PayPal (PYPL.US) shares lose 3.5% today despite better than expected earnings per share and 6% YoY revenue growth, which came in line with expectations. The company reported EPS of $1.20, above $1.07 anticipated on Wall Street, however its profitability (and margins) boost was balanced by quite mixed guidance, signalling profit taking pressure. As for now, shares trim early loses of 8% to 3.5%, signalling that the first market's 'panic' reaction may be too big, as the PayPal Q3 report overall came in strong and signals some major improvements.

- Q3 revenue rose 6% YoY to $7.85B vs $7.88B estimate, below total payment volume (TPV) which surged 9% YoY to above $422 billion. Active accounts number dropped 0.9% YoY to 432 million, but transactions per account were up 9% YoY Payments came in up 6% YoY to $6.6 billion.

- Q4 revenues are expected to increase by a low-single-digit percentage compared to $8.03 billion in the prior year’s period and slightly below the consensus of $7.81 billion. PayPal expects also adjusted EPS between $1.03-$1.07, vs $1.10 anticipated on Wall Street.

- Q3 revenue growth reached 6%, aligning closely with investors expectations and the company’s mid-single-digit previous guidance. However, it's not enough to fuel growth as PayPal stock surged recent months. On a constant currency, revenue growth came in 6% YoY vs 4% estimated by JP Morgan.

- Transaction margin dollars (TMD) increased 8% YoY vs 3% to 4% projected by Wall Street' in line with Q2 growth pace. Transaction take rate came in at 1.67%, slightly below consensus. Transaction expenses were approximately 0.5 bps below expectations. Non-transaction expenses rose 3% vs flat result expected on Wall Street; margins improved by 1.9 percentage point.

- PayPal for Q4 2024 expects low single-digit revenue growth, below 6% dynamic, forecasted by analysts. Adjusted EPS is projected to decline YoY in the low-to-mid single digits. For the full year, PayPal raised its TMD growth outlook to mid-single digits, up from the previous low-to-mid range. Non-transactional operating expenses are expected to grow in the low single digits, with no changes to previous guidance. Also, free cash flow guidance remains steady at $6 billion. Adjusted EPS growth was lifted to the high teens, up from the previous low-to-mid teens.

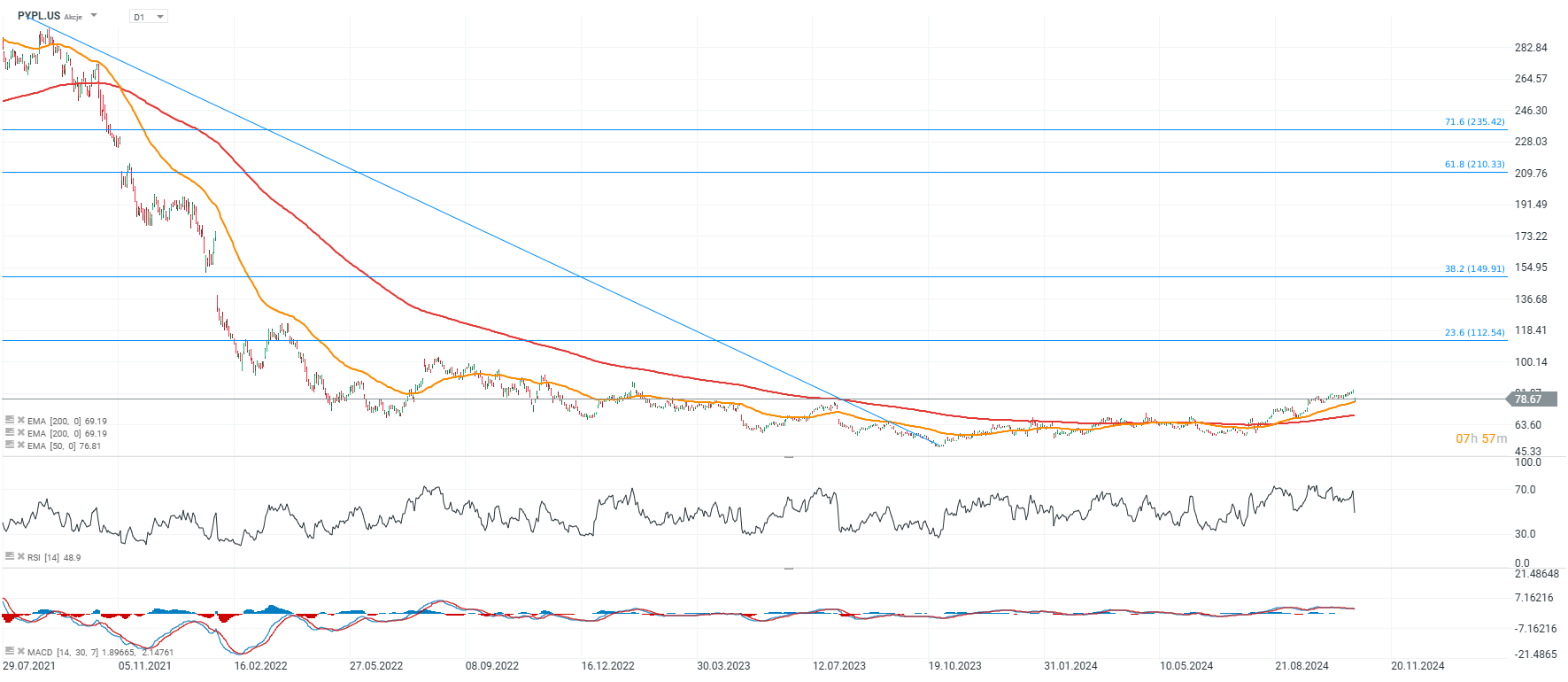

Source: xStation5

_9cfb25f32a.png)

Source: XTB Research, Bloomberg Finance L.P.

_e22aa49af6.png)

Source: XTB Research, Bloomberg Finance L.P.

📈 Boeing ปรับตัวขึ้น ท่ามกลางข่าว คำสั่งซื้อ 737 MAX ขนาดใหญ่จากจีนที่อาจเกิดขึ้น

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด