Wells Fargo - lower interest income

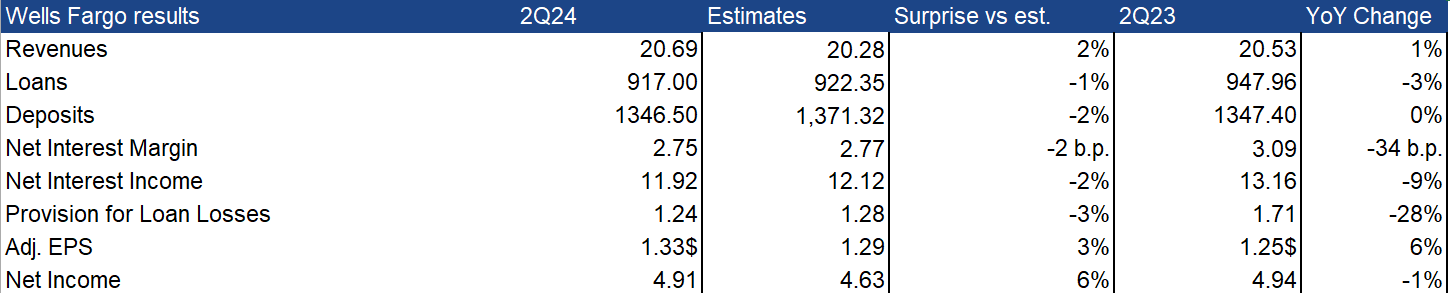

Wells Fargo's results turned out to be mixed. The company achieved positive growth in revenues, increasing them to $20.69 bln (+1% y/y) against an expected decline. The year-on-year increase was driven by a strong improvement in non-interest income, which rose 19% year-on-year. The strongest contributor to this was the increase in trading income in the Market segment, where income rose 16% y/y.

However, the bank reported a decline in net interest income, which amounted to $11.92 billion, down 9% year-on-year and 2% below forecasts. The reason for the erosion of the result was an increase in interest expenses related to the migration of customers to deposits offering higher interest rates, as well as weaker loan growth due to the high interest rate environment. Average loans fell to $917 billion (-3% y/y). The interest margin fell to 2.75% vs. 3.09% a year earlier (-0.02 p.p. vs. forecasts).

The market was most negative on the news that the forecast for full-year 2024 costs was raised to $54 billion. In 2Q24, non-interest expenses rose 2% to $13.3 billion (vs. a forecast increase of 0.2%). On a q/q basis, the bank continues to reduce costs, but the pace is still lower than the market expected.

The bank reported a -28% y/y decline in loan loss provisions. The only increase in the credit card-related loan loss provisions segment was offset by declines in other segments.

Results in bln $ (except for per share). Source: XTB Research, Bloomberg Finance L.P.

Results in bln $ (except for per share). Source: XTB Research, Bloomberg Finance L.P.

Source: xStation

Source: xStation

JPMorgan Chase - higher loan loss provisions

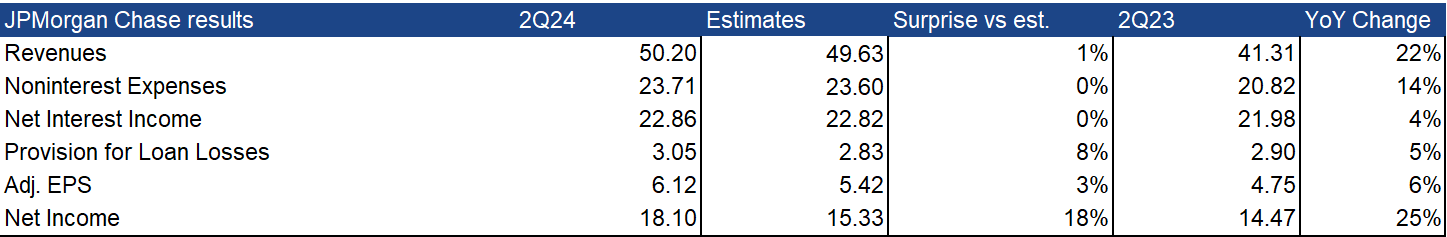

JPMorgan Chase presented strong results, mostly beating both analysts' consensus expectations and improving y/y performance. The bank performed particularly well in investment banking, where the company's revenues rose 46% y/y. The high growth rate was due, on the one hand, to an increase in bank fees, which rose by 50%, well above the company's projections of 25-30% growth, as well as higher activity in the capital market.

Investors' attention was captured by a strong increase in loan loss provisions, which were raised by 5% year-on-year and as much as 8% more than the consensus forecast. Provisions rose 61% year-on-year compared to the first quarter.

Net interest income rose 4% to $22.9 billion, and reported earnings per share were $6.12 (3% higher than analysts' estimates). The company's profit, which totaled $18.1 billion in 2Q24, was heavily influenced by increases related to Visa's share swap, which ultimately boosted the bank's earnings by $8 billion.

The bank's CEO Jamie Dimon notes that despite market optimism, the fight against inflation may persist for longer than markets anticipate, in his view, entailing a prolonged environment of high interest rates.

The company is losing nearly -1% in trading before the market opened.

Results in bln $ (except for per share). Source: XTB Research, Bloomberg Finance L.P.

Source: xStation

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