Oil continues to trade near but has not yet managed to close a bullish price gap, triggered by an unexpected OPEC+ output cut announcement. A bearish sentiment can be spotted on the crude market since mid-April and is trading less than $1 per barrel away from closing a bullish gap. Taking a look at OIL.WTI at the D1 interval from a technical point of view, we can see that downward move accelerated after the price failed to break above $82 resistance. According to the Overbalance methodology, this hints that the long-term trend remains bearish. Moreover, price dropped back below 100-period EMA, what further supports the bearish outlook.

OIL.WTI at D1 interval. Source: xStation5

OIL.WTI at D1 interval. Source: xStation5

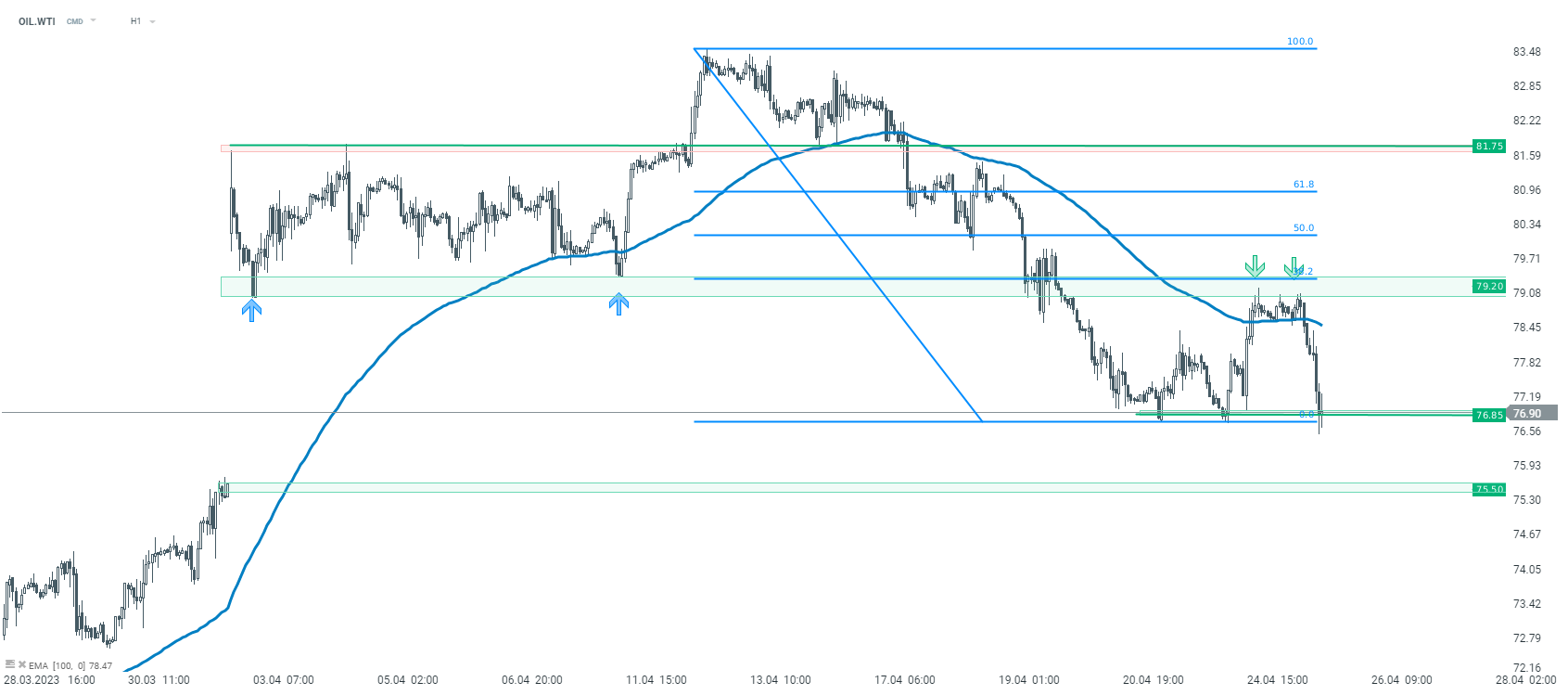

Taking a look at WTI at a lower interval (H1), we can see that price tested a recently-broken support as a resistance and, after a failure to break above it, downward move was resumed. Currently, we are observing OIL.WTI testing recent local lows in the $76.85 per barrel area and should we see a break below this zone, the way towards $75.50 - lower limit of bullish price gap - will be left open.

OIL.WTI at H1 interval. Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

📈 ราคาน้ำมันพุ่ง 6% – จะเกิดซ้ำเหมือนปี 2022 หรือไม่? 🛢️

สรุปข่าวเช้า 6 มี.ค.

สรุปข่าวเช้า 5 มี.ค.