- China's Hang Seng Index failed to repeat yesterday's gains, and Chinese index futures today saw a nearly 3% correction in the rebound, driven by dovish signals from the PBoC. European indices CAC40 and FTSE posted near 0.5% declines, DAX retreated slightly;

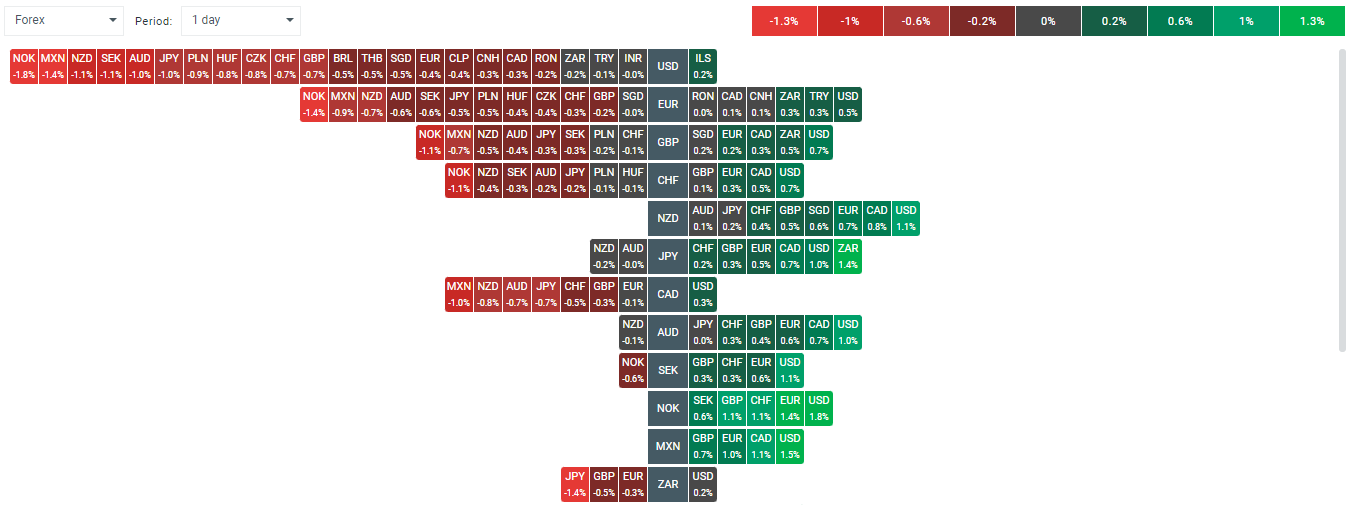

- The attention of the currency market today is captured by the dollar, which is recording a massive strengthening. USDIDX is gaining almost 0.7% and EURUSD has rapidly slid from local maxima near 1.12 to around 1.113 today, losing 0.4%. 10-year bond yields are up about 4 bps to 3.77%. Despite that gold gains 0.2% today,

- After a fairly positive opening of the US stock market, we are seeing a cooling of sentiment. Nvidia erased some of the growth and is now gaining 2%, while the US100 is trading flat and the US30 is losing 0.6%, buoyed largely by a nearly 5% drop in shares of pharmaceutical company Amgen

- Apple shares lose nearly 1% after August data pointed to low demand in China. New Street reported that it expects about 10% negative disappointment in this year's iPhone shipments (215 million shipments expected, 10% below consensus); however, it maintained its $225 per share rating

- Since news of the opening of the Three Mile Island nuclear power plant, which will supply power to Microsoft's data centers, speculative interest has been evident among uranium-related companies, with Denison Mines gaining nearly 6%, following an upgrade at BMO Capital

- U.S. new home sales data turned out to be marginally stronger than forecast. Home sales for August: 716,000 (expected: 699,000; previous: 751,000). The growth rate was -4.7% m/m (previous: 10.3% m/m). Earlier data showed an 11% increase in mortgage applications on a weekly basis, following last week's 14.2% increase.

- According to the US administration, there is still a risk of a full-blown escalation in the Middle East; Biden's statements indicate this, and Anthony Blinken indicated that the situation could escalate rapidly. Yesterday, Hezbollah took another rocket fire at Israel. Oil, however, retreated on the wave of 'de-escalation' of tensions in Libya.

Inventories according to the EIA indicated a stronger than expected decline in stocks. There was a decline in inventories, plus a drop in refining capacity utilization with fuel demand rising, but Brent Crude lost more than 2.3%

- Change in Brent Crude inventories: -4.47 million brk (expected: -1.43 million brk; previous: -1.63 million brk)

- Gasoline inventories: -1.5 million brk (expected: +0.2 million brk; previous: +0.069 million brk)

- Distillate stocks: -2.2 million brk (expected: -1.2 million brk; previous: +0.125 million brk)

- Russian President Putin indicated today that Russia would consider a nuclear response to even a conventional attack on its territory by a non-nuclear-weapon state, but supported by a nuclear-armed state, or group of nuclear-armed states. He indicated that new geopolitical realities will change Russia's 'nuclear doctrine'

- Among agricultural commodities, we can see the largest drop of almost 1.7% in cotton futures, however sentiments around wheat, soybean, coffee and sugar are solid, as grains gain in the range of 1-1.5%.

- Despite positive comments from analysts at QCP Capital, sentiment around cryptocurrencies remains mixed. Bitcoin slides to $63.500, despite dovish signals from China, where the PBoC announced rate cuts, potentially boosting interest in bitcoin and ETFs listed in Hong Kong

- OECD Chief Economist Pereira called, that US economy is very robust. OECD sees the US Federal Reserve cutting rates to 3.50% by end 2025, and ECB cutting to 2.25% by end 2025; estimates 2024 US GDP growth forecast at 2.6% (unchanged), but trims 2025 to 1.6% (1.8% previously).

The US dollar dominates today's currency market session, but despite that gold gains almost 0.2% today. Source: xStation5

The US dollar dominates today's currency market session, but despite that gold gains almost 0.2% today. Source: xStation5

BREAKING: EURUSD เคลื่อนไหวจำกัด; การเติบโตภาคบริการสหรัฐฯ เย็นตัวในเดือนธันวาคมจากความต้องการที่อ่อนตัว 📌

Barkin และ Miran ยังคงอยู่คนละฝั่งในแนวทางนโยบายของ Fed 🎙️

BREAKING: เงินเฟ้อเยอรมนีออกมาต่ำกว่าที่คาดอย่างมาก, EURUSD ร่วง 📉

ตลาดเด่น: OIL.WTI; ทรัมป์คาดหวังการลงทุนจากบริษัทยักษ์ใหญ่น้ำมันของสหรัฐฯ 🖋️