European stock market indices plunged at the start of today's cash trading. DE30 dropped 150 points and is testing lows from 19 August, 2021. There was no clear catalyst for the move and it looks like the sell-off in Europe is a response to a cumulation of events. Steep drop in cryptocurrencies yesterday, Asian equities snapping 8-day winning streak and hawkish comments from Fed members (Bullard interview with Financial Times). It looks like markets are finally realizing that tapering is coming sooner rather than later.

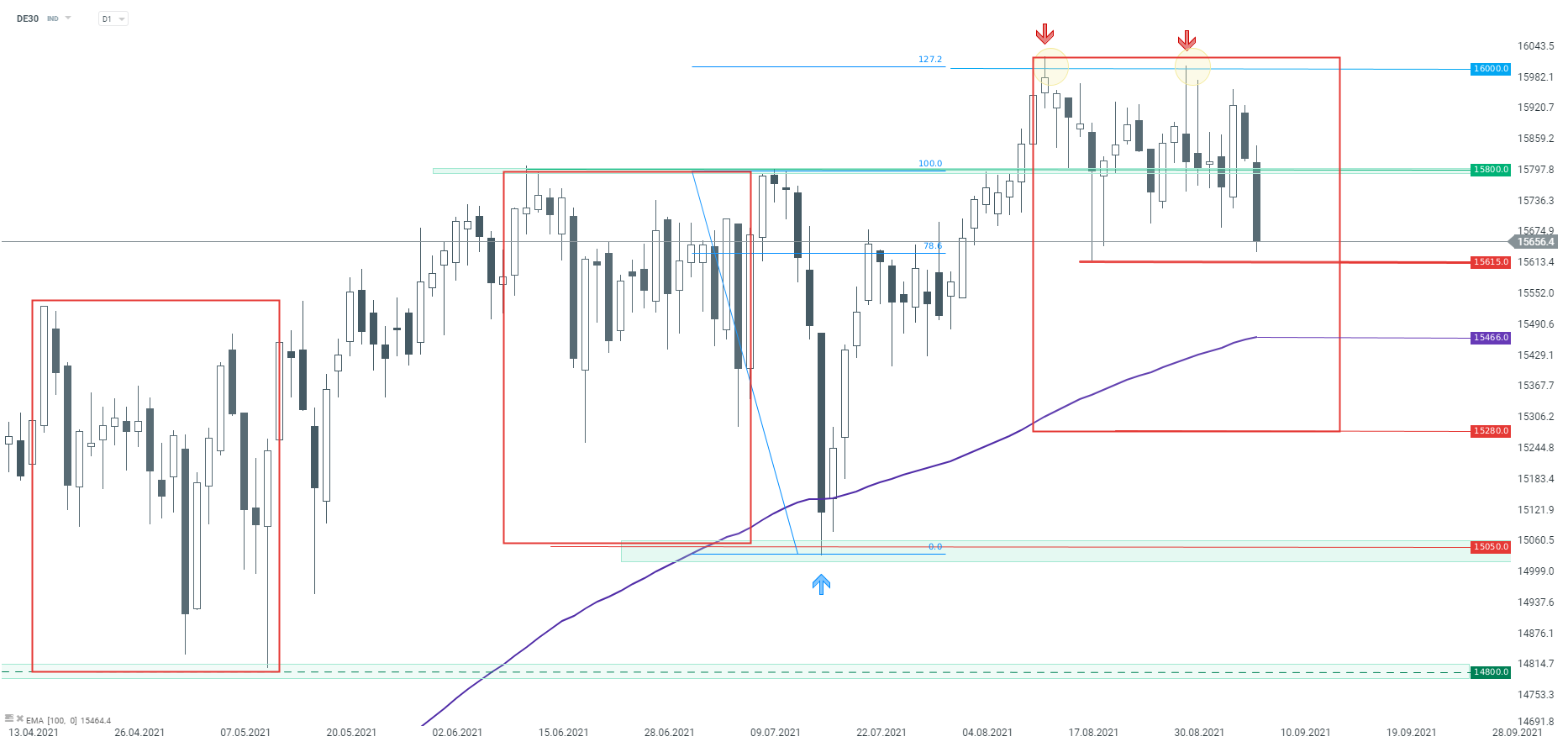

Taking a look at DE30 from a technical point of view, we can see that the index broke below recent local lows and is testing a mid-August low at around 15,635 pts. Breaking below this area would pave the way for a test of the 100-session EMA (purple line). However, key support that is guarding the uptrend can be found near 15,280 pts, where the lower limit of the Overbalance structure can be found.

Source: xStation5

Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