The world's largest container ship operator, Denmark's Maersk (MAERSKA.DK) faces a number of logistical challenges, which led the company to recently issue a special warning on supply chains disruptions. Maersk warned of bottlenecks in the supply chain and unprecedented logistical challenges, related to the Gulf of Bab-el Mandeb and the Red Sea more broadly and also to the congestion that has formed on the west coast of the US (Oakland, California), through which ships cannot sail for goods from China at a satisfactory rate.

- Maersk's ships are circumnavigating the Cape of Good Hope, lengthening the freight from Asia to Europe, negatively affecting delivery times and business profitability; the company is trying to counteract this and has increased the cargo capacity of vessels by 6%

- Longer freight times have also negatively affected the company's ability to handle shipments from the US East Coast

- Maersk warned large customers like Nike and Walmart to prepare for higher logistics costs

- The giant indicates that companies should book deliveries in advance and be ready for problems in the second half of the year. The company stressed that some companies may not be ready for higher product prices

- The company's biggest threat appears to be the prospect of reduced consumer demand, which could put it in a difficult financial position, given logistics costs and problems in timeliness and liquidity of deliveries.

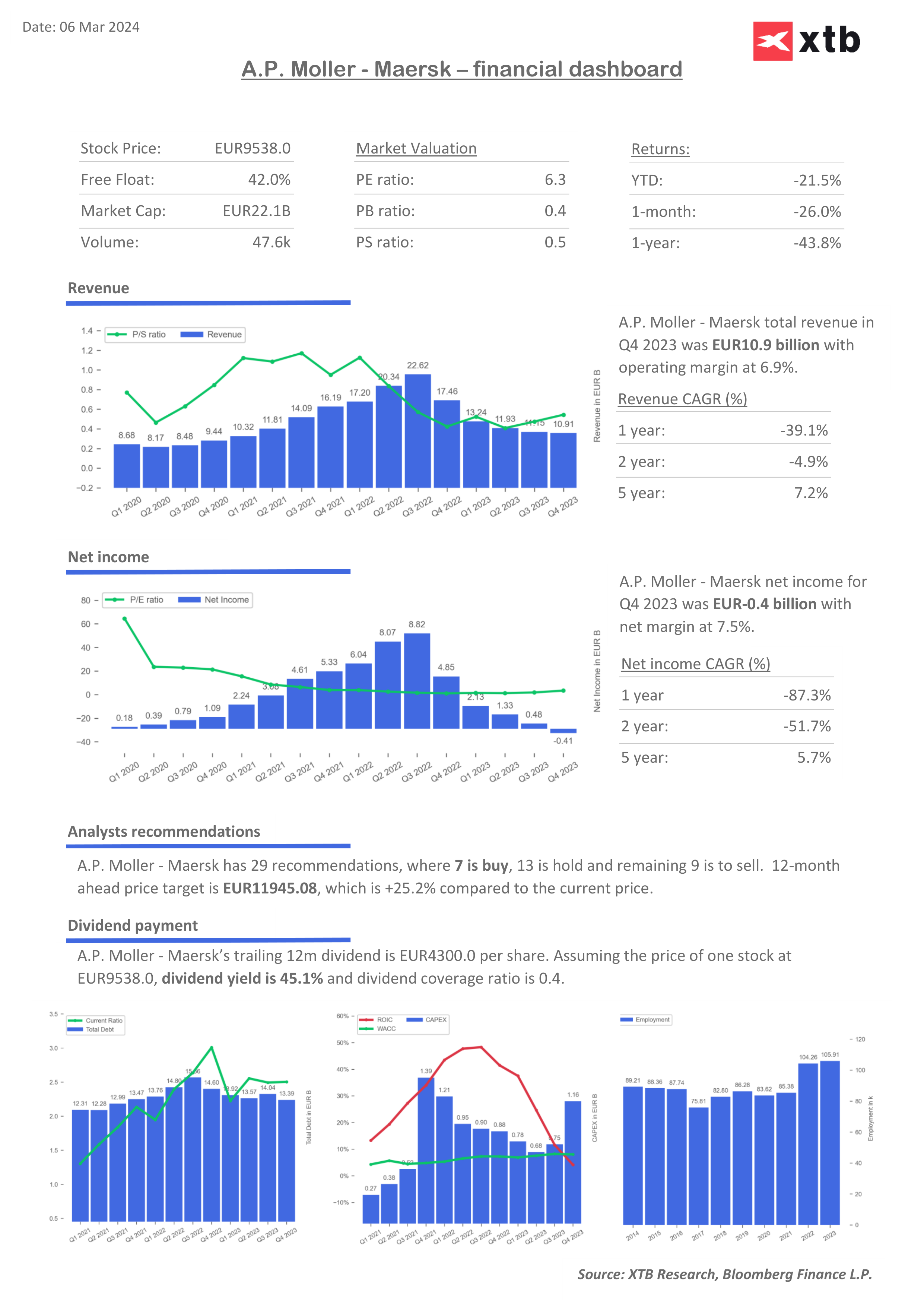

