Microsoft (MSFT.US) traded 3% lower yesterday in the after-market session following the release of fiscal-Q4 2023 earnings (calendar Q2 2023). Results were not that bad but have hinted that growth in some key parts of Microsoft's business is slowing. Let's take a closer look at earnings release from Microsoft!

Results mostly in-line, cloud growth slows

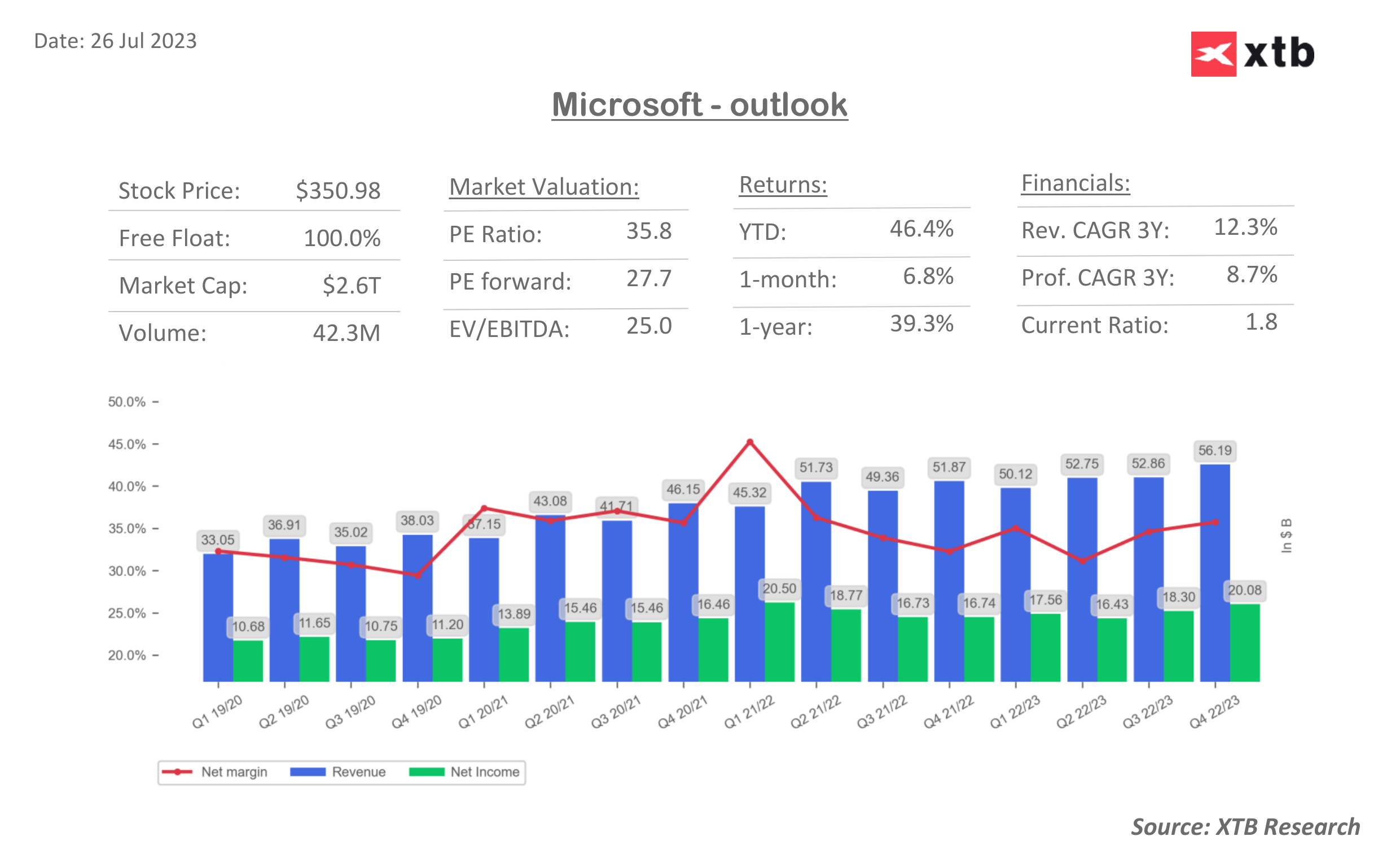

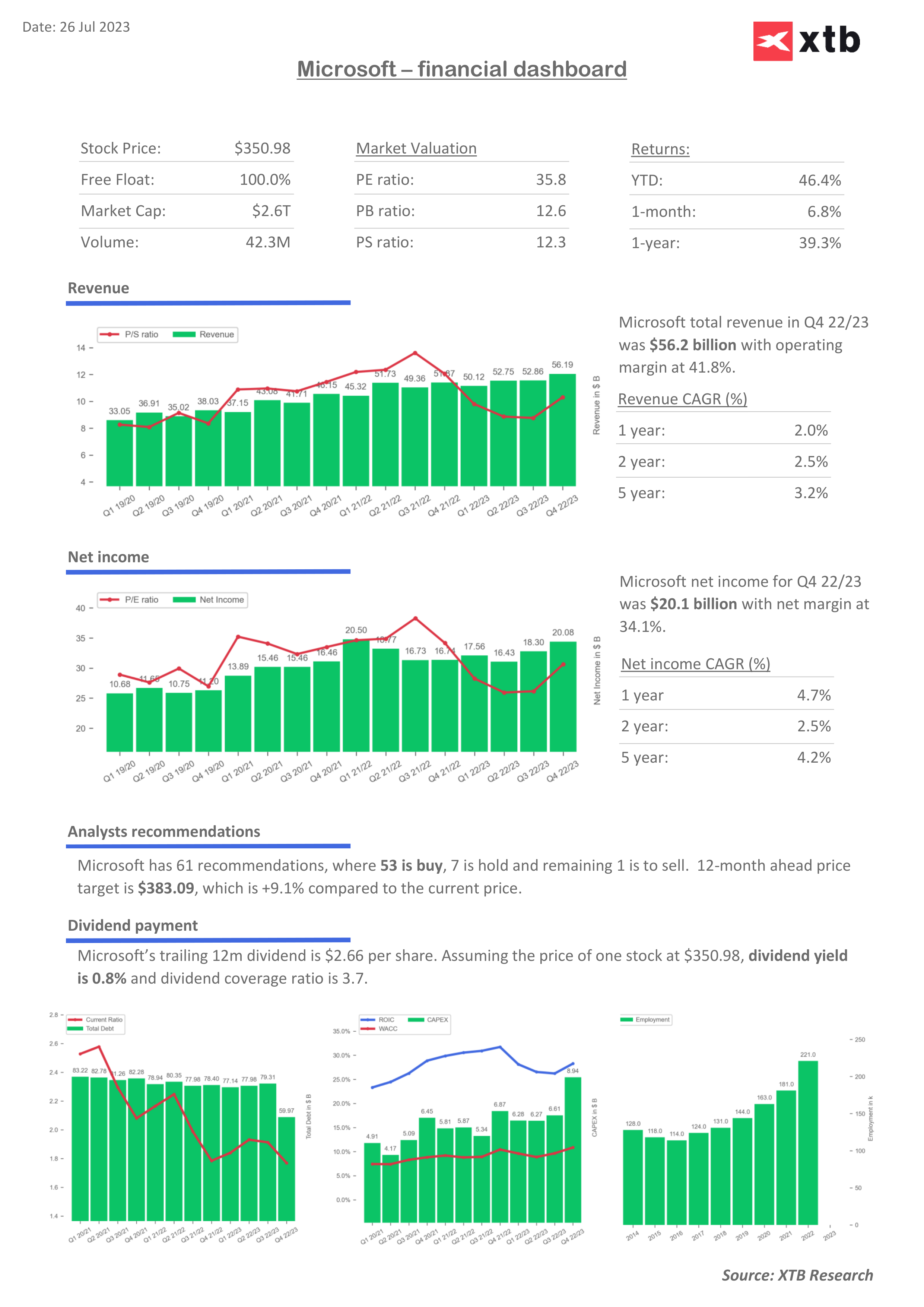

Microsoft results for fiscal-Q4 2023 (April - June 2023) were mostly in-line with market expectations. Total revenue grew by 8.3% YoY, slightly more than expected. This was driven by solid performance of the Intelligent Cloud segment. Total cloud sales reached $30.3 billion during the quarter and were 21% YoY higher. Growth in Microsoft's Azure Cloud at constant currency reached 27% during the quarter. While this is a slowdown, pace of deceleration begins to moderate and it is seen as a positive. Capital expenditure was much higher than expected during the quarter but it is expected to ease after a few years of rising investments, in spite of Microsoft rolling out and boosting its AI offering.

Fiscal-Q4 2023 results

-

Revenue: $56.19 billion vs $55.49 billion expected (+8.3% YoY)

-

Productivity and Business Processes: $18.29 billion vs $18.1 billion expected (+10% YoY)

-

Intelligent Cloud: $23.99 billion vs $23.8 billion expected (+15% YoY)

-

More Personal Computing: $13.91 billion vs $13.58 billion expected (-4% YoY)

-

-

Microsoft Cloud revenue: $30.3 billion vs $30.05 billion expected (+21% YoY)

-

EPS $2.69 vs $2.56 expected ($2.23 in fiscal-Q4 2022)

-

Operating income: $24.25 billion vs $23.28 billion expected (+18% YoY)

-

Net income: $20.1 billion (+20% YoY)

-

Capital expenditure: $8.94 billion vs $7.85 billion expected

