Global equity markets are allowed to catch a breath today. Beginning of the week was nervous with weekend increase in hostilities in the Middle East triggering pullback on futures markets. However, as the situation looks to be limited to Israel and Gaza Strip, and is not spilling over into other countries in the region, risk assets started to recover. Gains continue today with indices from Europe posting strong gains and Wall Street benchmarks advancing. Media reports saying that China is also mulling new stimulus measures and higher deficit in order to achieve growth targets are also supporting moods in the markets.

European indices are trading 1.5-2.8% higher today, with the biggest gains being seen in Italy, Spain and Poland. Wall Street indices are trading 0.6-1.5% higher with small-cap Russell 2000 being the top performer.

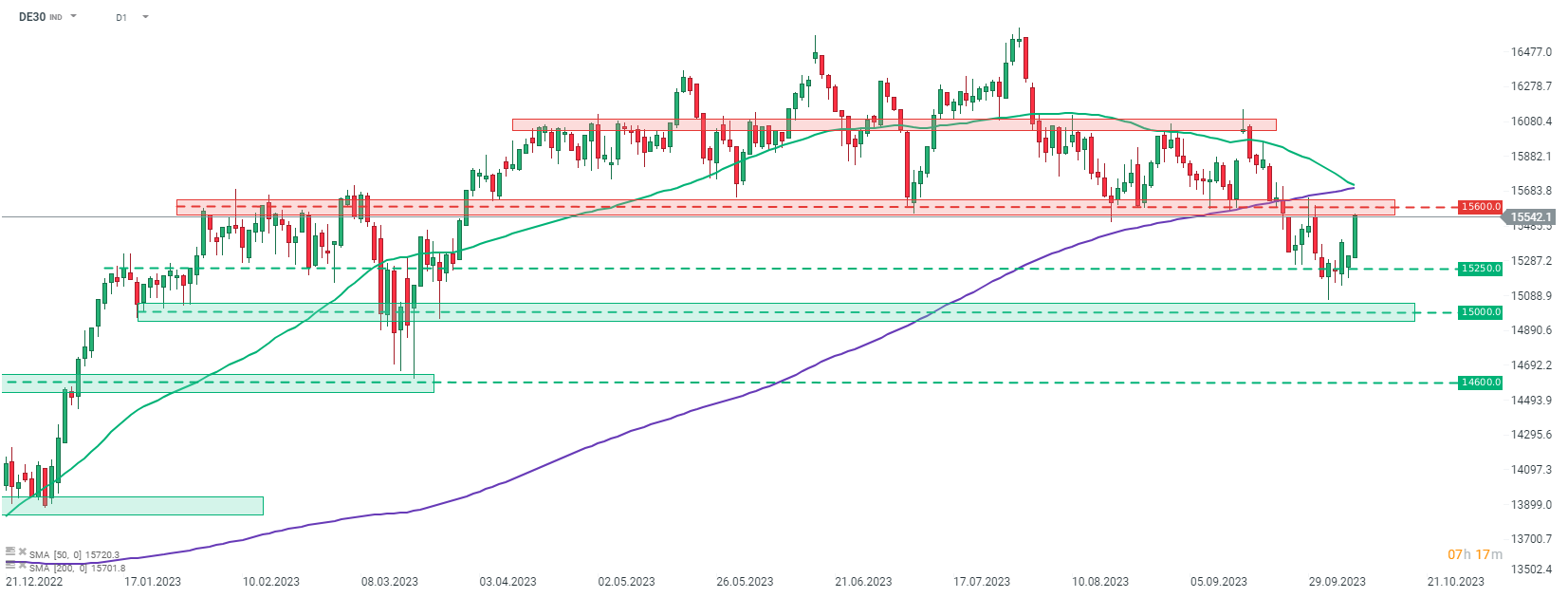

DE30 is trading 1.5% higher today and climbs back above the 15,500 pts amid overall improvement in moods on the markets. Index is approaching a key medium-term resistance zone in the 15,600 pts area. Source: xStation5

DE30 is trading 1.5% higher today and climbs back above the 15,500 pts amid overall improvement in moods on the markets. Index is approaching a key medium-term resistance zone in the 15,600 pts area. Source: xStation5

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ

Wall Street ปรับตัวขึ้นต่อเนื่อง; ดัชนี US100 รีบาวด์มากกว่า 1% 📈