Meta Platforms (META.US) will publish its report for the last quarter of 2023 after today's US stock market close. Investor expectations are high for both the past quarter and the forecast for 2024. The scale of these expectations is evident in the company's stock performance in January this year, which outperformed competitors like Alphabet, Microsoft, and Amazon.

Analyst Expectations:

Q4 2023:

- Estimated Revenues: $39.01 billion, including:

- Estimated advertising revenues: $37.81 billion

- Daily active Facebook users: 2.07 billion

- Monthly active Facebook users: 3.06 billion

- Ad impressions: +24.6%

- Average price per ad: -4.12%

- Earnings Per Share (EPS): $4.91

- Operating Margin: 39.5%

Q1 2024

- Estimated Revenue: $33.64 billion

2024 Year

- Total Expenses: $96.45 billion

- Capital Expenditure: $33.37 billion

Investor expectations are high, given the significant growth in the company's market capitalization throughout 2023. Recently, investor attention has been focused on the company after it surpassed a market capitalization of 1 trillion dollars. The Meta Platforms report is expected to not only show strong performance in the previous quarter but also a promising outlook for 2024. In this context, the company's development in artificial intelligence is of particular interest. Although Meta does not offer products directly related to AI, it has a wide scope to utilize this technology to enhance functionalities on social platforms and internal company operations. The year 2024 will also be interesting in terms of advertising expenditures, as it is an election year in the USA.

Meta Platforms' financial dashboard also shows how dynamic the company's development has been in recent years. Particularly noteworthy is the positive rebound in all indicators in 2023, improvement in liquidity, and employment.

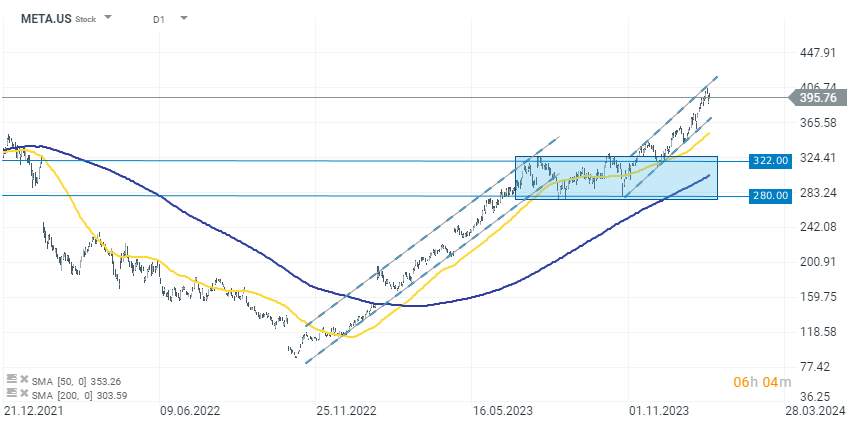

Meta Platforms Chart, H4 Interval

The company's improved performance in 2023 is reflected in its capitalization, which increased by over 200%. The shares remained in an almost continuous growth channel, except for a consolidation period in the early second half of 2023. If the results are good, we can expect the trend to continue, remembering that the current share price remains in a growth channel. However, failing to meet market expectations could exert downward pressure. In such a case, it is important to monitor the levels of the last consolidation, namely $280-$320.

Source: xStation 5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้