The US dollar has been under pressure recently due to mixed macro data and slightly worse prospects for interest rate hikes, which was confirmed by comments from four Fed members. In turn, the euro strengthened due to the change in rhetoric on the part of the ECB. These factors have led to a rebound in gold prices, which is sensitive to changes in monetary policy in the world.

The market is still valuing 5 hikes in the US, but also 2 in the euro zone. Interest rate hikes will be negative for gold in the long term, but the behavior of EURUSD is crucial for gold in the shorter term. EURUSD hit 1.14500, the highest level since mid-January and upward move may accelerate if today's US data negatively surprise. Employment is expected to increase by 120,000, but only by 33,000. in the private sector. It is worth remembering that the ADP report showed a 301,000 decrease in employment for January due to Omikron. The key aspect of today's report will be wages, which are to increase to 5.2% YoY from 4.7% YoY and the unemployment rate, which should remain at 3.9%.

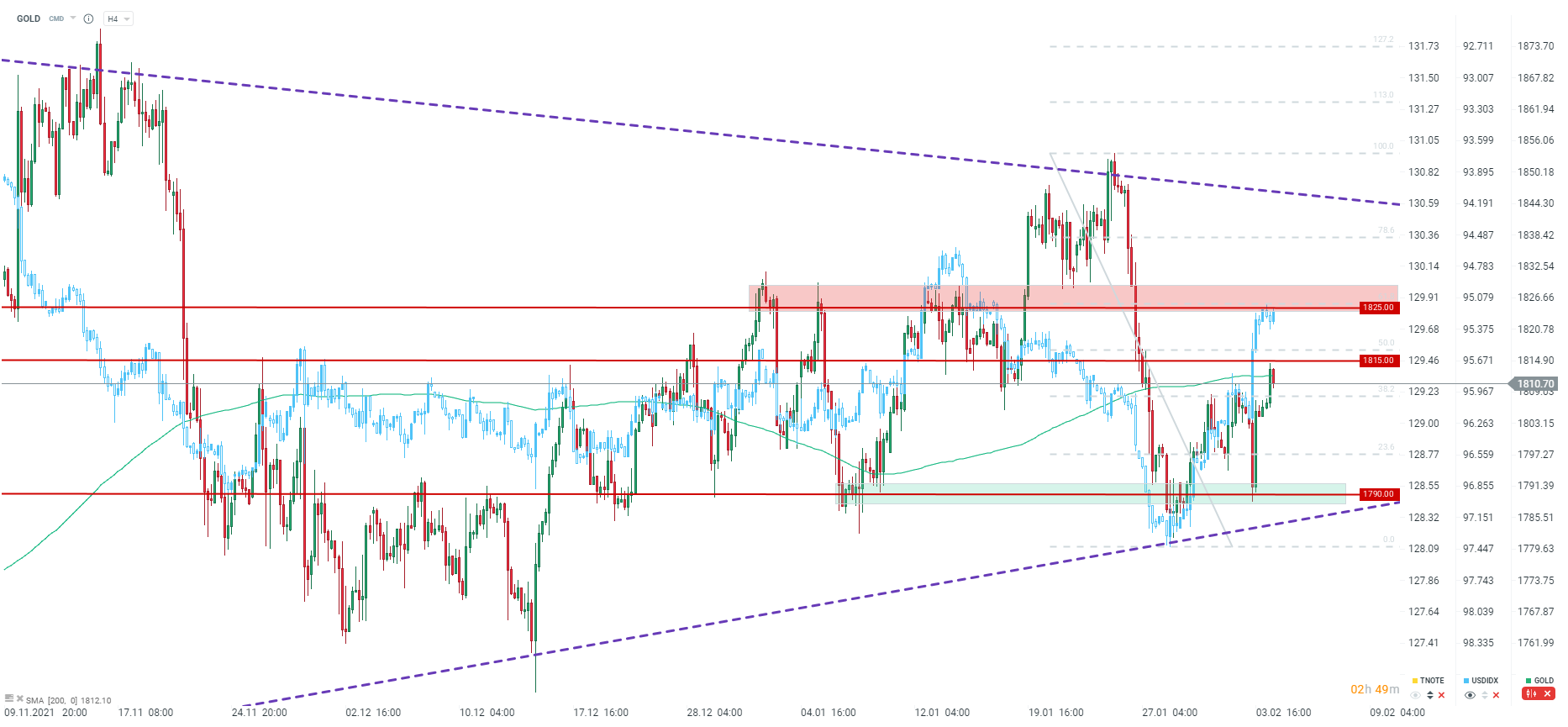

The key resistance levels for gold are located $1815 and $1825. Major support can be found at $1790. At the same time, however, gold remains within the large triangle formation whose limits have been tested recently. A breakout from this pattern may lead to stronger price movements. Source: xStation5

The key resistance levels for gold are located $1815 and $1825. Major support can be found at $1790. At the same time, however, gold remains within the large triangle formation whose limits have been tested recently. A breakout from this pattern may lead to stronger price movements. Source: xStation5

BREAKING: NATGAS ปรับตัวลงเล็กน้อยหลังรายงาน EIA ปริมาณสำรองต่ำกว่าคาด

BREAKING: รายงานปริมาณน้ำมันดิบสหรัฐฯ ออกมาผสมกัน

⏫น้ำมันพุ่งขึ้น 2% จากความไม่แน่นอนด้านอุปทาน

สรุปข่าวเช้า