- Despite weakness in tech giants Apple and Tesla, cryptocurrencies do not react with declines

- Bitcoin and Ethereum's correlation with the NASDAQ index still holds up

Better sentiment on the world's stock exchanges is helping the cryptocurrency market somewhat. Almost all major projects are trading up today. Ethereum is trading near $1,250, Bitcoin is struggling to surpass $16,900. Among altcoins, Cardano, Filecoin, Waves are the best performers. The uptick among Sandbox and Decentraland Metaverse-related cryptocurrencies followed news of Meta Platforms' acquisition of a company that 3D prints lenses for use in so-called smart glasses and AR/VR technology:

The most active cryptocurrencies today. Source: xStation5

The 'Fear and Greed' chart shows the market's persistent 'fear', stemming primarily from uncertainty about the cryptocurrency sector's events in the new year. Source: alternative.me

The 'Fear and Greed' chart shows the market's persistent 'fear', stemming primarily from uncertainty about the cryptocurrency sector's events in the new year. Source: alternative.me

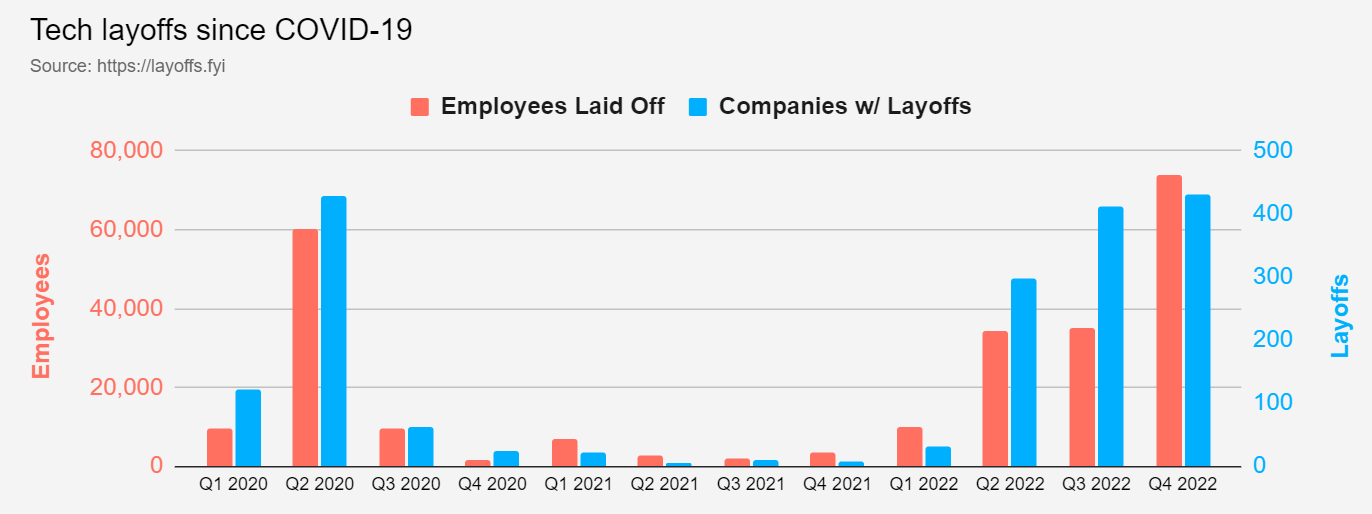

According to Reuters reports, employees laid off from tech giants are opening new startups en masse, mainly in AI and gaming. Although venture capital funding in 2022 fell 33% year-on-year amid a change in monetary policy and higher funding costs, the number of new VC funds, for startups, is still at record levels and has not fallen below 2021 levels. Some industry analysts have already begun to speculate about the potential migration of laid-off tech workers to the blockchain sector and fueling the so-called Web 3.0 revolution. source: layoffs.fyi

According to Reuters reports, employees laid off from tech giants are opening new startups en masse, mainly in AI and gaming. Although venture capital funding in 2022 fell 33% year-on-year amid a change in monetary policy and higher funding costs, the number of new VC funds, for startups, is still at record levels and has not fallen below 2021 levels. Some industry analysts have already begun to speculate about the potential migration of laid-off tech workers to the blockchain sector and fueling the so-called Web 3.0 revolution. source: layoffs.fyi

