-

European indices finished today's cash trading mixed with majority of blue chips indices from Western Europe deviating less than 0.3% from yesterday's closing prices

-

DAX futures (DE30) climbed back above 16,000 pts and reached the highest level since January 2022

-

Wall Street indices launched today's trading lower. However, losses were being erased as the session went on and now S&P 500, Nasdaq and Russell 2000 are trading in positive territory. Dow Jones trades slightly lower on the day

-

Asian session as well as the first half of the European session was marked with USD strengthening, which put pressure on precious metals and energy commodities

-

USD started to lose ground in the afternoon allowing silver to recover from losses and gold to reapproach $2,000 area

-

Netflix dropped 4% after company released disappointing Q1 2023 earnings report that showed slowdown in subscriber growth

-

IBM and Tesla are set to report Q1 2023 financials after close of the Wall Street session today

-

Bloomberg reported that Bank of Japan is unlikely to tweak its yield curve control policy at April meeting

-

Cryptocurrencies were trading lower today with Bitcoin dropping below $29,500 mark and Ethereum moving below $2,000 area

-

GBP and NZD are the best performing major currencies while JPY and CAD lag the most

-

Final CPI inflation data from euro area for March confirmed flash reading and showed headline CPI dropping from 8.5 to 6.9% YoY while core gauge ticked higher from 5.6 to 5.7% YoY

-

Japanese industrial production increased 4.6% MoM in February (exp. 4.5% MoM)

-

UK CPI inflation decelerated from 10.4 to 10.1% YoY in March (exp. 9.8% YoY). Core gauge stayed unchanged at 6.2% YoY (exp. 6.0% YoY)

-

Canadian housing starts data for March came in at 213.9k (exp. 240k)

-

Oil recovered part of the losses after the DOE report showed a massive 4.58 million barrel draw in US inventories (exp. -2.5 mb)

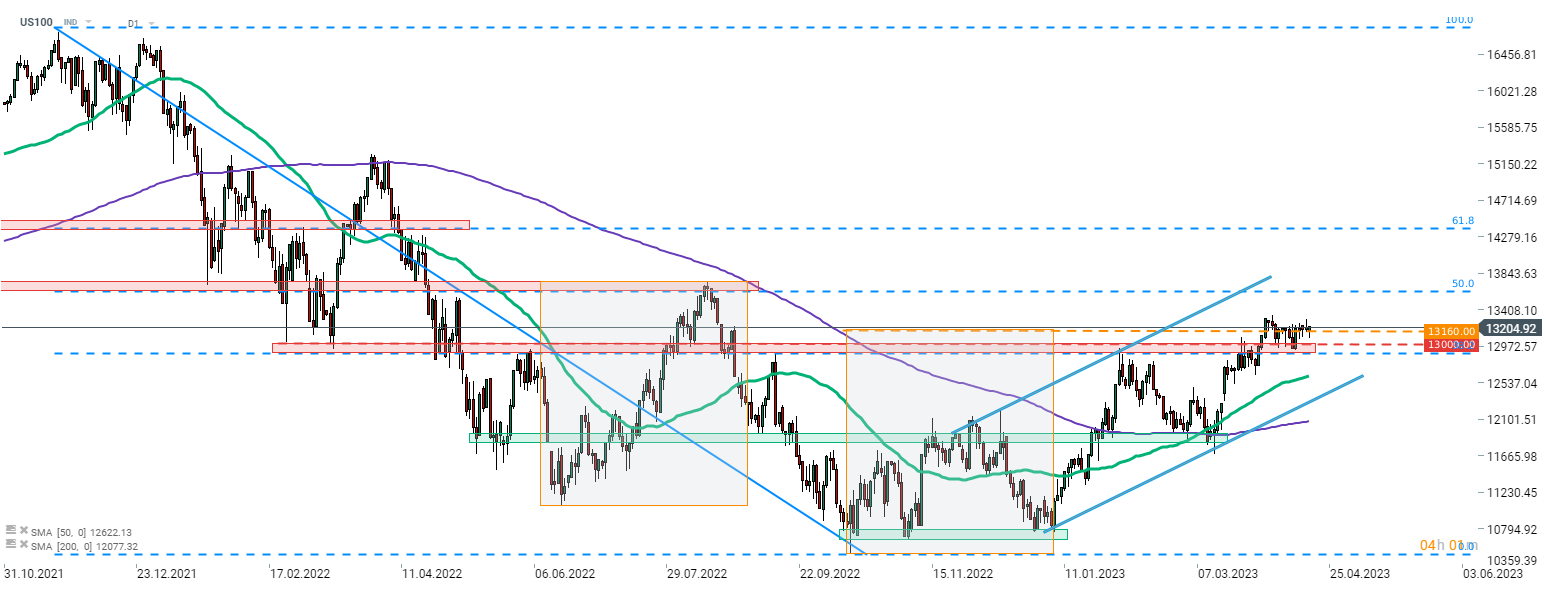

Nasdaq-100 (US100) continues to struggle in the vicinity of the upper limit of an Overbalance structure. Recent price action signals indecisiveness with the index trading mostly sideways over the past 2-3 weeks. However, earnings reports from Tesla, IBM and others may provide fuel for the move of the tech-heavy index. Source: xStation5

Nasdaq-100 (US100) continues to struggle in the vicinity of the upper limit of an Overbalance structure. Recent price action signals indecisiveness with the index trading mostly sideways over the past 2-3 weeks. However, earnings reports from Tesla, IBM and others may provide fuel for the move of the tech-heavy index. Source: xStation5

สรุปข่าวเช้า

Daily Summary: Holiday Commodity Fever

ข่าวเด่นวันนี้: ดอลลาร์อ่อนค่าลง ขณะที่ราคาน้ำมันฟื้นตัวจากความตึงเครียดระหว่างสหรัฐฯ–เวเนซุเอลา

US OPEN: ความคึกคักกลับมาในช่วงต้นสัปดาห์