- Wall Street indices finished yesterday's trading higher, even in spite of a downward revision to US Q3 GDP data

- S&P 500 gained 1.03%, Dow Jones moved 0.87% higher and Nasdaq climbed 1.26%. Small-cap Russell 2000 rallied over 1.7%

-

China's new gaming restrictions rattled Asian markets, sending Hong Kong tech stocks tumbling, including Tencent and NetEase. The Hang Seng Technology Index plunged 4%, and Tencent and NetEase sank 16% and 28%, respectively, marking the largest weekly drop in regional equities in over a month.

- Indices from Asia-Pacific traded mixed today - Nikkei, Kospi and S&P/ASX 200 traded flat, Nifty 50 added 0.6%, while indices from China traded slightly lower

- European index futures point to a flat or slightly lower opening of today's cash session for major blue chips indices from the Old Continent

- Bank of Japan minutes from October 2023 meeting showed that BoJ members agreed there is a need to patiently maintain current easy policy and that yield curve control must be sustained to support wage growth

- Japanese CPI inflation slowed from 3.3% to 2.8% YoY in November, while CPI inflation excluding food slowed from 2.9% to 2.5% YoY (exp. 2.5% YoY). Inflation excluding food and energy slowed from 4.0% to 3.8% YoY

- Australian private sector credit increased 0.4% MoM in November. On an annual basis, private sector credit increased 4.7% YoY. Increase was driven primarily by housing and business credit

- Major cryptocurrencies are trading mixed - Bitcoin gains 0.4%, Ethereum trades 0.6% higher, Ripple drops 0.4% and Dogecoin slumps 1.7%

- Brent gains 0.3%, WTI trades 0.6% higher and NATGAS drops 4% with a bulk of the drop coming from contract rollover

- Precious metals are trading lower today - silver and platinum drop 0.2% while palladium trades 0.9% down. Gold is the outperformer with 0.1% gain at press time

- GBP and USD are the best performing major currencies, while AUD and NZD lag the most

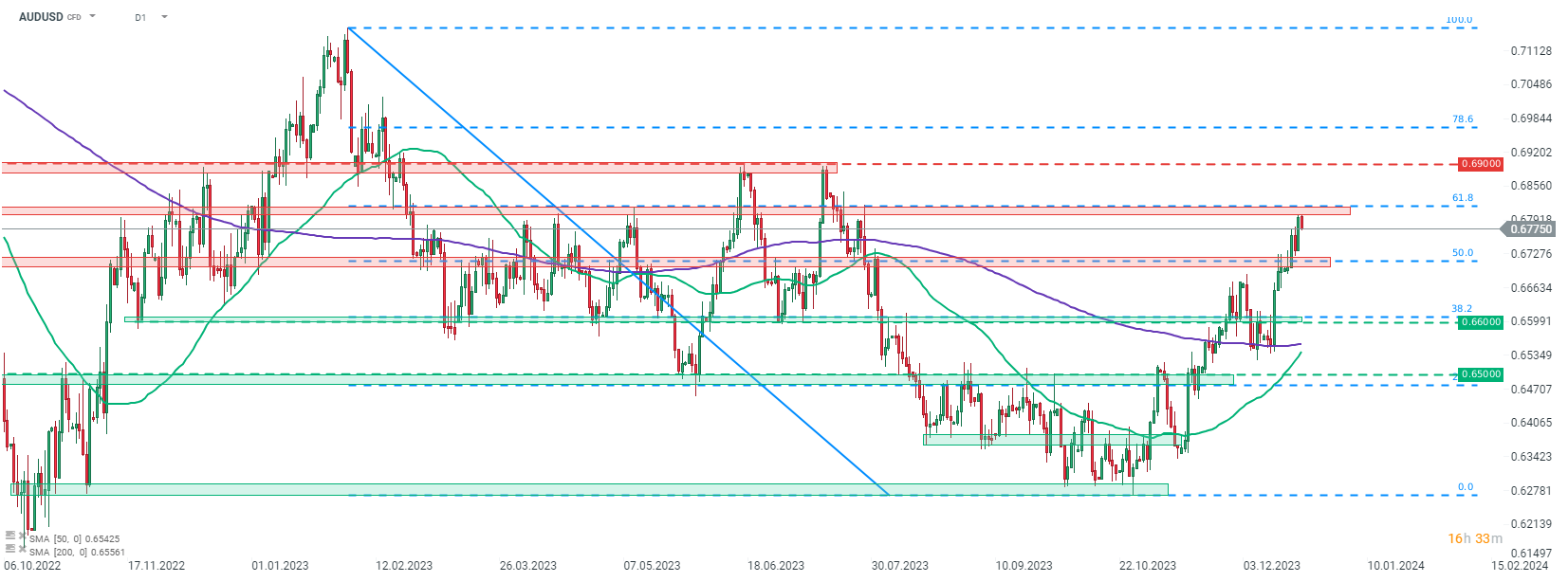

AUDUSD climbed to the highest level since late-July 2023, but bulls failed to break above the resistance zone ranging below 61.8% retracement of the downward move launched at the beginning of February 2023. A small pullback can be spotted today. Source: xStation5

AUDUSD climbed to the highest level since late-July 2023, but bulls failed to break above the resistance zone ranging below 61.8% retracement of the downward move launched at the beginning of February 2023. A small pullback can be spotted today. Source: xStation5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

พรรคของ Takaichi ชนะเลือกตั้งในญี่ปุ่น – ความกังวลหนี้กลับมาอีกครั้ง? 💰✂️