According to the latest information, MicroStrategy (MSTR.US), founded by Michael Saylor, has invested an additional approximately $821.7 million in purchasing 12,000 more bitcoins. The company acquired the additional bitcoins from February 26 to March 10, 2024. The investment was financed with $781.1 million from a recent bond offering and $40.6 million of excess cash. As of March 10, the company held a total of 205,000 bitcoins, purchased for a total of $6.91 billion, averaging $33,706 each, including fees and expenses. Assuming a bitcoin price of $72,000, the total value of MicroStrategy's assets amounts to $14.7 billion, thus the total profit from the investment has exceeded $7.79 billion.

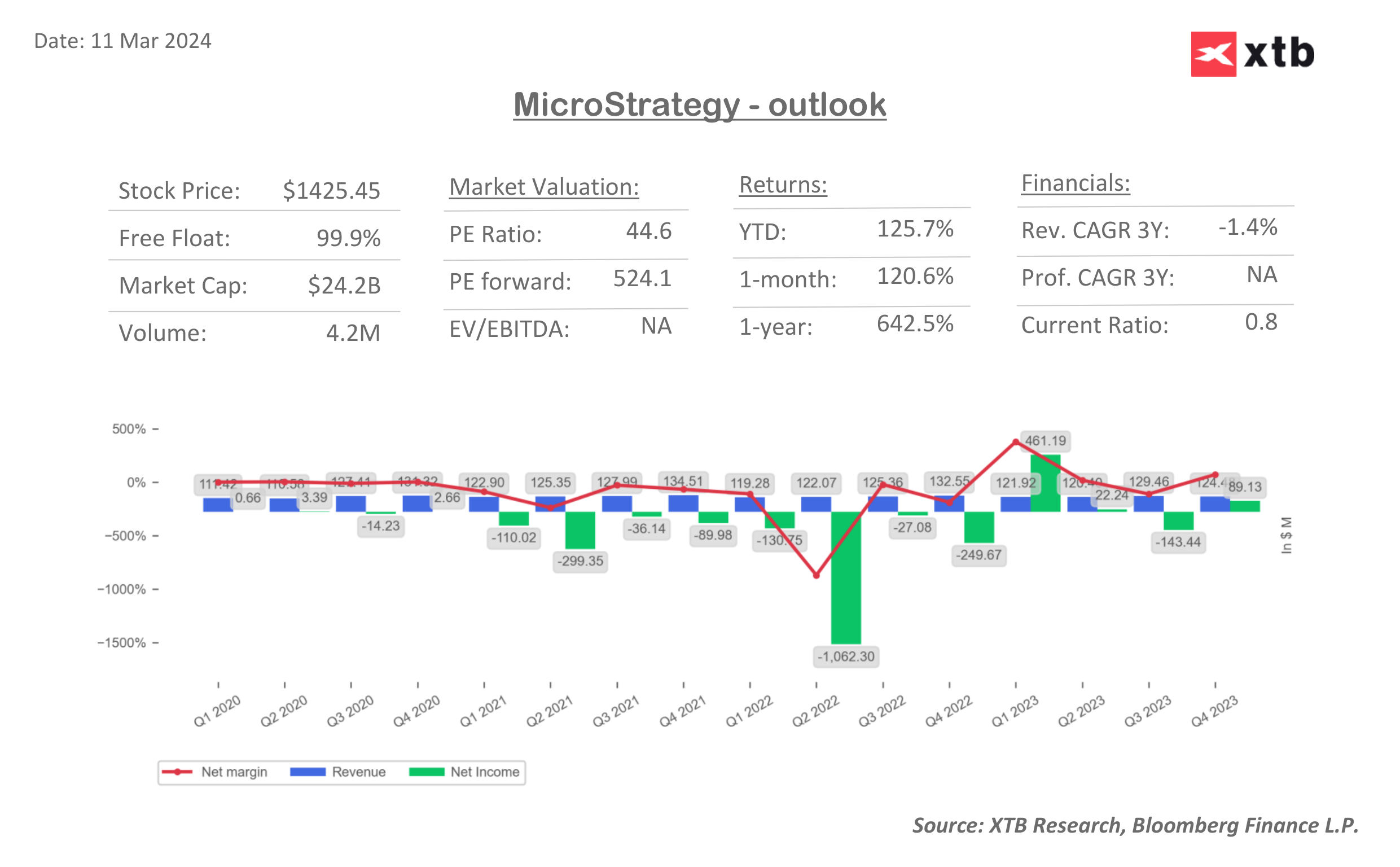

As we can see on the attached dashboard, the scale of MicroStrategy's business operations is incomparably smaller than its recent investment activities in the cryptocurrency market.

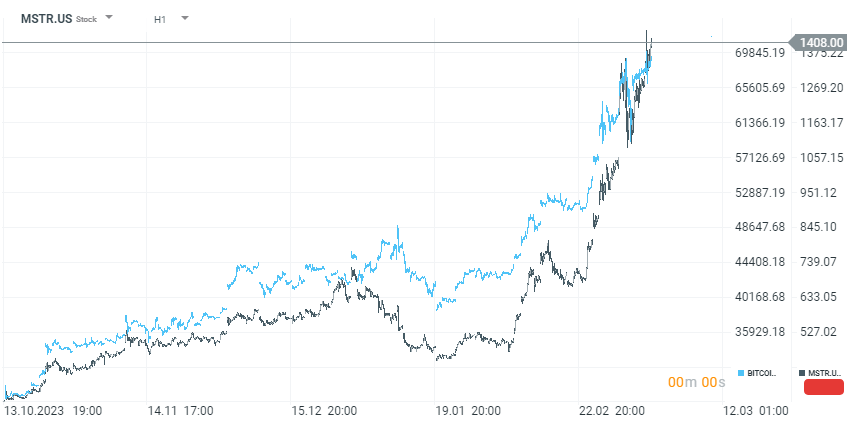

MicroStrategy's (MSTR.US) shares are gaining nearly 10% in pre-session trading. As the company increases its exposure to the cryptocurrency market, its stock prices are becoming more correlated with the price of BTC. Consequently, its market capitalization is becoming less dependent on its core business areas from a few years ago, which used to be IT, Cloud, and Business Intelligence solutions and services.

Source: xStation 5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้