-

Revenue at constant currency: +10% vs +8.52% expected

-

Capital distribution: $97 billion

Full fiscal-2023 highlights

-

Total revenue: $211.9 billion (+7%)

-

Operating income: $89.7 billion (+8%)

-

Net Income: $73.3 billion (+6%)

-

EPS: $9.81 (+7%)

-

Microsoft Cloud revenue above $110, up 27% at constant currency

Bleak forecast for fiscal-Q1 2024

While analysts are upbeat that deceleration in cloud is moderating, turnaround may still be some time away. Company expects total revenue in fiscal-Q1 2024 (July - September 2023) to grow around 8% YoY, to $53.8-54.8 billion. While this is in-line with fiscal-Q4 2023 revenue growth, the market's forecast of $54.94 was above the top range of the company-provided forecast. Microsoft expects growth in Azure cloud to slow further this quarter, to 25-26%. That's down from 27% in fiscal-Q4 2023 and 42% in fiscal-Q1 2023. While Microsoft said that it has over 11,000 clients for its Azure OpenAI product already (an increase from 4,500 in mid-May), increase in revenue from AI products are likely to materialize gradually.

Fiscal-Q1 2024 forecasts

-

Revenue: $53.8-54.8 billion vs $54.94 billion expected (+8~% YoY)

-

Azure growth at constant currency: 25-26% YoY

A look at the chart

Shares of Microsoft (MSFT.US) trade around 3.5% lower in premarket today. Stock reached the $350 resistance zone yesterday but failed to break above. Shares currently trade near $339 in pre-market - below 200-hour moving average (purple line) but above a short-term uptrend line. A support zone to watch can be found in the $335 area, where previous price reactions as well as the aforementioned trendline can be found.

Source: xStation5

Source: xStation5

Microsoft - financial dashboard

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้