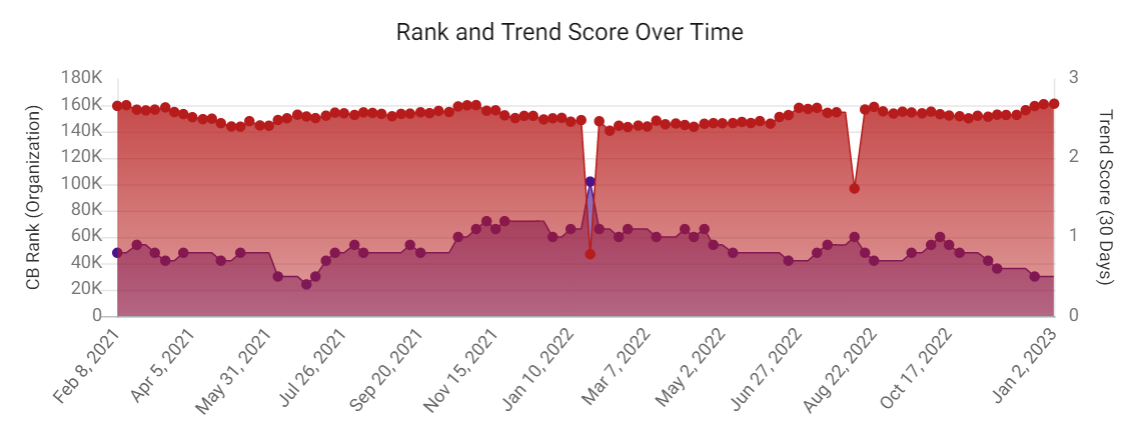

Although interest in blockchain startups still exists we see that the trend in this market in 2022 remains clearly downward. Source: crunchbase.com

Although interest in blockchain startups still exists we see that the trend in this market in 2022 remains clearly downward. Source: crunchbase.com

News

- Cryptopotato reports that Binance is finalizing the acquisition of a 41.2% stake in South Korea's Gopax exchange, one of the most popular in the region;

- Meta Platforms has acquired Luxexcel, a company that manufactures lenses used in augmented reality glasses. This is another step by the giant into the Metaverse;

- The Federal Reserve, FDIC and the Office of the Comptroller of the Currency (OCC) issued a joint statement Tuesday warning of the "significant" risks that cryptocurrency assets could pose to the broader banking system;

- Bankman-Fried himself faces up to 115 years in prison for his alleged role in one of the largest cryptocurrency scandals in history to date. The former billionaire pleads not guilty.

U.S. institutions have again warned against cryptocurrencies, and this time the statement was directed primarily at banks. The Federal Reserve, FDIC and Office of the Comptroller of the Currency (OCC) on Tuesday, in a joint statement, warned of the "significant" risks that cryptocurrency assets could pose to the broader banking system. The regulators warned banks pointing to fraud, volatility, poor risk management and contagion in the cryptocurrency sector. They also pointed to legal uncertainty when it comes to redemptions, ownership rights and cryptocurrency asset management practices. A chart of Bitcoin (red-green), Ethereum (blue-white) and US100 (yellow-white), on the M15 interval. We can see that cryptocurrencies, despite relatively low volatility and declining liquidity, are following the US index, known for its large share of technology companies. Source: xStation5

A chart of Bitcoin (red-green), Ethereum (blue-white) and US100 (yellow-white), on the M15 interval. We can see that cryptocurrencies, despite relatively low volatility and declining liquidity, are following the US index, known for its large share of technology companies. Source: xStation5

ข่าวคริปโต & โลหะมีค่า: เงินร่วงแรง ขณะที่ Bitcoin ฟื้นตัว 📈

ข่าวเด่นวันนี้

ตลาดเด่น: Bitcoin

ข่าวคริปโต: บิทคอยน์ร่วงต่ำกว่า 90,000 ดอลลาร์อีกครั้ง 🚩 สกุลเงินดิจิทัลเผชิญแรงกดดัน