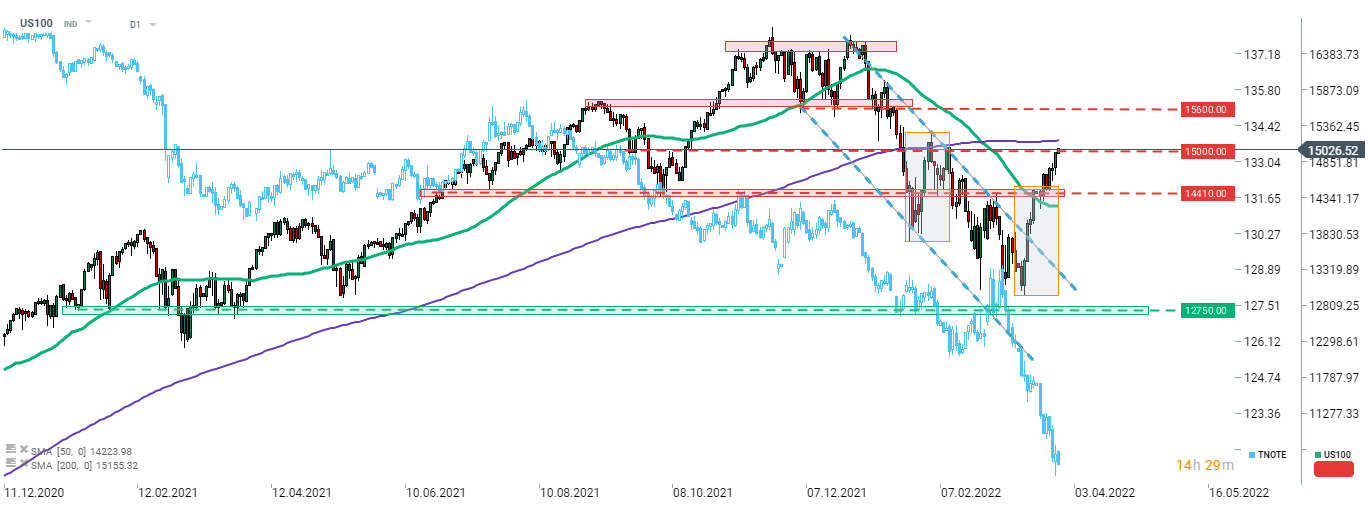

Futures on the US Nasdaq-100 index (US100) reached 15,000 pts this morning. This is the highest level since February 9, 2022 and has more than recovered all of the losses made since the beginning of the Russian invasion of Ukraine. Markets are increasingly looking past the Russia-Ukraine war after an initial period of turmoil. However, it looks like equity markets are also looking past the situation on the bond market. US100 and other tech indices have been quite reactive to changes in bond yields in the past with rising yields (falling bond prices) putting pressure on stocks. As one can see on the chart below, this correlation of US100 and TNOTE (10-year US bond price) have broken down two weeks ago, ahead of the FOMC meeting. Resulting discrepancy is quite large but it is unknown which market will adjust to which, or whether they will adjust at all. Nevertheless, continued increase in borrowing costs is likely to trigger some repricing on the stock markets sooner or later. In case bulls manage to sustain the break above 15,000 pts handle, the 200-session moving average in the 15,150 pts area (purple line) and 15,600 pts swing area will be the levels to watch.

Source: xStation5

Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