D.R. Horton (DHI.US) gains almost 11% after the largest home builder in America reported Q3 earnings. D.R. Horton operates in 121 markets across 33 states. It has built over 1.1 million homes in its 45-year history. The company constructs and sells single-family and multi-family homes, rental properties, and offers mortgage financing, title services, and insurance.

Q3 Fiscal 2024 Highlights:

- Earnings Per Share (EPS): Increased 5% to $4.10.

- Net Income: Up 1% to $1.35 billion.

- Revenues: Grew 2% to $10.0 billion.

- Homes Closed: Increased 5% to 24,155, valued at $9.2 billion.

- Net Sales Orders: Increased 1% to 23,001 homes, valued at $8.7 billion.

- Pre-Tax Income: Up 1% to $1.8 billion, with an 18.1% pre-tax profit margin.

- Rental Operations: Generated $64.2 million pre-tax income on $413.7 million revenue.

- Share Repurchases: 3.0 million shares for $441.4 million; new $4.0 billion repurchase authorization.

- Dividends: Declared a quarterly dividend of $0.30 per share.

Financial Position:

- Cash Balance: $3.0 billion.

- Total Liquidity: $5.8 billion.

- Debt: $5.7 billion, with $500 million maturing in the next twelve months.

- Return on Equity (ROE): 21.5%.

- Return on Inventory (ROI): 29.5%.

- Debt to Total Capital Ratio: 18.8%.

Guidance for Fiscal 2024:

- Revenue: $36.8 billion to $37.2 billion.

- Homes Closed: 90,000 to 90,500.

- Share Repurchases: Approximately $1.8 billion.

- Homebuilding Cash Flow: Approximately $3.0 billion.

Market View

The housing market continues to experience significant challenges, primarily due to elevated inflation and high mortgage interest rates. These factors have made home affordability a critical issue, with both new and existing home supplies at affordable price points remaining limited. Despite these challenges, the underlying demographics that support housing demand, such as population growth and household formation, continue to be favorable. This persistent demand, coupled with limited supply, has created a robust market for home builders. D.R. Horton remains optimistic as the company’s diverse product offerings and flexible lot supply position it well to capitalize on these market conditions.

Management Commentary

David Auld, Executive Chairman of D.R. Horton, highlighted the company's strong performance in the face of these market challenges. He emphasized that the company's strategic focus on affordable product offerings and flexible lot supply has been key to their success. Auld noted that D.R. Horton is well-positioned to maximize returns in each of its communities, thanks to its disciplined approach to capital allocation and financial flexibility. Auld also expressed confidence in the company's ability to generate increasing levels of consolidated operating cash flows

Housing prices

Despite high mortgage rates and inflation driving up construction costs, D.R. Horton anticipates stable home prices with moderate increases.

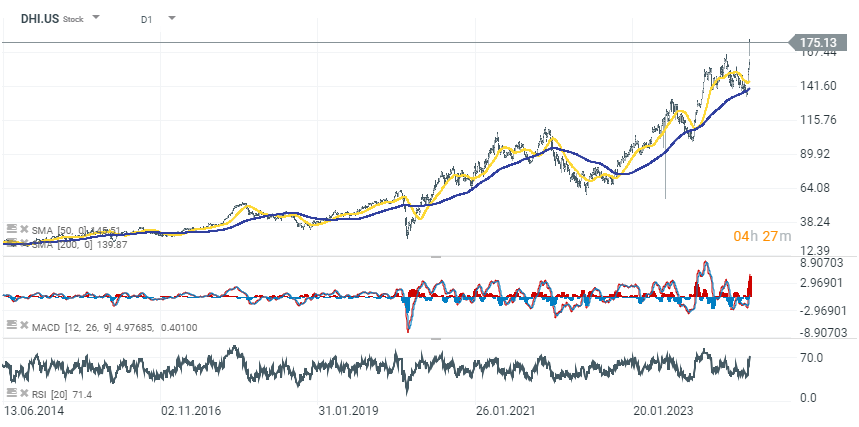

Price Chart (D1)

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈

เหลือเวลาไม่กี่วัน รีบรับหุ้นฟรี ⏳

Paramount Global และ Skydance Media หุ้นถูกกดดัน หลัง S&P ออกคำเตือน

Broadcom ในฐานะ “สุดท้ายของ Big Tech”