Declines in the shares of electric car maker Nikola (NKLA.US) have accelerated since the open on Wall Street today and are already above 14% as the company announced an additional USD 325 million bond issue and a recall of all 209 'semi-truck' EVs produced due to a potential design flaw.

- The company intends to correct their battery pack design flaw (risk of internal coolant leakage) after a fire broke out at the company's headquarters resulting in the burning of five cars (in June). The company said that the recall of battery-powered trucks will not affect newer models, based on hydrogen fuel cells.

- Nikola is hoping for a quick fix and a change or modification from the supplier of the small part probably responsible for the situation.

- The company is still not profitable and investors do not like the vision of further dilution of the shareholding and the 'overhang' of a large number of shares as debt is converted into company capital.The company will sell convertible bonds through a direct offering, in tranches. The first tranche will be for $124.5m at an interest rate of 5%.

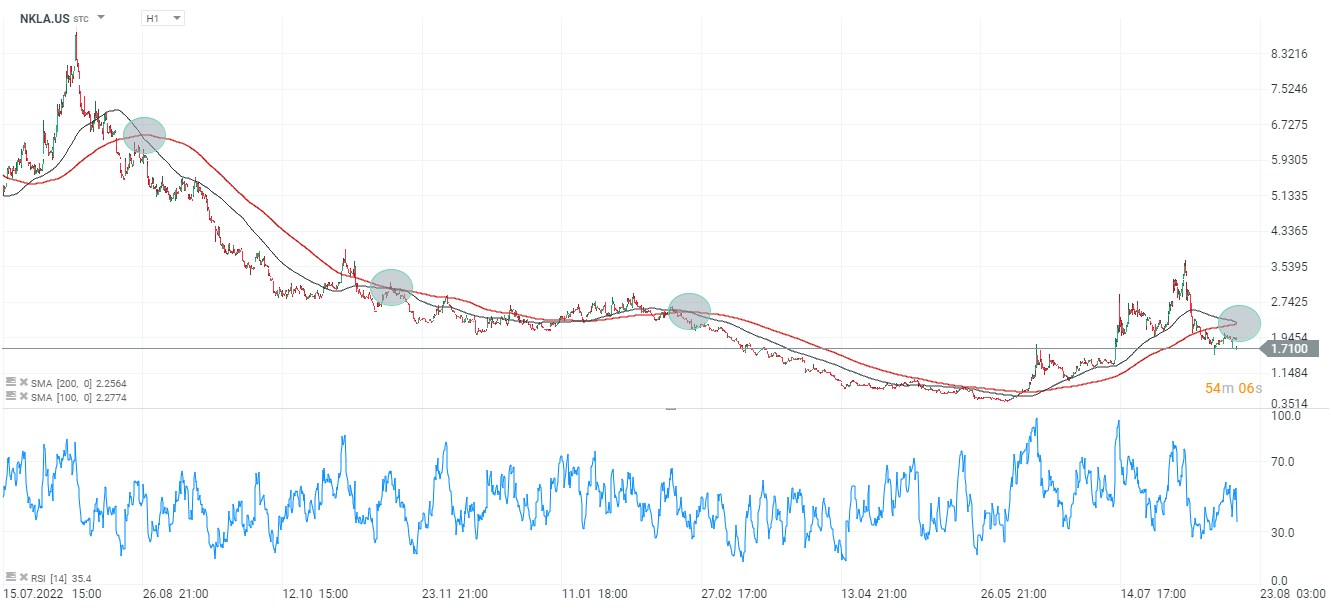

Nikola shares (NKLA.US), H1 interval. The SMA100 and SMA200 averages are approaching the intersection known as the 'cross of death' 0 looking previously similar situations usually precede a prolonged overbought stock. Source: xStation5

Nikola shares (NKLA.US), H1 interval. The SMA100 and SMA200 averages are approaching the intersection known as the 'cross of death' 0 looking previously similar situations usually precede a prolonged overbought stock. Source: xStation5

📈 Boeing ปรับตัวขึ้น ท่ามกลางข่าว คำสั่งซื้อ 737 MAX ขนาดใหญ่จากจีนที่อาจเกิดขึ้น

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด