After the market close on Wall Street today, e-commerce giant Amazon (AMZN.US) will report its fourth-quarter 2023 earnings. Investors eagerly anticipate another strong showing, with expectations of record revenue and continued growth in key segments. Analysts closely watch Amazon's cloud computing arm, AWS, as a major driver of innovation and future potential.

Market Expectations:

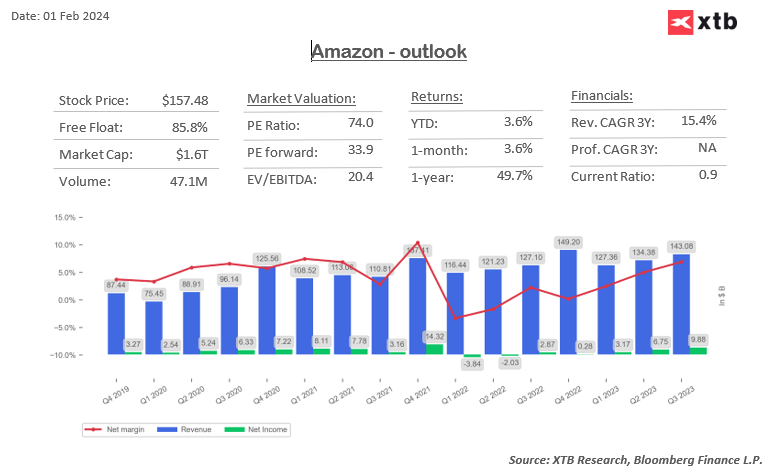

- Record Revenue: Analysts predict $166.25 billion in revenue, an 11.42% year-over-year increase.

- Strong EPS Growth: Earnings per share (EPS) are expected to be 79 cents, representing a significant 172% year-over-year growth.

- Core Retail Strength: Online sales are expected to reach $68.91 billion, with seller services generating an additional $42 billion.

- Cloud and Advertising Growth: Continued momentum is expected in the AWS (Amazon Web Services) and advertising segments. AWS revenue forecast is $24.5 billion, up 12% year-over-year, while advertising revenues might exceed $12.5 billion, representing a 9% year-over-year increase.

- Focus Areas: Investors will pay close attention to the company's plans for further cloud development, particularly regarding investments in artificial intelligence.

- Outlook and Advertising Returns: The upcoming quarters' outlook and returns on advertising after enabling Prime Video ads in the US will be closely scrutinized.

Market Concerns:

- EPS Lower Than Expected: Some analysts warn of potentially lower EPS growth, impacting share prices negatively.

- Economic Slowdown Impact: Concerns about a potential economic slowdown might raise uncertainty about Amazon's future performance.

- Competition and Growth Slowdown: Amazon may face challenges from growing online competition, potentially slowing down growth in key segments like online sales.

What to Watch:

- Investment Strategy: Declining investments in cloud development could weaken Amazon's position against competitors, but could also lead to higher margins and profits.

Market analysis:

- Analyst Sentiment: The company has 68 buy ratings, 2 hold ratings, and 0 sell ratings, indicating strong analyst confidence.

- Price Target and Volatility: The average price target of $148.8 per share suggests an 18% upside potential, with an implied daily share price change of +/- 7% after earnings release.

- Historical Performance: Amazon has beaten EPS estimates in 9 of the last 12 quarters. Its shares have gained 51.5% over the past year, compared to the S&P 500's 20% gain.

Technical view:

Unlike other tech giants, Amazon is far from its 2021 peak and hasn't kept pace with the US100 recently. Key support for the share price lies around $145, with potential upside to $166-170 on positive earnings.

Source: xStation5

Key data:

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈

เหลือเวลาไม่กี่วัน รีบรับหุ้นฟรี ⏳

Paramount Global และ Skydance Media หุ้นถูกกดดัน หลัง S&P ออกคำเตือน