USDCAD is one of the pairs that may see some moves today in the afternoon. Canadian CPI data for March will be released at 1:30 pm BST and is expected to show a small acceleration in headline price growth, from 2.8 to 2.9% YoY. Simultaneously, US housing market data for March, including housing starts and building permits, will be released. Apart from that, Fed Chair Powell and Bank of Canada Governor Macklem will take part in a moderated discussion on economic trends in North America at 6:15 pm BST, so additional USDCAD volatility may be also present then.

1:30 pm BST - Canada, CPI inflation for March. Expected: 2.9% YoY. Previous: 2.8% YoY

1:30 pm BST - US, housing market data for March.

- Housing starts. Expected: 1485k. Previous: 1521k

- Building permits. Expected: 1515k. Previous: 1524k

2:15 pm BST - US, industrial production for March. Expected: 0.4% MoM. Previous: 0.1% MoM

- Capacity utilization. Expected: 78.4%. Previous: 78.3%

6:15 pm BST - Moderated discussion with Fed Chair Powell and BoC Governor Macklem

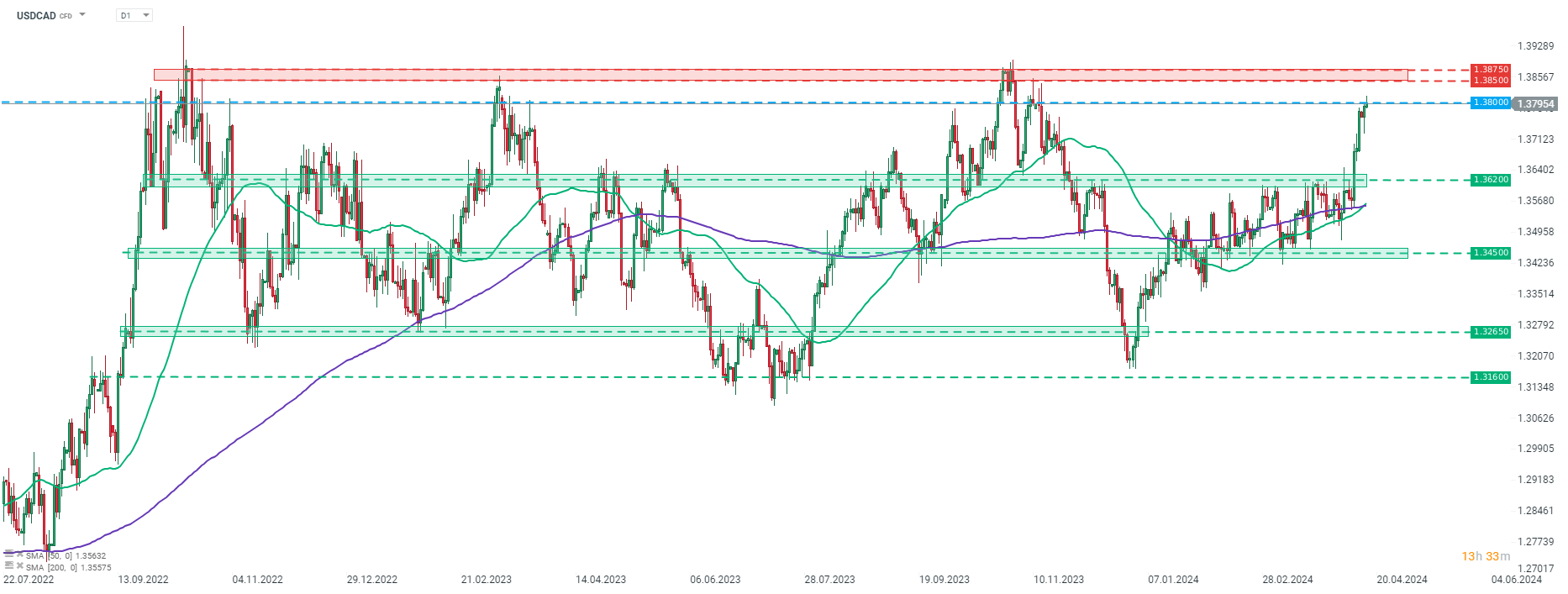

Taking a look at USDCAD chart at D1 interval, we can see that the pair has been trading in a sideways since Q4 2022. The pair has recently caught a bid and broke above 1.3620 price zone. Gains accelerated on the back of recent USD strength and the pair is now testing 1.3800 area. A key near-term resistance zone can be found in the 1.3850-1.3875 area, where the upper limit of medium-term trading range can be found.

Source: xStation5

Source: xStation5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

พรรคของ Takaichi ชนะเลือกตั้งในญี่ปุ่น – ความกังวลหนี้กลับมาอีกครั้ง? 💰✂️