Interestingly, despite the still precarious situation in freight (where rate increases alone do not offset all costs for companies and do not guarantee an improvement in profits), shares of rival Hapag Lloyd (HLAG.DE) have not seen a decline comparable to Maersk, illustrating that part of the problems may be related to Maersk's logistical challenges. The company presented a net loss of €410 million in Q4, against which even Q1 2020 (covid) looks good, recording a €180 million profit at the time.

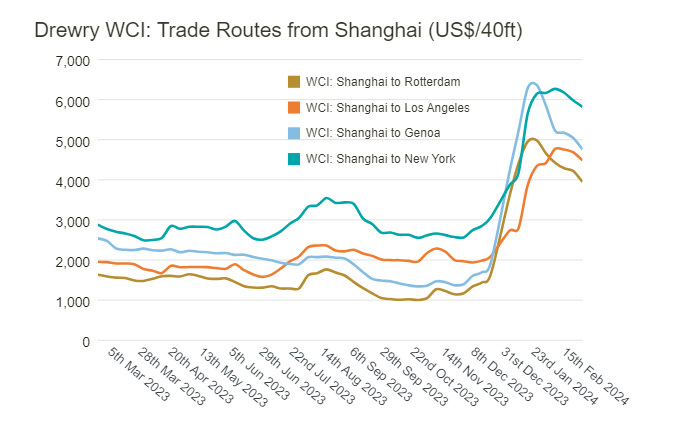

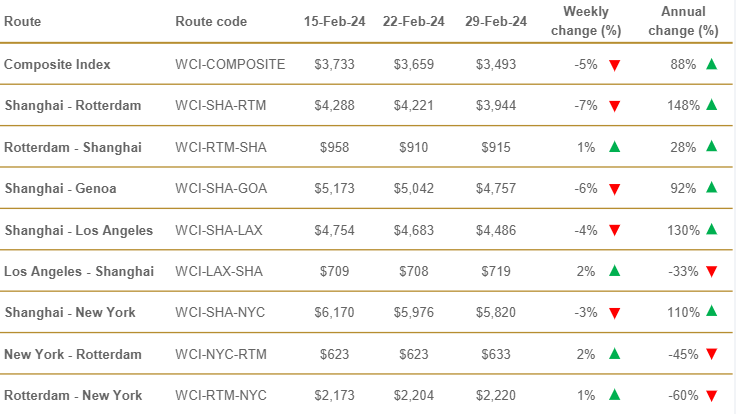

Freight costs for a standard 40-foot container have recently fallen, following a powerful rally fueled by concerns around the Red Sea. Source: Drewry Shipping

Year-on-year freight prices for a 40 ft container have risen most sharply on routes from Asia to Europe and Asia to the US; the benchmark index has rebounded 88% year-on-year, although it has seen nearly 10% declines in recent weeks. Last week, average shipping prices from Shanghai to Rotterdam fell 7%. Source: Drewry Shipping

Maersk shares (MAERSKA.DK), D1 interval

Source: xStation5

Source: xStation5

Return on invested capital (ROIC) has tumbled mightily from the very high levels of nearly 50% achieved in 2022 to less than 10% today, slipping below the weighted average cost of capital (WACC). This situation justifies the falling valuation. A price-to-sales ratio of 0.5, as well as almost 60% discount from book value (interestingly, without significant debt, which in relation to Maersk's 'equity' is about 8%) may seem attractive, but they reflect the high cyclicality of the shipping industry.

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้