Shares of major global container ship operators like Hapag Lloyd (HLAG.DE), ZIM (ZIM.US), and Maersk (MAERSKA.DK) came under pressure today. The largest global container carrier, Maersk, is down 5% today and has been under pressure for days after Deutsche Bank downgraded the company.

- The stock market saw higher odds for peace in Gaza, after Hamas told Reuters that it had accepted a United Nations (UN) peace resolution for the region. As a result, some of the premium that was present in the container freight market, due to the higher risk and problematic situation in the Red Sea, could be wiped out, lowering freight rates.

- Nordnet analysts pointed out that if the UN decision is accepted, it could weigh on sentiment in the maritime industry, as it could put an end to the Huti attacks, in the Red Sea. As a result, freight rates could fall again, in view of the significant surplus cargo capacity available on the market.

- Losing the most heavily (more than 10% before Wall Street opened) today are the shares of Israeli company ZIM, which were recently downgraded to 'sell' by Morgan Stanley. The company has significant exposure to spot rates, which depend on the current economic climate and market valuations of transportation rates, because it expected them to continue rising this year.

- Should rates tumble from their current high levels, the currency could be weighed down. We already know that Israel will not support the UN and Hamas peace proposal, as it is still counting on achieving all the goals of the Gaza war operation. Stock market values, however, have not reacted promptly to these reports and the sell side still prevails.

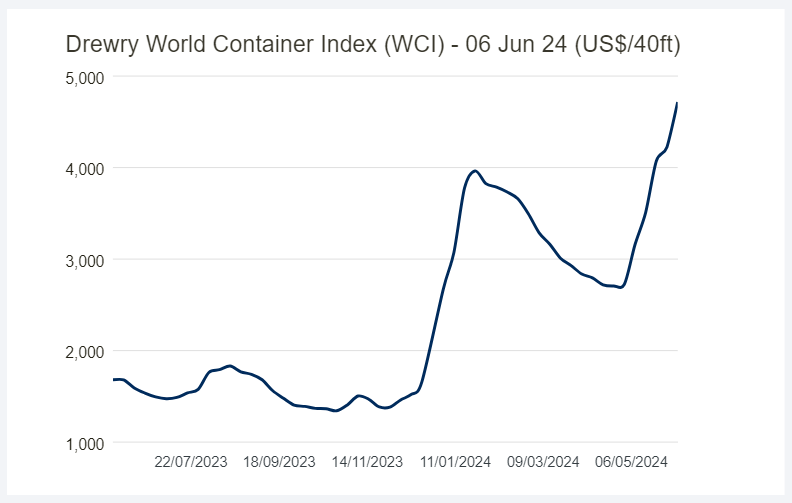

Freight rates are behind a huge, several-fold increase from levels in the fall of 2023. Source: Drewry

MAERSK shares (MAERSKA.DK)

Maersk shares are testing the 200-session moving average (red line) today, and have almost completely erased this year's gains, despite the several-fold increase in freight rates; their increase, however, is offset by the company's higher operating costs.

Source: xStation5

ข่าวเด่นวันนี้

การขายทำกำไรในปัจจุบันหมายถึงจุดจบของบริษัทควอนตัมหรือไม่?

Howmet Aerospace พุ่ง 10% หลังประกาศผลกำไร ทำมูลค่าบริษัททะลุ 100 พันล้านดอลลาร์ 📈

📊 หุ้นเด่นรายสัปดาห์: Datadog – การมอนิเตอร์ที่คุ้มค่า