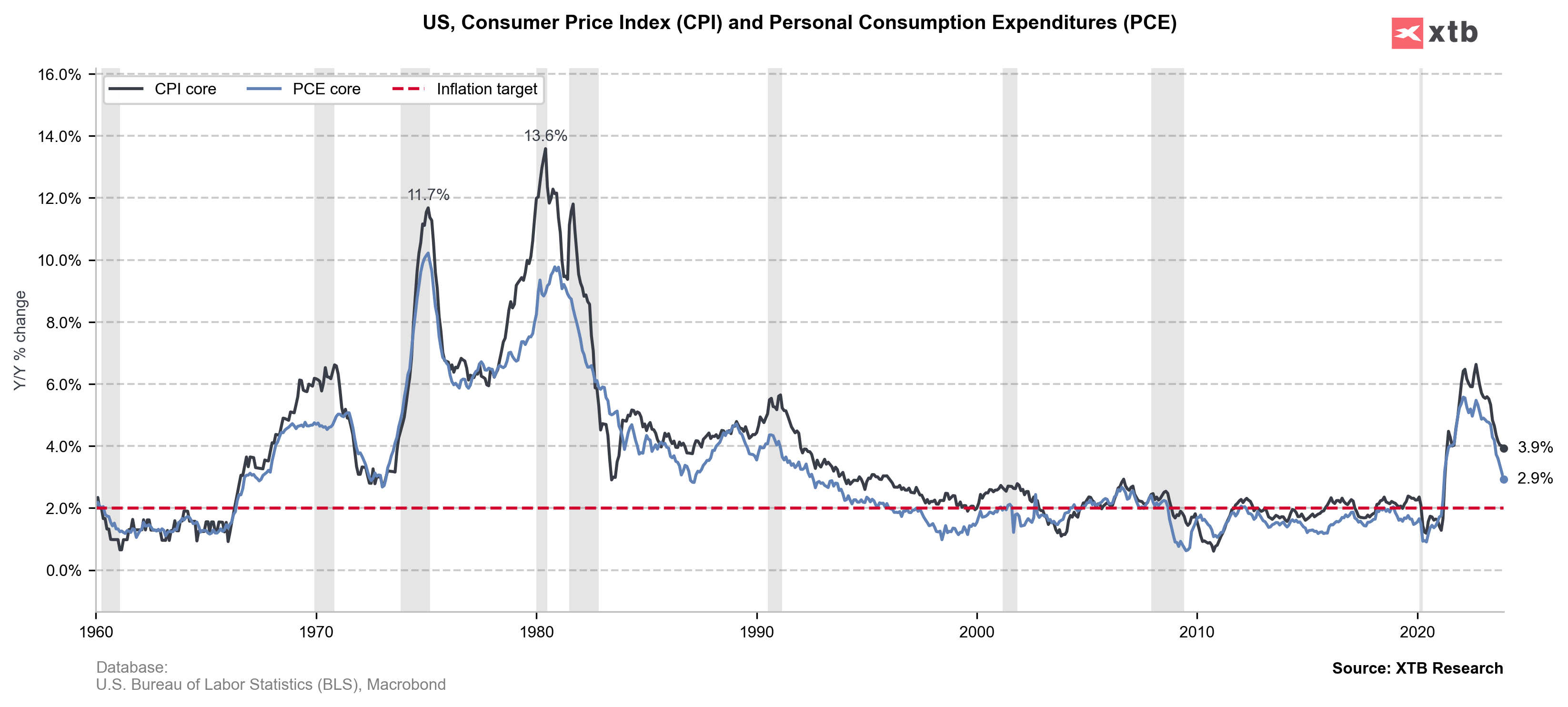

Core PCE Price Index YoY: 2.9% Forecast 3%, Previous 3.2%

US Consumer Spending MoM: 0.7% Forecast 0.5%, Previous 0.2%

- US Real Personal Consumption MoM: 0.5% Forecast 0.3%, Previous 0.3%

- US Personal Income MoM: 0.3% Forecast 0.3%, Previous 0.4%

After the reading, Wall Street still see probability of a first Fed rate cut in March at a little less than 50%. Rate-futures traders continue to see the strongest chance of the first Fed rate cut in May, then March. US short-term interest-rate futures fall after the reading. It's another reading which signals theoretically higher odds on 'soft landing scenario', we can see higher than expected data of spending and consumption with personal income in line and lower than expected core PCE, below 3% level. US December PCE services price index ex-energy/housing came in 0.3% MoM.

Source: xStation5

Source: xStation5

Source: XTB Research, BLS, Macrobond

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์